-

Home

- >

- Author: Steve Miley (The Market Chartist)

Steve Miley (The Market Chartist)

Steve Miley is the Market Chartist and has 32 years of financial market experience and as a seasoned expert now has many responsibilities. He is the founder, Director and Primary Analyst at The Market Chartist, the Editor-in-Chief for FXExplained.co.uk, the Academic Dean for The London School of Wealth Management

At FXExplained.co.uk Steve is the Editor-in-Chief, alongside producing numerous articles for the site. The ability to be able to reach out to a wide, global audience with his own analysis and also assist and nurture other authors in their creative process makes this a role that Steve values deeply.

Here are Steve’s tips on what pages to follow closely on FxExplained: Current market analysis and Best trading app in UK.

The Market Chartist

The Market Chartist was founded in 2012 and provides daily technical analysis reports, with written commentary and key support/ resistance levels to an institutional, professional and retail client base. The 30+ daily reports include European, UK and US Bonds & Equity Index Futures, G10 currencies, UK Natural Gas, TTF Gas, German Power, EUA Emissions and LME Base Metals.

As The Market Chartist, Steve has won many awards from the Technical Analyst Magazine. He was the 2016 & 2013 Winner (plus 2014 Runner Up) for Best Independent Fixed Income Research & Strategy and winner of Best FX Research & Strategy in 2012. He was also a finalist in the Technical Analyst of the Year category each year for 2012-2017.

Other Current Positions

Steve is also the Academic Dean for The London School of Wealth Management, a role he really enjoys. He appreciates the opportunity to be able to educate a diverse array of students in all aspects of the financial market’s world. Steve says “to be able to be a part of transforming an individual’s life through education is truly a privilege and very exciting”.

Steve also writes extensively for numerous financial markets sites including: FxStreet.com, TechnicalAnalyst.co.uk, InsideFutures.com, BarChart.com, StockTwits.com, StockBrokers.com, AskTraders.com and Investing.com.

Previous to this, Steve was also a Senior Lecturer at The London Academy of Trading where he fully began his journey into the world of education. It was here that he honed his skills as a lecture and mentor in the world of financial markets education.

Vast Technical Analysis Experience

Steve has also helped technical analysis push into a new era in his previous role as Director at Vega Insight. Vega Insight is a relatively new company with a specific focus on Artificial Intelligence and Machine Learning in global commodity and broader financial markets, with special focus on Energy. In his role Steve was responsible for the technical analysis inputs to the Artificial Intelligence and Machine Learning.

Steve spent 2009-2012 as a Director in the Technical Analysis Research Strategy team at Credit Suisse. Steve managed the FX division, responsible for the reports, forecasts and bank wide research for G10 & Emerging Markets currencies. In this role he also covered all major asset classes including Equity Indices, Rates & Credit, plus Commodities.

Steve spent most of his career at Merrill Lynch for 15 years from 1994-2009. The last ten years was as a Vice President in the research department as a technical analyst, responsible for daily reports, client presentations, plus in-house and client education programs. Prior to this, Steve was in the Fixed Income derivatives sales team where he managed the Italian Futures desk (BTP and EuroLira) on LIFFE (the London International Financial Futures Exchange). He was responsible for a four-man sales team, who consistently produced high volume of sales from both in-house and external clients.

He is a Member of the Society of Technical Analysts (MSTA) and holds a Master’s degree in politics, Philosophy & Economics from Oxford University (Lincoln College).

