-

Home

- >

- Author: Steve Miley (The Market Chartist)

Steve Miley (The Market Chartist)

Steve Miley is the Market Chartist and has 32 years of financial market experience and as a seasoned expert now has many responsibilities. He is the founder, Director and Primary Analyst at The Market Chartist, the Editor-in-Chief for FXExplained.co.uk, the Academic Dean for The London School of Wealth Management

At FXExplained.co.uk Steve is the Editor-in-Chief, alongside producing numerous articles for the site. The ability to be able to reach out to a wide, global audience with his own analysis and also assist and nurture other authors in their creative process makes this a role that Steve values deeply.

Here are Steve’s tips on what pages to follow closely on FxExplained: Current market analysis and Best trading app in UK.

The Market Chartist

The Market Chartist was founded in 2012 and provides daily technical analysis reports, with written commentary and key support/ resistance levels to an institutional, professional and retail client base. The 30+ daily reports include European, UK and US Bonds & Equity Index Futures, G10 currencies, UK Natural Gas, TTF Gas, German Power, EUA Emissions and LME Base Metals.

As The Market Chartist, Steve has won many awards from the Technical Analyst Magazine. He was the 2016 & 2013 Winner (plus 2014 Runner Up) for Best Independent Fixed Income Research & Strategy and winner of Best FX Research & Strategy in 2012. He was also a finalist in the Technical Analyst of the Year category each year for 2012-2017.

Other Current Positions

Steve is also the Academic Dean for The London School of Wealth Management, a role he really enjoys. He appreciates the opportunity to be able to educate a diverse array of students in all aspects of the financial market’s world. Steve says “to be able to be a part of transforming an individual’s life through education is truly a privilege and very exciting”.

Steve also writes extensively for numerous financial markets sites including: FxStreet.com, TechnicalAnalyst.co.uk, InsideFutures.com, BarChart.com, StockTwits.com, StockBrokers.com, AskTraders.com and Investing.com.

Previous to this, Steve was also a Senior Lecturer at The London Academy of Trading where he fully began his journey into the world of education. It was here that he honed his skills as a lecture and mentor in the world of financial markets education.

Vast Technical Analysis Experience

Steve has also helped technical analysis push into a new era in his previous role as Director at Vega Insight. Vega Insight is a relatively new company with a specific focus on Artificial Intelligence and Machine Learning in global commodity and broader financial markets, with special focus on Energy. In his role Steve was responsible for the technical analysis inputs to the Artificial Intelligence and Machine Learning.

Steve spent 2009-2012 as a Director in the Technical Analysis Research Strategy team at Credit Suisse. Steve managed the FX division, responsible for the reports, forecasts and bank wide research for G10 & Emerging Markets currencies. In this role he also covered all major asset classes including Equity Indices, Rates & Credit, plus Commodities.

Steve spent most of his career at Merrill Lynch for 15 years from 1994-2009. The last ten years was as a Vice President in the research department as a technical analyst, responsible for daily reports, client presentations, plus in-house and client education programs. Prior to this, Steve was in the Fixed Income derivatives sales team where he managed the Italian Futures desk (BTP and EuroLira) on LIFFE (the London International Financial Futures Exchange). He was responsible for a four-man sales team, who consistently produced high volume of sales from both in-house and external clients.

He is a Member of the Society of Technical Analysts (MSTA) and holds a Master’s degree in politics, Philosophy & Economics from Oxford University (Lincoln College).

