-

Home

- >

- Author: Steve Miley (The Market Chartist)

Steve Miley (The Market Chartist)

Steve Miley is the Market Chartist and has 32 years of financial market experience and as a seasoned expert now has many responsibilities. He is the founder, Director and Primary Analyst at The Market Chartist, the Editor-in-Chief for FXExplained.co.uk, the Academic Dean for The London School of Wealth Management

At FXExplained.co.uk Steve is the Editor-in-Chief, alongside producing numerous articles for the site. The ability to be able to reach out to a wide, global audience with his own analysis and also assist and nurture other authors in their creative process makes this a role that Steve values deeply.

Here are Steve’s tips on what pages to follow closely on FxExplained: Current market analysis and Best trading app in UK.

The Market Chartist

The Market Chartist was founded in 2012 and provides daily technical analysis reports, with written commentary and key support/ resistance levels to an institutional, professional and retail client base. The 30+ daily reports include European, UK and US Bonds & Equity Index Futures, G10 currencies, UK Natural Gas, TTF Gas, German Power, EUA Emissions and LME Base Metals.

As The Market Chartist, Steve has won many awards from the Technical Analyst Magazine. He was the 2016 & 2013 Winner (plus 2014 Runner Up) for Best Independent Fixed Income Research & Strategy and winner of Best FX Research & Strategy in 2012. He was also a finalist in the Technical Analyst of the Year category each year for 2012-2017.

Other Current Positions

Steve is also the Academic Dean for The London School of Wealth Management, a role he really enjoys. He appreciates the opportunity to be able to educate a diverse array of students in all aspects of the financial market’s world. Steve says “to be able to be a part of transforming an individual’s life through education is truly a privilege and very exciting”.

Steve also writes extensively for numerous financial markets sites including: FxStreet.com, TechnicalAnalyst.co.uk, InsideFutures.com, BarChart.com, StockTwits.com, StockBrokers.com, AskTraders.com and Investing.com.

Previous to this, Steve was also a Senior Lecturer at The London Academy of Trading where he fully began his journey into the world of education. It was here that he honed his skills as a lecture and mentor in the world of financial markets education.

Vast Technical Analysis Experience

Steve has also helped technical analysis push into a new era in his previous role as Director at Vega Insight. Vega Insight is a relatively new company with a specific focus on Artificial Intelligence and Machine Learning in global commodity and broader financial markets, with special focus on Energy. In his role Steve was responsible for the technical analysis inputs to the Artificial Intelligence and Machine Learning.

Steve spent 2009-2012 as a Director in the Technical Analysis Research Strategy team at Credit Suisse. Steve managed the FX division, responsible for the reports, forecasts and bank wide research for G10 & Emerging Markets currencies. In this role he also covered all major asset classes including Equity Indices, Rates & Credit, plus Commodities.

Steve spent most of his career at Merrill Lynch for 15 years from 1994-2009. The last ten years was as a Vice President in the research department as a technical analyst, responsible for daily reports, client presentations, plus in-house and client education programs. Prior to this, Steve was in the Fixed Income derivatives sales team where he managed the Italian Futures desk (BTP and EuroLira) on LIFFE (the London International Financial Futures Exchange). He was responsible for a four-man sales team, who consistently produced high volume of sales from both in-house and external clients.

He is a Member of the Society of Technical Analysts (MSTA) and holds a Master’s degree in politics, Philosophy & Economics from Oxford University (Lincoln College).

Beginner

Two of the main concepts in trading and technical analysis are support and resistance. In basic terms, support and resistance are a specific price levels or areas of price that acts as barriers to a market price moving through them. It is a simple concept but identifying these levels can trip you up sometimes. Here … Continued

Beginner

Trading charts can be used to plot the price of any market; forex, stocks, bonds, commodities and more, any market where the price changes. Charts are at the core of technical analysis. For you, the trader, an understanding of different chart types is vital when using technical analysis and helps you make informed trading decisions … Continued