Intermediate

Macroeconomic/ geopolitical developments The Monthly Fund Manager Survey from Bank of America showed that funds’ cash holdings are at their highest levels since 9/11, and equity exposure at the lowest levels since the 2007–2009 global financial crisis and recession. This can be viewed as a contrary indicator, meaning that there is plenty of cash to … Continued

Beginner

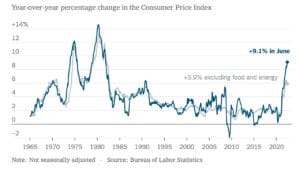

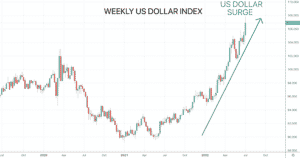

Macroeconomic/ geopolitical developments The big data print came from US CPI on Wednesday with the headline number moving to 9.1% YoY, up from the 8.6% print in May and higher than consensus. There is now a growing anticipation from short-term interest rate markets that the Fed could raise rates by 1.00% at their meeting on … Continued

Beginner

Macroeconomic/ geopolitical developments The FOMC Meeting Minutes on Wednesday reinforced recent hawkish comments from Fed members. S&P Global Services and Composite PMI, plus US ISM Services PMI came in above forecast for the US and were also broadly better than expected globally and notably for the UK and across Europe, although hitting very low levels. … Continued

Intermediate

Macroeconomic/ geopolitical developments The European Central Bank (ECB) Forum on Central Banking 2022, from Sintra, Portugal saw the world’s major central bankers reaffirm their commitment to fighting inflation. The Manufacturing Purchasing Managers Index (PMI) data was mixed last week, with some of the European data beating expectations, whilst the US PMI data from S&P Global just … Continued

Intermediate

Macroeconomic/ geopolitical developments Moderating inflation pressures and falling growth data helped global stock indices secures gains and technical bases last week. Global S&P Flash PMI on Thursday were not only lower than for May, but also below expectations in many instances, with the US services data hitting its lowest level since January. In addition, long … Continued

Intermediate

Macroeconomic/ geopolitical developments Central Banks were front and center last week, with the Swiss National Bank (SNB), US Federal Reserve (Fed), European Central Bank (ECB), Bank of England (BoE) and Bank of Japan (BoJ) all in play. First, the ECB held an ad hoc, emergency meeting on Wednesday to deal with surging bond yields for … Continued

Intermediate

Macroeconomic/ geopolitical developments As expected, the European Central Bank (ECB) pivoted to a more hawkish stance on Thursday, signaling a rate hike in July and maybe more aggressive rate hikes than anticipated thereafter. In addition, they announced the end to their Quantative Easing (QE) program, the Asset Purchase Program (APP) Friday’s US CPI data showed … Continued

Intermediate

Macroeconomic/ geopolitical developments The EU agreed on a partial ban on Russian oil. OPEC+ agreed on bigger oil-output hikes for July and August on Thursday, but still disappointed the oil market, which rebounded strongly, having previously sold off in anticipation of more aggressive hikes. EU inflation hit a new record high at 8.1%. Despite markets … Continued

Intermediate

Macroeconomic/ geopolitical developments Selling exhaustion in the equity markets saw recoveries last week, and a cross market shift to a “risk on” theme. This was helped by some positive forecasts from Macy’s, Ralph Lauren and Nordstrom. Fed Minutes pointed to hints of flexibility, helping the more positive outlook. Economic data was mixed, but the PCE … Continued

Intermediate

Macroeconomic/ geopolitical developments Poor results from US retailers, notably Target, but also Walmart, Lowe’s and Home Depot, highlighted a weakened US consumer. This stoked fears of a larger slowdown and future recession. This on top of US and global inflation worries, and hawkish Central Banks stoked the stagflation fire. Fed speakers, including Chair Powell have … Continued

Intermediate

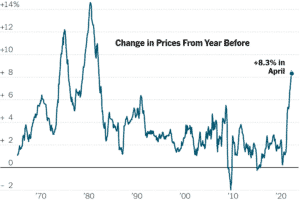

Macroeconomic/ geopolitical developments US CPI headline data year over year rose 8.3%, falling from March’s pace but not as much as expected, with consensus around 8.1%. Jerome Powell again stated that a hike of 0.75% was not something being actively considered, but was still a possibility. Possible easing of pandemic lockdowns in Shanghai, China brought … Continued