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Holiday Watch: It is the US Independence Day holiday on Friday July 4, US stock markets (cash and futures) are closed. Central Bank Watch: It is a light week for central bank activity, however, throughout the week there are numerous speeches from Fed, ECB and … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Central Bank activity is light this week, the main focus will be on Fed Chair Powell’s testimony on Tuesday and Wednesday. Macro Data Watch: It is a busy week for macro data, the main releases will be the Global Flash PMI on … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: It is a busy week for central bank activity, the main release will be the Federal Reserve Interest Rate Decision, Monetary Policy Statement, Press Conference and Economic Projections on Wednesday. Some other releases of note are the Bank of Japan on Tuesday, … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Central bank activity is light this week with Fed officials in their blackout period before the June meeting, with the main focus on speeches from ECB members throughout the week. Macro Data Watch: The main macro data release this week is the … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week are the Bank of Canada Interest Rate Decision and Monetary Policy Statement on Wednesday and the same from the European Central Bank (ECB) on Thursday. Macro Data Watch: The main macro data release this week … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activity this week is the Federal Open Market Committee Minutes on Wednesday. Macro Data Watch: The main macro data releases this week are the US GDP on Thursday and US PCE on Friday. Earnings Watch: US Q2 earnings … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week are the People’s Bank of China Interest Rate Decision and Monetary Policy Statement on Tuesday and the Reserve Bank of Australia Rate Statement and Monetary Policy Statement also on Tuesday. Macro Data Watch: The main … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Central Bank activity is quiet this week, the main focus will be on speeches from various Fed and ECB speakers throughout the week with particular focus on Fed’s Chair Powell Speech on Thursday. Macro Data Watch: The main macro data releases this … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week are the Federal Reserve Interest Rate Decision and Monetary Policy Statement on Wednesday and the Bank of England Interest Rate Decision, Minutes and Monetary Policy Statement on Thursday. Macro Data Watch: The main macro data … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activity this week is the Bank of Japan Interest Rate Decision and Monetary Policy Statement on Thursday. Macro Data Watch: The main macro data releases this week are the Global Manufacturing PMI data and the US Employment report … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week are the Bank of Canada Interest Rate Decision and Monetary Policy Statement on Wednesday and the same from the European Central Bank on Thursday. Macro Data Watch: The main macro data releases this week are … Continued

Intermediate

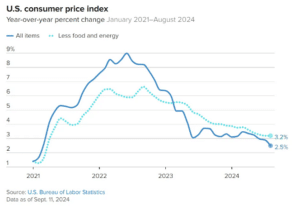

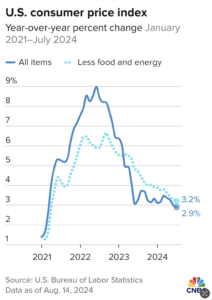

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activity this week is the Federal Open Market Committee Minutes on Wednesday. Macro Data Watch: The main macro data release this week is the US CPI data on Thursday. Some other releases of note are the Chinese CPI … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: There are no significant central bank events this week, only the Bank of Japan Monetary Policy Meeting Minutes on Tuesday. But Fed speakers will need to be monitored as ever. Macro Data Watch: The main macro data release to monitor this week … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank events this week are the Federal Reserve Interest Rate Decision and Monetary Policy Statement on Wednesday, plus from the Bank of Japan on Wednesday, from the People’s Bank of China and from the Bank of England on Thursday. … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activity this week is the Bank of Canada Interest Rate Decision and Monetary Policy Statement on Wednesday. Macro Data Watch: The main macro data release this week is the US CPI data on Wednesday. Some other releases of … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week are the Reverse Bank of Australia Meeting Minutes on Tuesday and the European Central Bank Interest Rate Decision and Monetary Policy Statement on Thursday. Macro Data Watch: The main macro data releases this week are … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: There is little central bank activity of note, but as ever watching Fed speakers through the week. Macro Data Watch: The main macro data release this week is the US PCE date on Thursday and Friday (notably MoM and YoY on Friday). … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activity this week is the Federal Open Market Committee Minutes on Wednesday. Some other activities of note are the Reserve Bank of Australia Interest Rate Decision and Monetary Policy Statement on Tuesday and the People’s Bank of China … Continued

