FunderPro Review

FunderPro is a proprietary trading firm, meaning it does not accept deposits from traders. It is not an online broker. Consequently, to operate, it does not require the licensing online brokers must have to legally deliver their services.

It is not easy to find information online about the corporate entity behind the FunderPro brand. The site of the firm refers to a FunderPro Ltd., presumably based in Malta. It also mentions that the company does not offer investment services listed in the First Schedule of the Investment Services Act, Chapter 370 of the Maltese law.

After a bit of digging, we found that FunderPro Ltd. bears the Universal Entity Code 9353-2066-3461-9193, and its official address is Kenilworth Court, Sir Augustus Bartolo Street, Ta’Xbiex, XBX 1093, Malta.

The proprietary trading firm has been around since late 2022, so it is one of the newer such operations.

As a proprietary trading firm, FunderPro’s business model aims to help traders succeed. When its traders win and profit, the company does as well.

These are some of the main selling points of this proprietary trading firm:

- It helps its traders optimize their efforts by offering them challenge resets, contests, and coupons.

- It does not feature any time limits and doesn’t pressure its traders through unrealistic profit requirements.

- Its trading products are focused on accuracy, simplicity, and speed.

- FunderPro rewards trader referrals.

- The firm allows its traders to keep 80% of the profits they generate and handle up to $200,000 in funds.

- Traders can get their first profit split only eight days after they place their first trade.

Use Promo Code FXE10 for 10% Discount

FunderPro Products

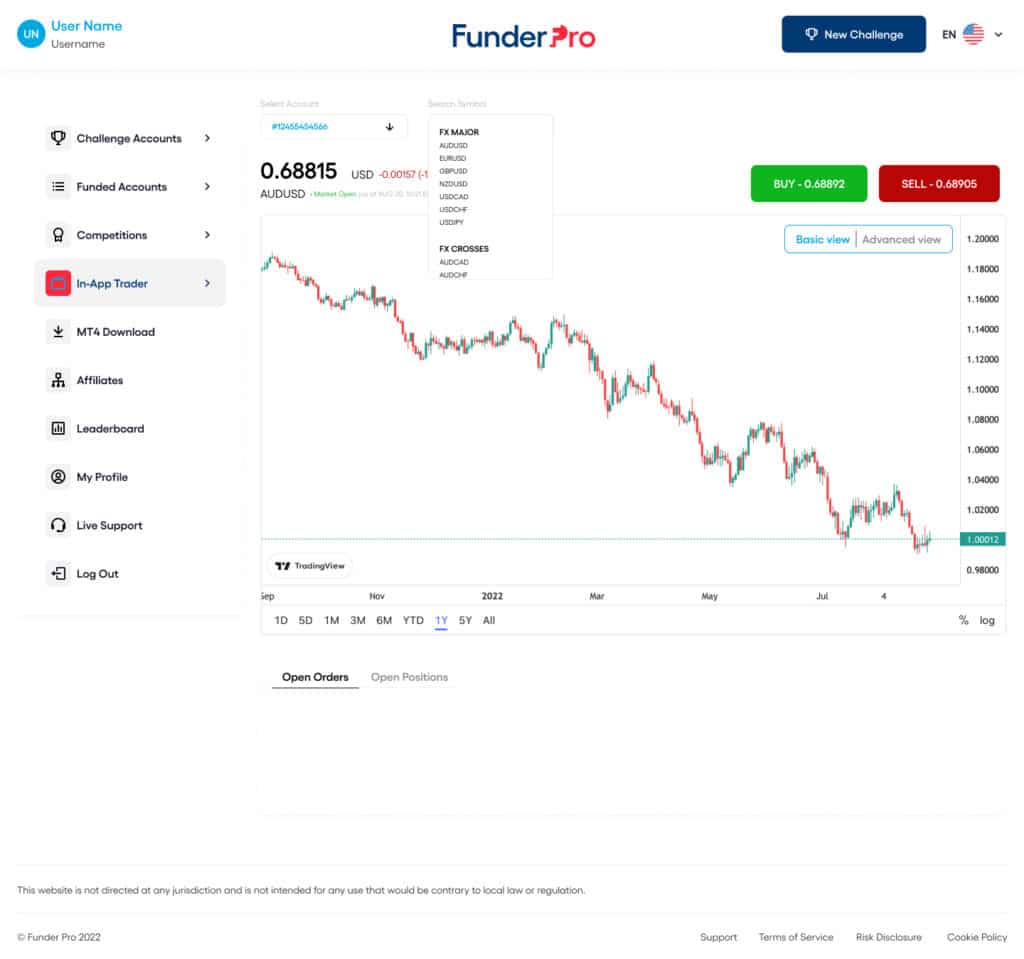

FunderPro is keen on providing full transparency about the costs its traders will incur. Since it only details spreads, we can assume that its trading products consist of CFDs covering a wide range of commodities, securities, and markets.

