Paying tax when trading in the UK

When it comes to trading, the UK has one of the most lenient tax systems in Europe (due to the relatively low tax regime of the UK). However, even in the UK, you need to understand that there are some taxes that you might incur.

So, what are the taxes that UK traders will pay when trading? It might sound like a relatively simple question. However, this is a question that does not come with a simple answer.

Firstly it depends upon the type of trader that you are. However, it also depends on what you are trading too. There are many grey areas within this whole topic, so we come bearing a caveat. If you are unsure, then you may wish to seek independent financial advice from an accountant, or speak directly to HMRC (HM Revenue & Customs).

As you will see, there are various aspects to this issue, so let’s try and make some sense of it for you.

What are the main taxes for trading and investing in the UK?

First of all, let’s start by looking at the taxes that UK traders could be subjected to.

- Capital Gains Tax – this is a tax on the profits of when you dispose of an “asset”. Capital Gains Tax rules.

- Income Tax – broadly speaking, this is applicable if “trading” is considered by HMRC as your primary source of income. Any profits will be treated as income and taxable under Income Tax rules.

- Corporation Tax – if a trader classes themselves as a private company, or plc, then the profits made by that company will be liable under the rules of Corporation Tax.

- Stamp duty – this is a specific tax that applies to the purchase of company shares. It is known as Stamp Duty Reserve Tax (SDRT)

- Dividend Tax – a tax paid on the dividends from company shares

We will look into these taxes in more detail as we go. However, for now, we will consider if and when these taxes apply to traders. As we touched upon earlier, it depends upon what sort of trader you are and what you are trading.

What type of trader are you?

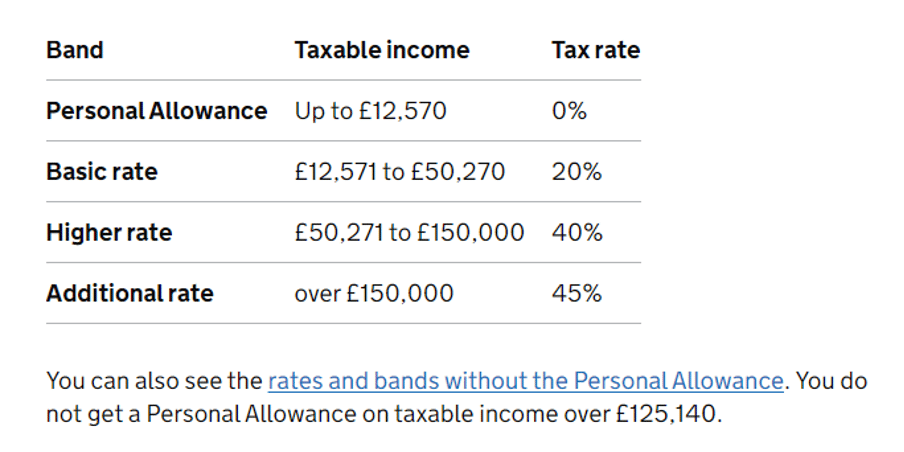

To determine your tax exposure, first of all, you need to determine the type of trader you are. If you are a professional trader (or forex investor), and trading is your primary income, then you will need to pay tax on your profits. HMRC will treat this as your job and subsequently, your profits will be liable for income tax. You will be taxed on profits above your Personal Allowance. Here are the bands according to HMRC for the tax year up to April 2023:

However, if you are a professional trader and set up as a private company (plc), then you can structure to pay Corporation Tax instead. This can help to reduce your tax bill. The tax on profits under £50,000 is 19%. We would recommend speaking to a tax advisor about this. Furthermore, there is potential tax to be paid under Capital Gains Tax rules too.

But what if you just like to dabble in forex, making the occasional trade? In this case, you are seen by HMRC as a short-term “Speculative Trader” (or some might refer to this as a gambler). HMRC does not see this as a primary source of income and does not treat it as income and is tax-free.

Perhaps the reason that this might be the case (and this is just our humble opinion) is that somewhere between 70% and 80% of traders do not make money trading forex. HMRC has probably taken a calculated view that if traders can offset their losses against their tax bill, then HMRC would be losing out on its tax take.

So, do retail traders avoid paying tax in the UK? No, not necessarily! Whilst speculative traders (seen as retail traders) do not pay income tax, HMRC could still class the profits being made as being liable to tax. You could be classed as a “Self-Employed Trader” and could come under Capital Gains Tax rules (see later). For this reason, it is always best to keep a ledger to record trades and profits. HMRC might look into your taxation status. They could enquire into issues such as your salary bracket, your employment status, and the assets and products that you have traded.