Beginner

Technical analysis is a way of assessing financial markets to be able to determine and hopefully predict future market price moves. It is also sometimes referred to as charting, with technical analysts being known as chartists. Technical analysis is just one type of the many different approaches to market analysis that a trader, investor or … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: A quiet week for central banks, though we do get Fed speakers through the week, which is the last week before the Fed speaker blackout period ahead of the early November FOMC Meeting. We get Reserve Bank of Australia (RBA) Meeting Minutes … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week A quiet start to the week, with the US Columbus Day holiday on Monday, US cash bond markets are closed, plus it is Thanksgiving Day in Canada. Central Bank Watch: A quiet week for central banks, with the main focus on the release of the … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 10/02/2023 Global Manufacturing PMI from S&P Global; US ISM Manufacturing PMI; Fed’s Powell speaks; EU Unemployment 10/03/2023 RBA interest rate decision and statement 10/04/2023 RBNZ interest rate decision and statement; Global Services and Composite PMI from S&P Global; EU Retail Sales; … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 09/25/2023 German IFO Survey 09/26/2023 US Consumer Confidence 09/27/2023 Bank of Japan Meeting Minutes; Australian CPI; US Durable Goods Orders 09/28/2023 German CPI; US GDP and Personal Consumption Expenditure (PCE) QoQ; Fed’s Powell speaks 09/29/2023 UK GDP; German Retail Sales and … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 09/18/2023 No events of note 09/19/2023 RBA meeting minutes, EU CPI, Canadian CPI 09/20/2023 UK CPI report, FOMC interest rate decision, monetary policy statement and economic projections 09/21/2023 Swiss National Bank interest rate decision and monetary policy assessment, Bank of England … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 09/11/2023 Nothing of note 09/12/2023 UK Employment report; German ZEW Survey 09/13/2023 UK GDP, Industrial and Manufacturing Production; US CPI 09/14/2023 Australian Employment report; ECB interest rate decision and press conference; US PPI and Retail Sales 09/15/2023 Chinese Industrial Production and … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 09/04/2023 US Labor Day public holiday 09/05/2023 Reserve Bank of Australia monetary policy, Final Services PMIs for Eurozone & UK, US Factory Orders 09/06/2023 Australian GDP, Bank of Canada monetary policy; ISM Services PMI, Fed’s Beige Book 09/07/2023 China’s Trade Balance; … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 08/28/2023 n/a 08/29/2023 US Consumer Confidence, JOLTS Jobs Openings 08/30/2023 Australian CPI inflation; German prelim CPI; ADP Employment Change, US Prelim GDP, Pending Home Sales 08/31/2023 China Official PMIs; Eurozone Flash HICP inflation and Unemployment, ECB Monetary Policy Meeting Accounts; US … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 08/21/2023 n/a 08/22/2023 Existing Home Sales, Richmond Fed Manufacturing 08/23/2023 Flash PMIs from Australia, Japan, Eurozone, UK and the US; Eurozone Consumer Confidence; US New Home Sales 08/24/2023 ECB minutes; US Weekly Jobless Claims, Durable Goods Orders; Jackson Hole Economic Symposium … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Index futures are breaking, or are threatening to break below key support areas. The e-mini NASDAQ 100 futures have broken below the higher low at 15063, whilst the e-mini S&P 500 futures are threatening the support at 4411. If these breaks are confirmed, they come as outlook-changing moves. … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 08/07/2023 n/a 08/08/2023 Chinese trade balance; US Trade Balance 08/09/2023 Chinese CPI and PPI 08/10/2023 US CPI 08/11/2023 UK monthly GDP, Industrial Production and Trade Balance; US PPI and prelim Michigan Sentiment

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 07/31/2023 China Manufacturing & Non-Manufacturing PMIs, Eurozone Flash HICP Inflation 08/01/2023 Reserve Bank of Australia monetary policy, Final Manufacturing PMIs for Eurozone & UK, US ISM Manufacturing and JOLTS jobs openings 08/02/2023 ADP Employment Change 08/03/2023 Final Services/Composite PMIs for Eurozone … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 07/24/2023 Flash PMIs for Australia, Eurozone, the UK and the US 07/25/2023 German Ifo Business Climate, US Consumer Confidence, Richmond Fed Manufacturing 07/26/2023 Australian CPI, US New Home Sales, FOMC monetary policy 07/27/2023 European Central Bank monetary policy; US Durable Goods … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 07/17/2023 China GDP, Industrial Production & Retail Sales; US Empire State Manufacturing 07/18/2023 Canadian CPI inflation; US Retail Sales & Industrial Production; New Zealand CPI inflation 07/19/2023 UK CPI inflation; US Building Permits & Housing Starts 07/20/2023 Australian Unemployment; US Weekly … Continued

