Macroeconomic/ geopolitical developments

- Global equity markets turned lower by week’s end as geopolitical tensions, trade uncertainty, and deflation concerns triggered a broad risk-off shift, erasing early gains across major U.S., European, and Asian indices.

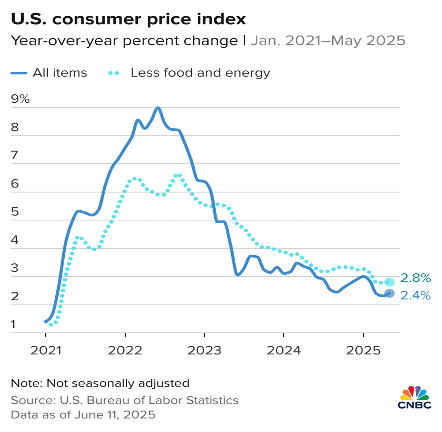

- Softer-than-expected inflation data for May, including modest rises in both consumer and producer prices, eased market concerns and boosted expectations for Federal Reserve rate cuts later this year.

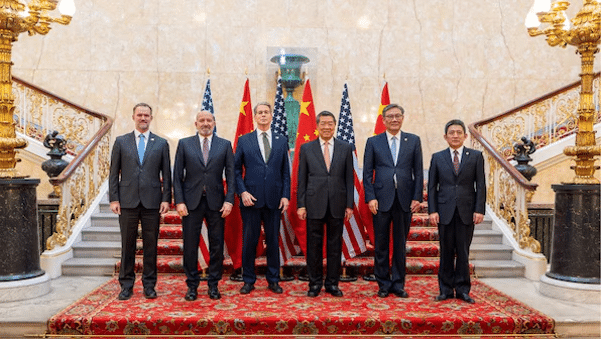

- The U.S. and China reached a tentative trade framework in London aimed at easing tariffs and restoring rare-earth exports, signaling a pause in tensions as both sides await final approval from their leaders.

- Escalating conflict between Israel and Iran has roiled global markets, sending oil and gold prices sharply higher, sparking risk-off sentiment, and heightening fears of inflation, supply disruptions, and broader economic fallout.

- This week, markets are closely watching the Federal Reserve’s interest rate decision and Chair Powell’s guidance amid steady inflation and labor data, while escalating Israel-Iran tensions and ongoing U.S. trade negotiations with key partners like Japan and China add layers of geopolitical and tariff-related uncertainty.

Global financial market developments

- US and global equity averages were lower.

- US and European bond were little changed, but slightly lower on the week

- The US Dollar Index moved to a multi-year low, before a bounce Friday.

- Gold futures surged high Friday, closing in on the record high.

- Oil futures prices rallied through the week and spiked Friday to a multi-month peak.

Key this week

Central Bank Watch: It is a busy week for central bank activity, the main release will be the Federal Reserve Interest Rate Decision, Monetary Policy Statement, Press Conference and Economic Projections on Wednesday. Some other releases of note are the Bank of Japan on Tuesday, and the Bank of England on Thursday and the People’s Bank of China on Friday.

Macro Data Watch: Macro data is light, the main releases are Retail Sales from China, US, UK and Canada through the week and CPI from the UK, EU and Japan towards week end.

| Date | Major Macro Data |

| 06/16/2025 | Chinese Retail Sales and Industrial Production |

| 06/17/2025 | BoJ Interest Rate Decision, Monetary Policy Statement and Press Conference; US Retail Sales and Industrial Production; |

| 06/18/2025 | Japanese Trade Report; UK CPI and RPI; EU CPI; Fed Interest Rate Decision, Monetary Policy Statement, Press Conference and Economic Projections; US Housing Starts and Building Permits |

| 06/19/2025 | BoE Interest Rate Decision, Monetary Policy Summary and Minutes; UK Consumer Confidence |

| 06/20/2025 | Japanese CPI; BoJ Monetary Policy Meeting Minutes; PBoC Interest Rate Decision and Monetary Policy Statement; German PPI; UK Retail Sales; Canadian Retail Sales; EU Consumer Confidence |