Intermediate

Macroeconomic/ geopolitical developments A 0.5% hike by the Fed as expected, but Jerome Powell stated that a hike of 0.75% was “not something we are actively considering.” Stock indices initially rallied strongly on this information Wednesday, then reversed these gains and more on Thursday and Friday. Friday’s US Jobs reports saw 428K jobs added in … Continued

Intermediate

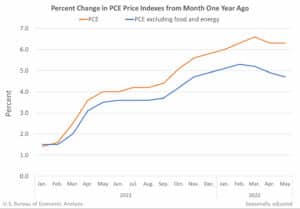

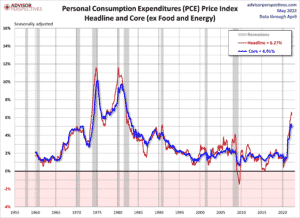

Macroeconomic/ geopolitical developments Disappointing earnings results from the tech sector last week, including Alphabet and Amazon, and concerning forward guidance from Apple eclipsed solid Meta numbers. The US core Personal Consumption Expenditures (PCE) price index YOY data, which is the Fed’s preferred inflation gauge posted its first deceleration in over a year, whilst the YOY headline … Continued

Intermediate

Macroeconomic/ geopolitical developments More hawkish comments from various Fed policymakers, notably Bullard and Fed Chair Powell indicated even more aggressive interest rate hikes in 2022 and also in the near future, sending bond and stock markets lower in the US and globally. European Central Bank (ECB) hawks and doves have called for earlier and more … Continued

Intermediate

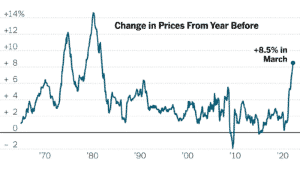

Macroeconomic/ geopolitical developments US headline CPI data leapt by 1.2% in March, with the year-over-year rise at 8.5%, above consensus expectations to a four-decade high. More hawkish comments from Charles Evans of the Fed (historically a dove) regarding accelerated rate hikes echoed the comments the prior week from another dove, Lael Brainard. The European Central … Continued

Intermediate

Macroeconomic/ geopolitical developments Hawkish comments from Lael Brainard of the Fed (usually more of a dove) regarding rate hikes and balance sheet normalization saw Bonds yields surge last Tuesday, with growth/ tech stocks leading the US stock averages lower. This was affirmed by Wednesday’s FOMC Meeting Minutes, which reinforced a more hawkish threat from the … Continued

Intermediate

Macroeconomic/ geopolitical developments The financial markets have been less dominated by the Russian invasion of Ukraine, as a lack of any significant escalation has seen a further shift towards more of a “risk on” theme for stocks since mid-March. There have also been hopes from the Ukraine/ Russia talks and also from reported setbacks suffered … Continued

Intermediate

Macroeconomic/ geopolitical developments The financial markets have been less dominated by the Russian invasion of Ukraine, as a lack of any significant escalation has seen a further shift towards more of a “risk on” theme for global risky assets (notably stocks) since mid-March. This has also been assisted by hopes from the Ukraine/ Russia talks … Continued

Intermediate

Macroeconomic/ geopolitical developments The financial markets have once more been dominated by the Russian invasion of Ukraine, but with a shift towards more of a “risk on” theme through mid-March. This has been driven by hopes from minimally positive signals from the Ukraine/ Russia talks. And, although there have been some upsetting impacts on civilians, … Continued

Beginner

Macroeconomic/ geopolitical developments The financial markets have again been dominated by the Russian invasion of Ukraine, with shifts between “risk on” and “risk off” themes. Further punitive sanctions including the US barring Russian oil imports has increased the threat to global trade and global economic growth. Global commodity prices have again risen aggressively, but also … Continued

Intermediate

Macroeconomic/ geopolitical developments The financial markets have again been dominated by developments in the Russian invasion of Ukraine, with shifts between “risk off” and “risk on” themes. More punitive sanctions have seen European and U.K. stocks under particular pressure given the likely impact on global trade and the global economy. Global commodity prices have risen … Continued