Intermediate

Macroeconomic/ geopolitical developments Key this week Date Key Macroeconomic Events 07/10/2023 China CPI & PPI 07/11/2023 UK Unemployment and wage growth; German ZEW Economic Sentiment 07/12/2023 Reserve Bank of New Zealand monetary policy; US CPI; Bank of Canada monetary policy 07/13/2023 UK GDP (monthly); US PPI and Weekly Jobless Claims 07/14/2023 Michigan Sentiment (prelim)

Intermediate

Macroeconomic/ geopolitical developments Key this week Date Key Macroeconomic Events 07/03/2023 Eurozone & UK Final Manufacturing PMI; US ISM Manufacturing, US Factory Orders 07/04/2023 Reserve Bank of Australia monetary policy; US Independence Day holiday 07/05/2023 China Caixin Services PMI; OPEC meeting; FOMC meeting minutes 07/06/2023 ADP Employment Change, US Weekly Jobless Claims, ISM Services 07/07/2023 … Continued

Intermediate

Macroeconomic/ geopolitical developments Key this week Date Key Macroeconomic Events 06/26/2023 German Ifo Business Climate 06/27/2023 Canada CPI; US Durable Goods Orders, S&P/CS House Prices Index, US Consumer Confidence, US New Home Sales 06/28/2023 Australian CPI; central bank governors of the Fed, ECB, BoJ and BoE speak; 06/29/2023 US final GDP, Weekly Jobless Claims, Pending … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 19/06/2023 US public holiday (for Juneteenth) 20/06/2023 US Building Permits and Housing Starts 21/06/2023 UK CPI; Canadian Retail Sales; Jerome Powell Congressional testimony (House Financial Services Committee) 22/06/2023 Swiss National Bank monetary policy; Bank of England monetary policy; US Weekly Jobless … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 12/06/2023 N/A 13/06/2023 UK Unemployment and wage growth; German ZEW Economic Sentiment; US CPI 14/06/2023 UK monthly GDP; US PPI and Federal Reserve monetary policy 15/06/2023 Australian Unemployment; Chinese Industrial Production & Retail Sales; European Central Bank monetary policy; US Retail … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 05/06/2023 S&P Global Services PMI global data and from US ISM Services PMI, US Factory Orders 06/06/2023 Reserve Bank of Australia monetary policy 07/06/2023 Australian GDP; China Trade Balance; Bank of Canada monetary policy 08/06/2023 US Weekly Jobless Claims 09/06/2023 China … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 29/05/2023 US Memorial Day and UK Spring bank Holiday, markets closed 30/05/2023 Eurozone Sentiment; US Consumer Confidence, Dallas Fed Manufacturing Index 31/05/2023 Japanese Retail Sales and Industrial Production; Chinese PMIs (official); German inflation; Canadian GDP; US JOLTS jobs openings 01/06/2023 Final … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 22/05/2023 Eurozone Consumer Confidence (flash) 23/05/2023 Flash PMIs for Japan, the Eurozone, the UK and the US; New Home Sales, Richmond Fed Manufacturing 24/05/2023 UK CPI inflation, German IFO Business Climate, FOMC minutes 25/05/2023 US Weekly Jobless Claims, Pending Home Sales … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 15/05/2023 Eurozone Industrial Production 16/05/2023 Chinese Industrial Production & Retail Sales; UK Unemployment; Eurozone Trade Balance; Eurozone GDP (2nd); German ZEW Economic Sentiment; Canadian Inflation; US Retail Sales & Industrial Production 17/05/2023 Japanese GDP (Q1 prelim) & Industrial Production; Eurozone HICP … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 08/05/23 Nothing of note, UK holiday with markets closed 09/05/23 Australian Consumer Confidence, Chinese trade data 10/05/23 US CPI 11/05/23 Chinese CPI inflation, Bank of England monetary policy, US Weekly Jobless Claims, US PPI 12/05/23 UK GDP (Q1 prelim), UK Industrial … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 01/05/2023 China, UK and Europe markets closed for the May Day holidays; ISM Manufacturing 02/05/2023 RBA monetary policy, Eurozone final Manufacturing PMI, UK final Manufacturing PMI, Eurozone HICP inflation, US JOLTS, US Factory Orders 03/05/2023 ADP Employment Change, ISM Services PMI, … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 24/04/2023 German IFO Survey 25/04/2023 US Consumer Confidence, US New Homes Sales 26/04/2023 Australian CPI, US Durable Goods 27/04/2023 EU Consumer Confidence, US Advance GDP and PCE 28/04/2023 Bank of Japan interest rate decision and statement, German Unemployment, GDP and HICP … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Macroeconomic data: US data is light the coming week, but we do get Canada, UK and EU CPI, plus China GDP, UK Employment and Retail Sales, but standout data for the week is probably the global Flash PMI from S&P Global on Friday Date Key … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 10/04/23 Easter Monday holiday, UK and European markets are closed; Fed’s Williams speaks 11/04/23 China CPI; EU Retail Sales; Fed’s Harker speaks 12/04/23 Fed’s Kashkari speaks; US CPI; BoC interest rate decision and statement; FOMC Minutes released 13/04/23 Australian Employment report; … Continued