So, even if you think you are a speculative trader taking a punt, HMRC might see it differently. This is where, if you are taking trading more seriously, it might be wise to seek the advice of a tax accountant, to help with any confusion.

What are you trading?

The type of instruments you are trading (or investing) can make a difference to your tax bill. We will now look into instruments, shares, and contracts for difference and spread betting.

Let’s start with shares. There are a few things to consider.

SDRT – A tax on buying UK shares

If you are investing in UK shares, you will pay tax (or stamp duty) at the outset of the trade. A tax called SDRT (Stamp Duty Reserve Tax) is added to every buy order for UK investors. It amounts to +0.5% of the position size. For example, an investment of £1000 will incur a £5 charge of SDRT. This tax is automatically added to the order by the broker.

SDRT applies to:

- buying shares in a UK company

- buying options

- buying the rights to company shares

- buying foreign company shares that are registered in the UK.

Taxation on share dividends

If you own shares in a company that pays a dividend then you are liable to pay tax on that dividend (if the shares are owned outside an ISA umbrella – see below).

For UK taxpayers, dividends are declared through your tax return. There is a £2000 dividend tax-free allowance (although this is being reduced to £1000 from April 2023) above which you will pay tax depending upon your income tax bracket:

- Basic rate taxpayers will pay 8.75% on anything above the £2000 tax-free allowance.

- Higher rate taxpayers will pay 33.75% on dividends above the basic rate band.

- Additional rate taxpayers will pay 39.35% above the higher rate band.

Shares ISAs – How to avoid paying CGT

The best way to avoid paying tax on investment profits and dividends is to invest under the umbrella of a Shares ISA. Investments made within a Shares ISA are tax-free and are an efficient way of protecting your investments from Capital Gains Tax and Dividend Tax. They work especially well for medium to longer-term investing.

Capital Gains Tax – A tax on profits from selling UK assets

If you are lucky enough to be very good at investing and trading, when you lock in profits on your UK investments, you might be liable to a Capital Gains Tax (CGT) bill at the end of the tax year.

When selling assets, if you have made a profit of over £12,300 (or £6,150 for trusts) you will be liable to pay Capital Gains Tax (this is the allowance for the tax year 2022/2023).

Basic tax rate payers would pay 10% on profits above the CGT allowance. However, if your profits take your profits and income above into the higher rate tax bracket, you will be liable to pay 20% on the profits above the basic rate band.

There are other CGT rules for property, whilst crucially, you can also offset prior-year losses too. Furthermore, for cryptocurrency traders, HMRC treat profits the same way they do with shares. Crypto profits are liable to CGT.

Here’s a list of a few assets (referred to as “chargeable assets”) where gains are liable to be taxed in the UK under HMRC’s CGT rules:

- Stocks and shares

- Contracts For Difference (CFDs)

- Cryptocurrencies

- Property (aside from your primary residence)

HMRC notes that any gains made from ISAs, UK Government bonds (including Premium Bonds) and betting/lottery winnings are not subject to CGT.

Spread betting – a tax-free investment

In light of HMRC’s classification of gambling being tax-free income. This has created a growth in demand for spread betting accounts with forex brokers.

Spread betting allows traders to speculate on the movement in the price of an instrument. The trader can either buy (hoping for the instrument to move higher ) or sell (hoping for the instrument to move lower). The attraction is that the position can be leveraged by paying “£s per point”. Assets such as forex, commodities, stocks and bonds can all be traded.

However, the chief reason behind the popularity of spread betting is that any profits are classified by HMRC as betting winnings. Spread betting is tax-free. This is the primary difference between spread betting and CFDs, where CFD profits are liable to Capital Gains Tax rules, but spread betting “winnings” are not.

Trading Taxes Takeaways

We have tried to clear up what is still a very cloudy area of taxation on trading in the UK. Essentially, if you make a few quid here and there as you dip your toe into the water of trading in financial markets, the UK tax office is not interested. However, if you take it all more seriously and intend on it being more than just a casual pastime, then taxation becomes more of an issue.

One final thing though, please remember that at FXExplained we are not tax experts. If in doubt, we suggest you speak to an accountant who can help you make further sense of an uncertain topic.