Intermediate

Macroeconomic/ geopolitical developments The markets were dominated last week with shifts between “risk off” then “risk on” themes with the Russian invasion of Ukraine. The “risk off” theme on the initial invasion quickly shifted to “risk on”, as is often seen when conflict is predicted by markets and then finally breaks out, “sell the rumour, … Continued

Intermediate

Macroeconomic/ geopolitical developments The markets were dominated last week with shifts between “risk on” then “risk off” themes with conflicting reports regarding the potential for conflict starting between Russia and Ukraine. Reports of Russian troops withdrawing saw a “risk on” move earlier in the week, which was dismissed by Western statements regarding a potentially imminent … Continued

Intermediate

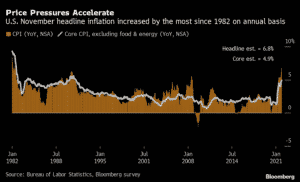

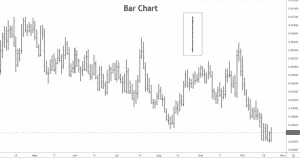

Macroeconomic/ geopolitical developments Another inflationary shock to the upside with the release of the US CPI data on Thursday that saw a print of 7.5% on an annual basis, above consensus estimates and at its highest level for 40 years, since 1982. The surging inflation data from the US (and globally so far in 2022) … Continued

Intermediate

Macroeconomic/ geopolitical developments A more hawkish tone from global central banks with the Fed shifting more hawkish through January, on Thursday we saw the Bank of England and European Central Bank both signal a more hawkish tone. The Bank of England delivered a 25bp interest rate hike as anticipated, but the vote was close for … Continued

Intermediate

Macroeconomic/ geopolitical developments We got the US Federal Open Market Committee (FOMC) interest rate decision, statement and press conference on Wednesday and although markets moved initially to a “risk on” theme after the statement, the press conference saw a “risk off” shift, as, markets interpreted comments from Fed Chair Jerome Powell as opening the door … Continued

Intermediate

Macroeconomic/ geopolitical developments Increasing worries of global inflationary pressures and fears of even higher interest rates from the major Central Banks have seen a more aggressive shift to a “risk off” phase through mid-January. These concerns have been heightened by the threat of conflict as Russia continues to amass troops on the Ukrainian border. These … Continued

Intermediate

Macroeconomic/ geopolitical developments Ongoing concerns of global inflationary pressures have seen an erratic start to the year for global markets, seen again last week. The US CPI data for December showed a 7% rise over a year, the highest inflation rate since 1982! Although this was priced in, it continues to fuel inflationary and higher … Continued

Intermediate

Macroeconomic/ geopolitical developments 2022 kicked off with a continuation of the latter 2021 theme of rising concerns of global inflationary pressures. This saw a rise in not just US bond yields, but in global bond yields, particularly in the major, economic centres. This higher yield theme was reinforced by the release of the Minutes from … Continued

Intermediate

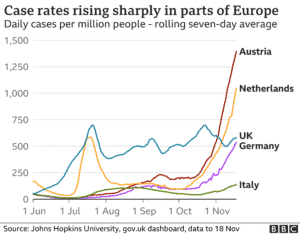

Macroeconomic/ geopolitical developments Concerns that the Omicron strain of COVID-19 could contribute to supply chain disruptions and weigh on global economic growth have resurfaced over the past week. This has been driven by global medical institutions warnings of the more contagious aspect of Omicron the surging numbers of cases in many countries (for example the … Continued

Intermediate

Macroeconomic/ geopolitical developments Concerns that the Omicron strain of COVID-19 could contribute to supply chain disruptions and weigh on global economic growth have decreased over the past week. This has been due to positive sounding from vaccine providers and medical institutions regarding the efficacy of vaccines and that the variant could be less severe than … Continued

Beginner

Macroeconomic/ geopolitical developments Concerns that the omicron strain of COVID-19 could contribute to supply chain disruptions and weigh on global economic growth have impacted “riskier” assets. This has been intensified by relatively “hawkish” comments from Federal Chair Jerome Powell in testimony to Congress, indicating inflation worries and the potential to speed up the tapering of … Continued