Beginner

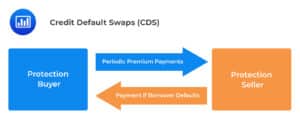

There has been a re-emergence of a banking crisis in 2023. Suddenly, traders are looking out for key indicators of stress in the banking system. This has brought credit default swaps back into focus. This is enough to put the shudders down the spine of even the hardiest of traders. Credit Default Swaps (or CDS … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 03/04/23 S&P Global Manufacturing PMI (global): US ISM PMI; Fed Governor Cook speaks 04/04/23 RBA interest rate decision and statement; Fed Governor Cook speaks 05/04/23 S&P Global Services PMI (global): US ISM PMI; US ADP Employment change 06/04/23 Canada Employment report … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 27/03/23 Shift to Daylight Saving Time in the UK and EU on 26/03/23; German IFO 28/03/23 Australian Retail Sales 29/03/23 Australian CPI 30/03/23 EU Consumer Confidence; German CPI; US GDP and PCE 31/03/23 Japan CPI; China PMI; UK GDP; German Retail … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 20/03/23 Japan Vernal Equinox Day markets closed; no data of note 21/03/23 RBA Meeting Minutes; German ZEW Survey; Canadian CPI 22/03/23 UK CPI; US FOMC Interest Rate Decision, Projections and Press Conference 23/03/23 SNB and BoE Interest Rate Decisions 24/03/23 UK … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 13/03/23 US switched to Daylight Saving Time on Sunday 12/03 14/03/23 UK Employment report; US CPI 15/03/23 BoJ Monetary Policy Meeting Minutes; China Retails Sales; EU industrial Production; US Retail Sales 16/03/23 Australian Employment report; ECB Monetary Policy Decision, Statement and … Continued

Intermediate

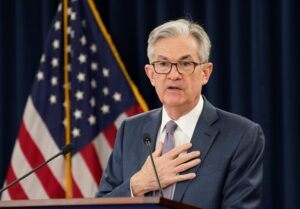

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 06/03/23 EU Retail Sales 07/03/23 RBA interest rate decision; Jerome Powell testimony to Congress 08/03/23 German Retail Sales; EU Employment and GDP; ADP Employment Change; Jerome Powell testimony to Congress; BoC interest rate decision 09/03/23 Japan GDP; China CPI 10/03/23 BoJ … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 27/02/23 US Durable Goods 28/02/23 Australian Retail Sales; Canada GDP; US Consumer Confidence 01/03/23 Australian GDP; global S&P Global Manufacturing PMI; German Unemployment and CPI; US ISM Manufacturing PMI 02/03/23 EU Unemployment and CPI 03/03/23 Global S&P Global Services and … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 20/02/23 US Presidents day holiday, US equity and bond cash markets are closed; PBoC interest rate decision 21/02/23 RBA Meeting Minutes; global S&P Global Flash Purchasing Managers Index (PMI); Canada CPI and Retail Sales 22/02/23 German CPI; German IFO Survey; FOMC … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 13/02/23 Nothing of note 14/02/23 Japan GDP; UK Employment report; EU GDP; US CPI 15/02/23 UK CPI; US Retail Sales 16/02/23 Australian Employment report; US PPI 17/02/23 UK Retail Sales

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 06/02/23 EU Retail Sales 07/02/23 RBA interest rate decision; Fed’s Powell speaks 08/02/23 Nothing of note 09/02/23 German CPI 10/02/23 China CPI, UK GDP, Manufacturing and Industrial Production; Canada Employment report; US Michigan Consumer Sentiment