Intermediate

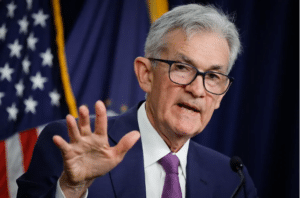

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Central bank activity is modest this week, with the key focus on Fed Chair Jerome Powell’s testimony before Congress on Tuesday and Wednesday. Macro Data Watch: The main macro data release this week is the US CPI on Wednesday and US PPI … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activity this week is the Bank of England Interest Rate Decision, Monetary Policy Report and Minutes on Thursday. Macro Data Watch: The main macro data releases this week are the Global PMI on Monday and Wednesday and the … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activity this week is the Federal Reserve Interest Rate Decision, Monetary Policy Statement and Press Conference on Wednesday. Other releases of note are Bank of Japan Monetary Policy Meeting Minutes on Wednesday, the Bank of Canada Interest Rate … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Geopolitical Watch: Monday, January 20, marks the federal holiday honoring Rev. Martin Luther King Jr., with US equity, bond and futures markets closed or having altered hours. Monday also sees the inauguration of President-elect Donald Trump. Central Bank Watch: The main central bank activities this … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Central Bank activities this week are modest, with key focus on speeches from Fed officials. Macro Data Watch: The main macro data release this week is the US Inflation data on Tuesday (PPI) and Wednesday (CPI) . Some other releases of note … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activity this week is the US Federal Open Market Committee Minutes on Wednesday. Geopolitical Watch: US markets will be closed on Thursday in honor of former U.S. President Jimmy Carter. Macro Data Watch: The main macro data release … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week are the Bank of Japan and Reverse Bank of Australia Monetary Policy Meeting Minutes on Tuesday. Macro Data Watch: The main macro data releases this week are the US US Consumer Confidence, plus the UK … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activity this week is the Federal Reserve Interest Rate Decision, Monetary Policy Statement; Economic Projection, Press Conference and Interest Rate Projections all on Wednesday. Some other activities of note are the Bank of Japan Interest Rate Decision and … Continued