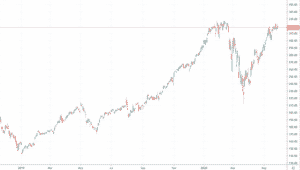

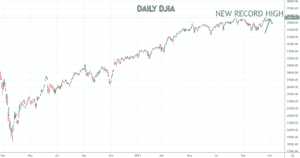

Macroeconomic/ geopolitical developments US Retail Sales data came in at 1.7% in October, its biggest gain since March, whilst September data was also revised higher. US Industrial Production for October also beat estimates. This has sustained the “risk on” theme, despite headwinds of higher inflation and rising COVID-19 rates in Europe. The high COVID-19 rates … Continued

Intermediate

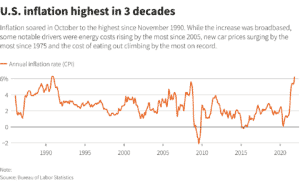

Macroeconomic/ geopolitical developments The standout event last week was the US CPI data on Wednesday, which came in much higher than expected at 6.2% year-over-year, its highest level since 1990. This fuelled ongoing, underlying inflation concerns, seeing global stock indices setback (then bounce), whilst global bonds pushed to higher yields. Tesla saw a steep decline … Continued

Intermediate

Macroeconomic/ geopolitical developments The Federal Reserve Open Market Committee (FOMC) met on Wednesday and as expected announced the start of tapering their monthly bond purchases by USD 15 billion later in November and December. However, the FOMC statement again highlighted an expectation for inflation to moderate and signalled no rush to tighten monetary policy. Markets … Continued

Beginner

Time frames can be a challenging aspect of trading to understand. Not just for beginners, but the idea of time frames even causes issues for more established and veteran traders. What we’ll cover Concept of trading time frames How they work Why understanding them is essential Different time frames and how they’re used We’ll be … Continued

Beginner

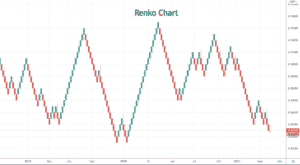

In our article What are Trading Charts? — Part 1 we looked at how various trading charts work, why they’re important, how to read live charts and how to use them. Plus, we covered when charts should be used and what to consider when trading using charts.In this article, we explore the different types of … Continued

Beginner

Trading charts can be used to plot the price of any market; forex, stocks, bonds, commodities and more, any market where the price changes.Charts are at the core of technical analysis. For you, the trader, an understanding of different chart types is vital when using technical analysis and helps you make informed trading decisions Charts … Continued

Beginner

Technical analysis is a way of assessing financial markets to be able to determine and hopefully predict future market price moves. It is also sometimes referred to as charting, with technical analysts being known as chartists. Technical analysis is just one type of the many different approaches to market analysis that a trader, investor or … Continued

Intermediate

Macroeconomic/ geopolitical developments The busiest week of the US earnings season saw mixed earnings from Big Tech, with positives from Facebook, Microsoft and Google, and a positive announcement for Tesla, but significant misses from Apple, and Amazon. Further progress was seen on Biden’s proposed social infrastructure bill Despite losses after the Apple and Amazon releases, … Continued

Intermediate

Macroeconomic/ geopolitical developments Earnings season continued in the US last week, with positive earnings surprises across sectors, reinforcing solid results from the financial sector the prior week. But Snapchat parent Snap did disappoint on Friday, dragging the tech sector and Nasdaq lower to end the week. Fiscal stimulus hopes also helped the “risk on” theme … Continued

Intermediate

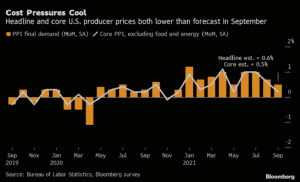

Macroeconomic/ geopolitical developments Although the FOMC meeting minutes on Wednesday did indicate that bond purchase tapering is likely to begin before the end of 2021, the minutes also revealed that Fed officials are currently looking to keep interest rates at or near zero for the next couple of years. Data has suggested that both supply … Continued