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 30/01/23 German GDP; EU Consumer Confidence 31/01/23 China PMI; German Retail Sales; EU GDP; German CPI; US Consumer Confidence 01/02/23 EU CPI; global Manufacturing PMI from S&P Global; US ISM Manufacturing PMI; FOMC interest rate decision 02/02/23 BoE interest rate decision; … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 23/01/23 BoJ Meeting Minutes; EU Consumer Confidence 24/01/23 Flash PMI global drive from S&P Global 25/01/23 Australian CPI; German IFO; BoC interest rate decision 26/01/23 US GDP, PCE, Durable and Capital Goods Orders 27/01/23 US PCE

Beginner

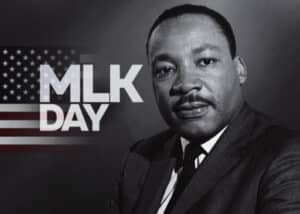

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 16/01/23 US Martin Luther King Holiday, equity and bonds cash markets are closed 17/01/23 China GDP, Industrial Production and Retail Sales, UK Employment report, German CPI, German ZEW Survey, Canada CPI 18/01/23 UK inflation report (CPI); EU CPI; US PPI and … Continued

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 09/01/23 EU Unemployment 10/01/23 Japan CPI 11/01/23 China CPI 12/01/23 US CPI 13/01/23 UK GDP, Industrial & Manufacturing Production; Michigan Consumer Sentiment

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week This will be the last MacroWatch report for 2022. Happy holidays to you all, Merry Christmas and wishing you a great trading and investing year for 2023! Date Key Macroeconomic Events 19/12/22 German IFO Survey 20/12/22 RBA Meeting Minutes, PBoC interest rate decision; BoJ interest … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 12/12/22 UK GDP, Industrial and Manufacturing Production 13/12/22 UK Employment; German CPI; German and EU ZEW Survey; US CPI 14/12/22 Japan Tankan report; UK inflation report (including CPI); FOMC Meeting, interest rate decision and press conference 15/12/22 Australia Employment; China Industrial … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 05/12/22 Global Services and Composite PMI data from S&P Global and US ISM Service PMI; EU Retail Sales 06/12/22 RBA interest rate decision 07/12/22 Australian GDP; EU GDP; BoC interest rate decision 08/12/22 Japan GDP 09/12/22 US PPI; Michigan Consumer Sentiment … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 28/11/22 Australian Retail Sales 29/11/22 German CPI; Canadian GDP 30/11/22 Australian CPI; German Employment report; EU CPI; ADP Employment change; US GDP and PCE; Fed Chairman Powell speaks 01/12/22 German Retail Sales; global PMI data from S&P Global and US ISM … Continued

Beginner

Macroeconomic/ geopolitical developments UK inflation accelerated more than anticipated in October to hit a 41-year high of 11.1%, significantly above the 10.1% print in September. Global financial market developments Key this week Date Key Macroeconomic Events 21/11/22 PBoC interest rate decision 22/11/22 Canada Retail Sales 23/11/22 RBNZ interest rate decision; global Flash PMI from S&P … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 14/11/22 Nothing of note 15/11/22 RBA Minutes; China Retail Sales; UK Employment; EU GDP; German ZEW Survey; US PPI 16/11/22 UK inflation report (including CPI); US Retail Sales; Canada CPI 17/11/22 Australia Employment; EU CPI 18/11/22 UK Retail Sales

Beginner

The Fibonacci sequence of numbers has been used in trading strategies for many decades now and is a valuable tool in the identification of important levels to monitor when trading markets. In this article, we will look at: The historical and mathematical basis of the Fibonacci numbers An outline of the various Fibonacci numbers used … Continued

Beginner

“Insanity is doing the same thing over and over and expecting different results.” – Albert Einstein Progress can be tracked by considering the history of a set of actions and outcomes. For a trader or investor, if you want to learn how to successfully trade Stocks, Indices, Forex, Bonds or Commodities (or any of the … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 07/11/22 China trade data 08/11/22 US midterm elections; EU Retail Sales 09/11/22 China CPI 10/11/22 US CPI 11/11/22 UK GDP; German CPI; US Veterans Day, Bond markets closed

