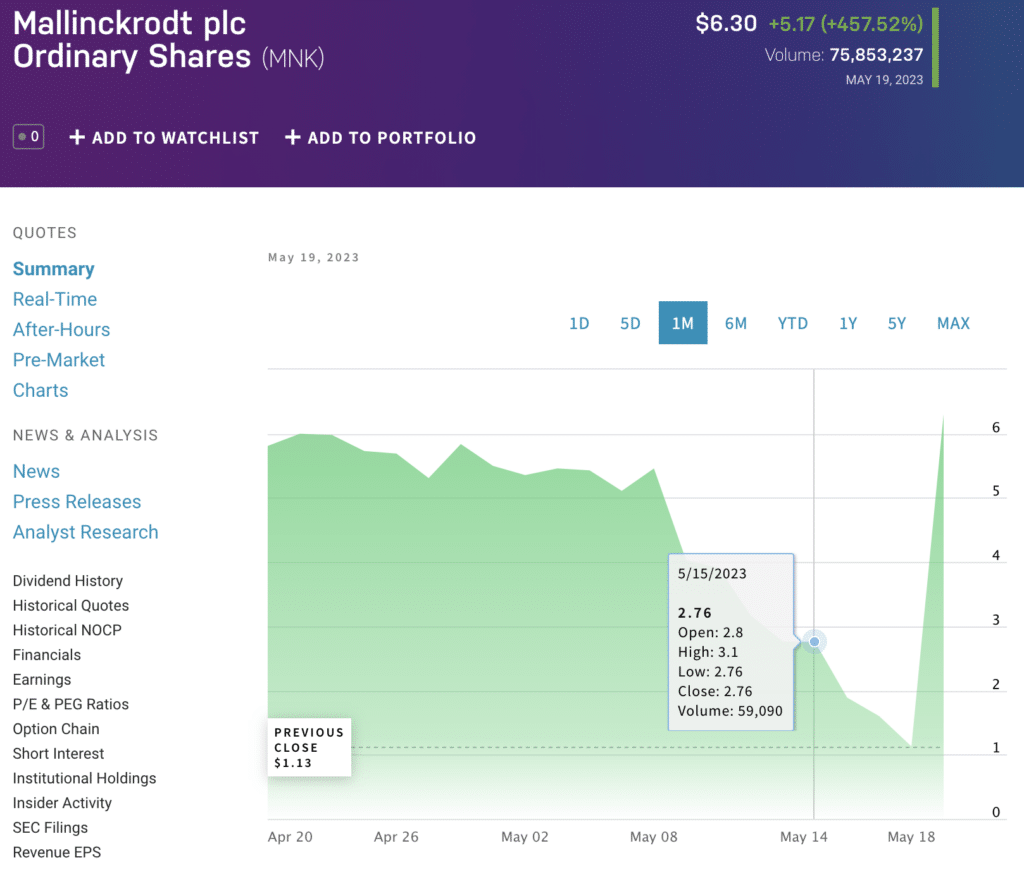

MNK was up 435% on Friday – this is option-like price movement.

Mallinckrodt (NYSEAmerican: MNK) jumped 435% on Friday. Which is the sort of price behaviour we expect from options, not from major corporations. The reason for the volatility – not for the price movement, the volatility – is that in effect MNK stock is indeed an option on Mallincktrodt. That needs a little explaining or perhaps isn’t entirely clear – let’s make it so.

Mallinckrodt first really came to public attention when it was a reverse merger out from the US into Ireland. That lowered the corporate tax bill considerably and really didn’t win it any political friends. This didn’t help – not greatly at least – when it got caught up in the opiates scandal. That idea that all the companies selling opiates had done so illegally in some manner, or at least violating good common sense, and so should pay lots of compensation to addicts. Or more likely to the drug counsellors who were suing the companies.

That led to a Chapter 11 bankruptcy and reorganisation. Yes, this is all a bit involved but it’s important to grasp what’s happening now. There wasn’t enough cash or assets to pay the compensation demanded. But it was likely that if the company could continue in business – but not selling opiates – that it could make enough over time to fill up that compensation fund. So, a very stripped down Mallinckrodt emerged from the Chapter 11 and that’s what is now quoted as MNK.

The compensation fund needs Mallinckrodt to survive

But, and there’s the thing, any substantial earnings for some years are to go to the compensation fund. So, there’s not really any equity around – or no value in the public equity that is. Friday morning the MNK market capitalisation was around $13 million. Yes, with an m. Which for a company doing near half a billion of sales a quarter isn’t much. True, it’s also losing about $250 million a quarter but still. We’ve a pretty large business perched atop a tiny equity valuation.

It is a microcap but not in another sense. Most microcaps are tiny businesses with mild, to be polite, prospects. Mallinckrodt might not have great prospects – might do so too of course – but it is a large business. Get the margins sorted and it’ll be worth a considerable sum.

And that’s why the share price is so volatile, can move so much. It moves like an option because it is, really, an option. A $13 million (OK, $80 million by the end of Friday) option on a $2 billion a year business.

Maybe this next compensation payment can be delayed?

As to why MNK moved – rather than explaining the size of the move – there’s a rumour and no more about the compensation fund. The agreement was that they’d pay $1.6 billion over 8 years. Some of that has to come out of the operating results of the current MNK. The next payment, of $200 million, is about to become due. But looking at the accounts would suggest – suggest – that it would cripple the company if paid. Which would mean no further payments into the compensation fund. So, perhaps a deal can be reached which doesn’t cripple the company by delaying that next payment?

Weirdly, the more likely it is that the payment would bust MNK again the less likely they are to have to pay it – which means that the more bust they are the more they’re worth. For of course if they don’t have to make the payment now they might survive to become actually worth something as a real business again.

Which is why Mallinckrodt jumped that 435% on Friday. That rumour. There’s no confirmation of it, just gossip and talk, some of it even coming from people who might be thought to know a bit about it. Maybe.

There really is no confirmation here

There’s nothing released to the SEC (Edgar is here) but that’s not wholly surprising. In London or Australia, the market regulators would have demanded a statement already. The SEC can take a day or three to do so over such price moves. So, we might get something early this week. Or, of course, everyone might stop believing the rumour and the price collapses again.

There’s also another point to make here. Microcaps are subject to manipulation attempts. Something with a $10 or $20 million market cap can have its price substantially moved my trivial amounts of trading. This probably isn’t true at Mallinckrodt. The volume of trade was up at 75 million pieces of stock – that’s hugely larger than the number in issue. There is something happening here. It can still be a rumour, of course it can, one that turns out to be wrong even. But it’s not a few kiddies playing with the price for laughs.

There’s logic here plus a rumour.

There’s also that logical story to back up the rumour. That the compensation payment would cripple the company, again, a crippled company, again, being the last thing the recipients of the compensation want. So, a deal is possible – which absolutely is not the same as saying that a deal will happen.

Mallinckrodt is moving for good, logical reasons. Now, which way is it going to move next? Well, that’s more difficult.