Intermediate

Macroeconomic/ geopolitical developments The “risk off” theme that had struck global financial markets earlier in September resumed into month-end as inflation concerns returned, alongside higher yield pressures. Global stock indices reversed previous recovery rebounds, looking technically vulnerable. Debt ceiling and stimulus uncertainty are also weighing on riskier assets. Although the federal government passed a short-term … Continued

Intermediate

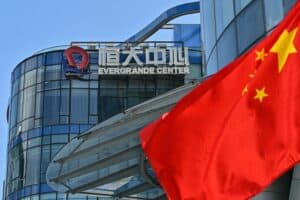

Macroeconomic/ geopolitical developments The “risk off” mode that has gripped global financial markets in September due to growth and inflation concerns was intensified early last week with Evergrande contagion worries. However, these contagions fears have eased through the week, as have the growth and inflation worries, which have seen global stock indices post robust recovery … Continued

Intermediate

Macroeconomic/ geopolitical developments Ongoing growth and inflation concerns have left global financial markets in “risk off” mode, and still vulnerable to further erratic, “risk off” moves. Growth concerns have been sparked by three main factors: ongoing supply chain worries fuelling inflation fears Inflation worries putting the spotlight on Central Banks and in particular the Fed … Continued

Intermediate

Macroeconomic/ geopolitical developments The ongoing global spread of the COVID-19 Delta variant and the concerns regarding the new Mu variant, have impacted on growth expectations. In addition, ongoing supply chain worries have continued to fuel inflation fears and accentuate growth concerns. These factors leave global financial markets vulnerable to erratic, “risk off” moves. On Thursday … Continued

Intermediate

Macroeconomic/ geopolitical developments The standout economic event last week was the August US Employment report on Friday, which was disappointing, the headline Non-Farm Payroll (NFP) data missed expectations, posting at 235K, with 750K expected. Prior monthly gains were revised higher though, whilst the Unemployment Rate fell to a pandemic-era low at 5.2%. Global Purchasing Managers … Continued

Intermediate

Macroeconomic/ geopolitical developments The standout economic event last week was the Jackson Hole Economic Policy Symposium, but it ended up as a non-event, as Fed Chair Powell did not signal anything different than previously communicated with respect to removing policy accommodation. The chaos, unrest and terrorist activity in Afghanistan has had muted impact on global … Continued

Beginner

Macroeconomic/ geopolitical developments The standout event last week was the Fed Minutes which showed increasing talk of tapering Bond purchases later this year. The data even last week were the US Retail Sales numbers which fell 1.1% in July (though June data was revised higher). Chinese stocks remain under pressures with the ongoing regulatory clampdown … Continued

Beginner

Macroeconomic/ geopolitical developments The standout event in a light data week was the US Consumer Price Index (CPI) data, with the ex-Food & Energy number coming in at 0.3%, below consensus estimates. On the fiscal side, the US Senate passed the infrastructure spending bill, approximately USD 1 trillion with about USD 560 billion of new … Continued

Beginner

Macroeconomic/ geopolitical developments The standout event in the week was Friday’s strong US Employment report, with 943K jobs added in June, notably above consensus estimates. Thursday saw the Bank of England Meeting and a slightly more hawkish tone stating that “some modest tightening of monetary policy over the forecast period is likely to be necessary”. … Continued

Beginner

Macroeconomic/ geopolitical developments A regulatory crackdown by Chinese authorities on large internet stocks saw Chinese share indices plunge and also saw some delayed and limited contagion effect on global stock averages. We got the Fed decision on Wednesday last week, with a slightly more hawkish tone in the statement, but a slightly more dovish tone … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial markets reacted to ongoing fears of more hawkish monetary policy in the US, alongside concerns around the spread of the COVID-19 Delta variant globally. As we will look at below, this is sent global bond markets higher (to lower yields, led by the US), whilst world stock averages sold off … Continued