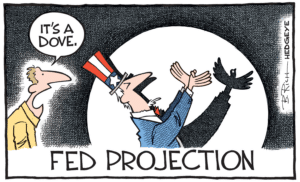

Expert

Here we present the Hawk / Dove sheet, an explanation of the terminology as well as the implications on forex trading and how it is used in fundamental analysis. Hawkish and Dovish HawkishA Hawk is a term originally used in economics to describe economists or Central Bankers who are more concerned with potential recession from … Continued

Intermediate

Macroeconomic/ geopolitical developments US third-quarter earnings results are largely meeting or beating expectations. About a fifth of S&P 500 companies have reported Q3 results, and approximately 73% have exceeded forecasts. Investor sentiment has been very negative, possibly assisting the market rebound, the Bank of America Fund Managers monthly survey showed investors were holding the most … Continued

Intermediate

Macroeconomic/ geopolitical developments US core consumer price index (CPI) inflation hit at four-decade high, at 6.6% year-over-year, higher than consensus. Earnings season began, with US financials leading the way, overall posting above expectations. In the UK, the U-turns continue on the much-criticised mini budget, with the chancellor of the exchequer, Kwasi Kwarteng a political casualty, … Continued

Intermediate

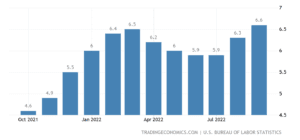

Macroeconomic/ geopolitical developments On the data front, Monday saw the release of the US ISM Manufacturing PMI activity data, which was below expectations, and also showed falling price pressures (fuelling a risk on theme to start the week, month and quarter). Further easing inflation fears and adding to the risk on tone, the US job … Continued

Intermediate

Macroeconomic/ geopolitical developments The UK mini-budget on Friday 23rd September that saw tax-cuts, the cancellation of national insurance and corporation tax increases, supply-side reforms, plus a GBP 60 billion energy support package had serious impacts on global financial markets last week. The Pound plunged across the Forex board, which saw Cable, GBPUSD, hit an all-time-low, … Continued

Intermediate

Macroeconomic/ geopolitical developments The key focus last week was the Federal Reserve Open Market Committee (FOMC) decision, statement and press conference on Wednesday. This brought an anticipated 75bp rate hike, but also a more hawkish tone than markets had anticipated, with rates possibly now moving to a higher peak in 2023 up to 4.50% and … Continued

Intermediate

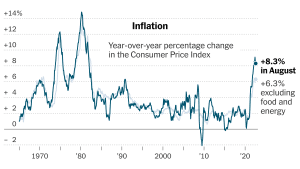

Macroeconomic/ geopolitical developments The dominant event last week was the far higher than expected release for the US Consumer Price Index (CPI) data on Wednesday. Headline CPI rose 8.3% YoY ended August against expectations of an 8.1% rise. Core inflation (CPI excluding food and energy) leapt to its highest level since March at 6.3%, higher … Continued

Intermediate

Macroeconomic/ geopolitical developments Easing inflation fears seemed to be at work last week, possibly assisted by a midweek decline in oil prices to multi-month lows. Plus, the Fed’s “Beige Book” indicated that price increases were moderating in 9 of its 12 districts. Fed speakers Brainard and Mester also delivered comments that seemed to be more … Continued

Intermediate

Macroeconomic/ geopolitical developments Further hawkish messages from Federal Reserve officials last week have reinforced the tone evident since the Fed Chair, Jerome Powell’s 26th August Jackson Hole speech. Friday’s US Employment report saw 315K jobs added, down from the revised 526K number for July, but still a solid report. Global financial market developments The major … Continued

Intermediate

Macroeconomic/ geopolitical developments Markets had interpreted Fed Chair Jerome Powell’s post-meeting press conference after the July 26-27 policy meeting as a dovish “pivot”. Last week several Fed officials pushed back against this dovish market narrative and indicated that the central bank is still steadfast in raising rates until inflation is under control House Speaker Nancy … Continued

Intermediate

Macroeconomic/ geopolitical developments As expected, the Federal Open Market Committee (FOMC) increased rates on Wednesday by 0.75%, taking the benchmark Fed Funds rate to about 2.5% Powell highlighted a Fed Funds range of 3.0%-3.5% by year end, implying about 50-100 basis points of more tightening over the three meetings for the balance of this year, … Continued