From the perspective of proprietary traders, CFDs are superior to futures. They contain their costs in the spreads and incur no commissions. They can cover a wider range of markets and offer better liquidity. The position sizing is more advantageous on CFDs.

CFDs and futures are both financial derivatives. If you sign up to FunderPro as a trader, you won’t have to own any of the assets you trade. You only trade the swings that occur in the prices of the underlying assets. And FunderPro offers plenty of such assets.

- The FX Majors cover currency pairs like EUR/USD or USD/CHF. The spreads among these tradable assets are in the 0.5-1.6 range.

- The FX Crosses section covers currency pairs like the AUD/CAD and CHF/JPY. These are less liquid currency pairs, and thus, the spreads on them are higher, in the 1.8 – 4.5 range.

- FX Exotics are for traders familiar with certain currency pairs like the EUR/PLN or the EUR/HUF. The spreads on these assets are much higher, in the 1.4- 47 range.

- With FunderPro, traders can trade indices like the DAX, US30, or UK100. The spreads on this asset class are reasonable, in the 1-6 point range.

- The proprietary trading firm has only included three commodities among its tradable assets for now: natural gas, US oil, and UK oil. The spreads range from 0.06 to 0.45.

- The crypto section covers many crypto/USD pairs. The spreads in this section range from less than a point to tens of points, depending on the tradable asset.

- FunderPro features a small section of EU-based stocks and a wider selection of US-based stocks. Traders can choose from popular stocks like Tesla and Netflix. The spreads on these stock-based CFDs are mostly below one point.

- The metals section covers copper, gold, silver, and platinum. The spreads in this section range from 0.20 to 4.90 points.

The spreads on all these CFDs are variable. They reflect the market conditions. Since FunderPro doesn’t feature commissions on any of its tradable assets, we can assume that it doesn’t offer futures for trading.

If you become a FunderPro trader, you can trade through the popular MT4 platform. Using MT4 to fulfill your evaluation and consistency requirements makes things straightforward for all experienced traders.

Use Promo Code FXE10 for 10% Discount

FunderPro Rules

The evaluation and trading rules can be extremely complex, but FunderPro has done its best to simplify them as much as possible.