Beginner

Macroeconomic/ geopolitical developments Manufacturing Purchasing Managers Index (PMI) data for June mostly beat expectations on Thursday 1st July, both from Markit for many major economies and from the US Institute of Supply Managers (ISM), with the Manufacturing PMI coming in at 60.6%, beating consensus for a 13th straight month above 50.0%. The US Employment report … Continued

Intermediate

Macroeconomic/ geopolitical developments Last week, global financial markets were still digesting the big event of the prior week with the US Federal Reserve signalling a more hawkish tone than the financial markets had anticipated. Fed officials this past week have sought to calm markets and allay fears that they were about to start to tighten … Continued

Intermediate

Macroeconomic/ geopolitical developments The big event of the past week was US Federal Open Market Committee (FOMC) interest rate decision and statement on Wednesday. The FOMC dot plot chart at least two quarter-point rate increases in 2023. This was a more hawkish tone than the US and global financial markets had anticipated, causing significant price … Continued

Beginner

Macroeconomic/ geopolitical developments US CPI data was higher than expectations, with the headline data posting at 5% year-on-year for May, at its fastest pace since August 2008, with the core rate at 3.8%, its highest for nearly three decades. But Bond markets and stock indices shrugged off this data, with moves to lower yields and … Continued

Intermediate

Macroeconomic/ geopolitical developments Another quiet week in financial markets up until Friday, despite a busy data calendar. Markets kicked into life after Friday’s US Employment report, which saw 559K jobs added in May, which was slightly worse than expectations. Over the weekend, the G7 agreed a global minimum corporate tax of 15%. Global financial market … Continued

Intermediate

Macroeconomic/ geopolitical developments A quiet week in financial markets with muted central bank activity and a relatively light data calendar. The standout on Wednesday was a more hawkish tone from the Reserve Bank of New Zealand (RBNZ). This helped the New Zealand Dollar post firm gains across the Forex board. Cryptocurrencies remained volatile, with Bitcoin … Continued

Intermediate

Macroeconomic/ geopolitical developments Inflation concerns remain, after the recent spike in US CPI data. The Fed Minutes on Wednesday highlighted an improving US economy but still far from the Fed’s goals, this did not have a significant impact on global financial markets. Tensions in Gaza have eased with an Israel-Hamas ceasefire announced. The Indian COVID … Continued

Intermediate

Macroeconomic/ geopolitical developments The US Consumer Price Index released on Wednesday came in at 4.2% from a year ago and 0.8% from March, significantly higher than expected. This data heightened US and wider inflation concerns, which had already spooked Big Tech stocks through mid-May, pulling broader equity indices lower. Tensions in Israel have had little … Continued

Beginner

An interview with Jack Schwager, legendary author of the Market Wizards series of trader interviews, who has 22 years experience as a Director of Futures Research for some of Wall Street’s largest firms, including Prudential Securities. Jack is also currently championing Fund Seeder, as a co-founder. FundSeeder.com is a platform devised to find unknown global trading talent and to connect these unknown but … Continued

Intermediate

Macroeconomic/ geopolitical developments US President Biden announced his $1.8 trillion American Families Plan (human infrastructure) to complement the $2 trillion infrastructure plan announced at the end of March. Earnings season has continued with more positives, with Amazon, Google, Apple, Facebook and Tesla all beating estimates (though the price action on these stocks has not been … Continued

Intermediate

Macroeconomic/ geopolitical developments US President Biden announced a potentially significant increase in Capital Gains Tax (CGT) rates, which had a negative impact on US (and global) risk assets. Earnings season has continued with mostly positives, though Netflix missed the expectations of analysts on new subscribers, which was a broader negative for new media/ big tech. … Continued

Beginner

Macroeconomic/ geopolitical developments US Retail Sales data for March came in extremely strong on Thursday, beating expectation with a rise of 9.8% MoM. Earnings season has kicked off in earnest in the US, with the Banks and Financials leading the way, in most instances beating expectations. The European vaccine rollout has improved, although it still … Continued