Evaluation Rules

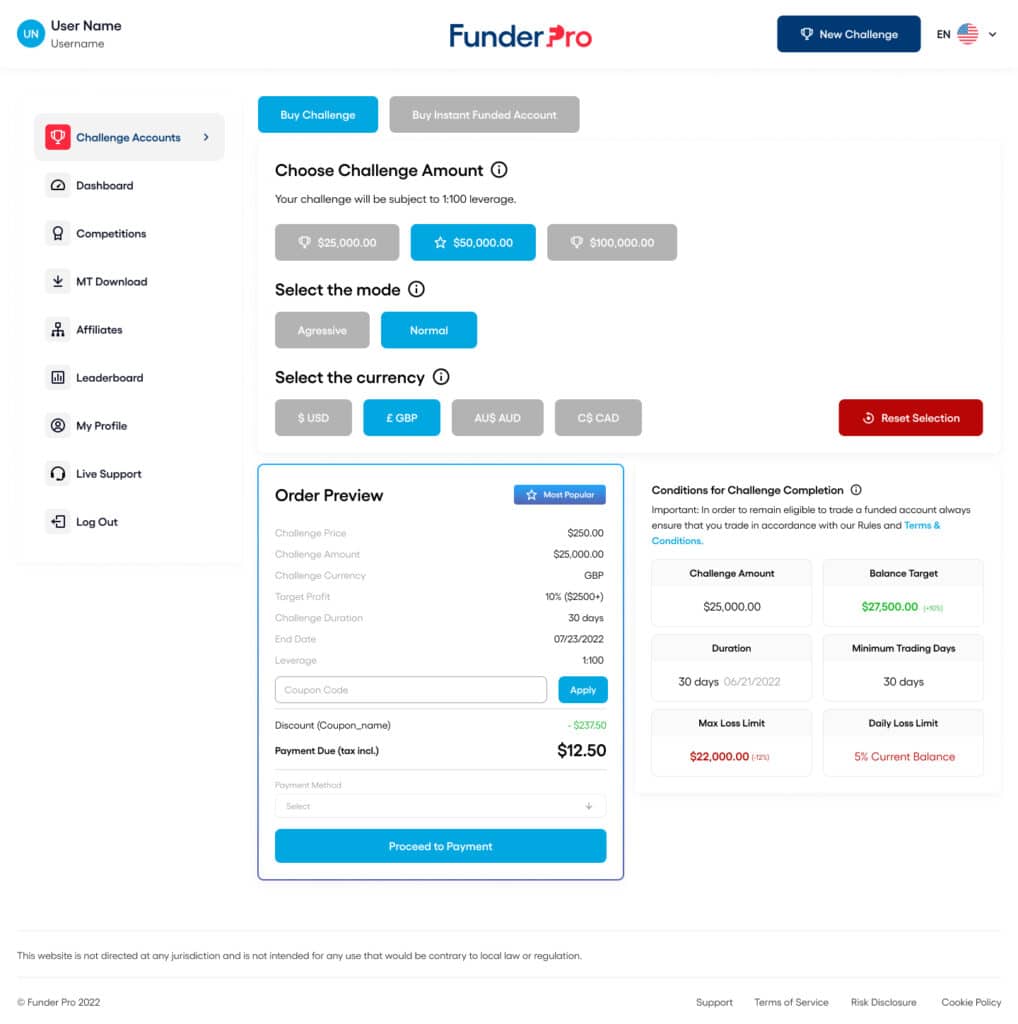

FunderPro’s rules feature no time limits. You are free to take your time fulfilling the requirements. The evaluation process features two phases and four tiers.

Traders can choose whether they want to go after $25,000, $50,000, $100,000, or $200,000 amounts. The larger the sum, the more money they have at their disposal to invest and turn into profits.

The evaluation rules are the same for all four funding tiers.

- The profit target for the first phase of the evaluation is 10%. In the case of the $25,000 challenge, that translates to $2,500. For the second phase, the profit target is 8%. Those who become funded traders do not have profit targets to meet.

- The minimum number of trading days is five for the first phase and the second one. Funded traders have no such targets.

- The maximum daily drawdown is 5% for the first phase, the second phase, and the funded trader phase. Your balance cannot drop by more than $1,250 if you go for the $25,000 target. You cannot lose more than that per day as a funded trader, either.

- The maximum overall drawdown is 10%. You cannot lose more than $2,500 of your trading balance as a funded trader or during your evaluation.

- The leverage is 1:100 during the evaluation phases as well as during the funded trader phase.

- During the first phase of your evaluation, you pay a $250 fee (for the $25,000 challenge). The second phase is free. You can have the $250 refunded as a funded trader.

Percentage-wise, these rules are consistent over all four account tiers (challenges).

If you are a consistently successful trader, FunderPro allows you to add 50% more funds to your trading account every three months. The limit on your account is $5 million. With a massively funded account, traders can scale up their profits.

Consistency Rule

In addition to the mentioned rules, traders have to fulfill a consistency rule as well. Anyone can get lucky and log a highly profitable day of trading, then go on dry spells. FunderPro is not promoting gambling and doesn’t value lucky streaks. Through its consistency rule, it aims to eliminate luck as a factor in the performance of a trader.

The rule applies to the second phase of the challenge. And it states that your best single-day trading profits cannot amount to more than 60% of your total profits.

The trading environment FunderPro offers its traders is a live STP one. Straight-Through Processing is purely electronic trading without any manual intervention. The prices used for the underlying assets are the market prices. No one can manipulate prices and cause traders to fail on purpose.

FunderPro allows weekend positions and honors withdrawals weekly. With an 80/20 profit split, traders can request withdrawals once a week. The platform only accepts cryptocurrency payments, and traders can withdraw their profits in cryptocurrencies.

The withdrawal process is simple and fast.

Use Promo Code FXE10 for 10% Discount

FunderPro Pricing Options

FunderPro deposits and withdrawals do not entail additional fees. The platform does not have any rules meant to discourage or delay withdrawals. The only fees traders pay are the challenge fees which they can recover later when they become funded.

- The $25,000 challenge costs $250.

- The $50,000 challenge costs $300.

- The $100,000 challenge costs $550.

- The $200,000 option costs $995.

The only other fees traders pay are through the spread on the CFDs they trade.

FunderPro Credibility

User feedback on FunderPro’s services is a mixed bag thus far. Some people like it. Others complain about its customer support, and many don’t like that the platform only operates with cryptocurrencies.

What people like about FunderPro:

- The reasonable rules and the unlimited time available to complete the challenges.

- The clarity of the rules.

- The excellent customer service.

What people don’t like about FunderPro:

- The allegedly slow customer support.

- Alleged and unspecified issues with withdrawals.

- An alleged lack of professionalism on the part of the support personnel.

Use Promo Code FXE10 for 10% Discount

Summary

Operating on the well-known and trusted MT4 platform, featuring simple rules and no time-wise restrictions, FunderPro is an attractive proprietary trading firm. Some users have complained that that firm only accepts crypto payments. It is, however, setting up credit card payments.

We gave the real money trading a test and liked what we saw.

See a interview with a trader that uses FunderPro

Use Promo Code FXE10 for 10% Discount