Intermediate

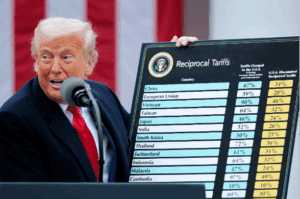

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: A busy week for central banks, with the Reverse Bank of Australia Interest Rate Decision and Rate Statement on Tuesday, then the equivalent from the Bank of Canada on Wednesday and from the European Central Bank (ECB) on Thursday. Macro Data Watch: … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Central bank activity is very modest this week. Key focus will be on the speeches from the Fed members. Macro Data Watch: The main macro data releases this week are the Global PMI on Monday and Wednesday and the US Employment Data … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activity this week is the US FOMC Minutes on Tuesday. Macro Data Watch: The main macro data release this week is the US PCE on Wednesday. Other releases of note are the US Consumer Confidence on Tuesday, US … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week are Reverse Bank of Australia Meeting Minutes on Tuesday and People’s Bank of China Interest Rate Decision on Wednesday. Macro Data Watch: The main macro data released this week are the global Flash PMI on … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: There is no central bank activity of note this week, with the focus back on Fed speakers after the recent blackout period before the FOMC Meeting last week, with the standout on Thursday as Powell speaks. Macro Data Watch: The main focus … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week is the Federal Reserve Interest Rate Decision and Monetary Policy Statement on Thursday. Some other activities of note are the Reverse Bank of Australia Interest Rate Decision and Monetary Policy Statement on Tuesday, Bank of … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activity this week is the Bank of Japan Interest Rate Decision and Monetary Policy Statement on Thursday. Macro Data Watch: The main macro data release this week is the US Employment Report on Friday. Some other releases of … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week are People’s Bank of China Interest Rate Decision on Monday, and the Bank of Canada Monetary Policy Statement and Interest Rate Decision on Wednesday. Macro Data Watch: The main macro data release this week is … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week are the European Central Bank Monetary Policy Statement and Bank of England Monetary Policy Report Hearing on Thursday. Macro Data Watch: The main macro data releases this week are the Chinese, UK and Japanese CPI, … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activity this week is the Federal Open Market Committee Minutes on Wednesday. Macro Data Watch: The main macro data release this week is the US CPI data on Thursday. Some other releases of note are the German CPI, … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Central bank activity is modest this week, but with Fd speakers still in the spotlight, notably Powell on Monday. Macro Data Watch: The main macro data releases this week are the global PMI which are released Tuesday and Thursday, and of course … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week are the Reserve Bank Australia Interest Rate Decision and Rate Statement on Tuesday and the same from the Swiss National Bank (SNB) on Thursday, along with the Bank of Japan Monetary Policy Meeting Minutes and … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activity this week is the Federal Reserve Interest Rate Decision and Monetary Policy Statement on Wednesday and the Bank of England Interest Rate Decision and Monetary Policy Report on Thursday. Some other activities of note are the Bank … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week is the European Central Bank Monetary Policy decision, statement and press conference on Thursday. Macro Data Watch: The main macro data release this week is the US CPI data on Wednesday. Some other releases of … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main Central Bank activity this week is the Bank of Canada Interest Rate Decision and Monetary Policy Statement on Wednesday. Macro Data Watch: The main macro data release this week is the US Job data on Friday. Some other releases of … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: No significant central bank activity this week, but Fed speakers will be key as always. Macro Data Watch: The main macro data release this week is the US PCE data on Thursday and Friday, with Friday’s data key. Some other releases of … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main focus will be on FOMC Minutes on Wednesday and Jackson Hole Symposium from Thursday. Other central bank activities this week are the People’s Bank of China Interest Rate decision on Tuesday and the Reserve Bank of Australia Meeting Minutes also … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: A light week for central banks, we get the Bank of Japan Monetary Policy Meeting Minutes on Monday and the Reserve Bank of Australia Interest Rate Decision and Monetary Policy Statement on Tuesday. Macro Data Watch: A quiet week for macroeconomic data, … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week are the Bank of Japan Interest Rate Decision and Monetary Policy Statement on Tuesday, Federal Reserve Interest Rate Decision and Monetary Policy Statement on Wednesday and the Bank of England Interest Rate Decision, Monetary Policy … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week are the The People’s Bank of China Interest Rate Decision on Monday and the Bank of Canada Interest Rate Decision and Monetary Policy Statement on Wednesday. Macro Data Watch: The key macro data releases this … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Central bank focus will be on the ECB Interest Rate Decision and Monetary Policy Statement on Thursday. Macro Data Watch: The main macro data releases this week are inflation data from the UK, EU, Canada and Japan, Retail Sales from China, Germany … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Fed Chair Powell testifies to Congress on Tuesday. The only other central bank activity of note is the Reserve Bank of New Zealand Interest Rate Decision and Monetary Policy Statement on Wednesday. Macro Data Watch: The main macro data release this week … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Central bank activity is light this week with the focus on Fed speakers. Macro Data Watch: The main macro data releases this week are the global CPI data throughout the week. But the main focal points for the week will be the … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Central bank focus will be on the RBA Interest Rate Decision on Tuesday, BoJ Monetary Policy Meeting Minutes Wednesday and PBoC and SNB Interest Rate Decisions on Thursday. But the main spotlight is on the BoE Interest Rate Decision and Monetary Policy … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week is the FOMC Interest Rate Decision and Policy Statement on Wednesday. One other release of note is the Bank of Japan Interest Rate Decision and Policy Statement on Friday. Macro Data Watch: The main macro … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week are the Bank of Canada Interest Rate Decision and Policy Statement on Wednesday and the EU Monetary Policy Statement on Thursday. Macro Data Watch: The main macro data released this upcoming week are the global … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Central bank activity is light this week but watching Fed speakers in the last week before the FOMC External Communications Blackout Period from 1st June. Macro Data Watch: The main macro data releases this week are the German CPI data on Wednesday, … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Central bank focus will be on the PBoC interest rate decision Monday, the RBA Meeting Minutes Tuesday and the RBNZ interest rate decision Tuesday. But the main spotlight will be on the FOMC Meeting Minutes Wednesday, as well as Fed speakers through … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Central bank activity is modest this week. The key focus will be the Fed speakers after the release of the US CPI data on Wednesday. Macro Data Watch: The main macro data release this week is the US CPI data on Wednesday. … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The most important central bank activities this week are the FOMC Minutes on Wednesday ECB Monetary Policy Decision and Statement on Thursday. We will also observe the RBNZ and BoC Interest Rate Decisions and Statements Wednesday. Macro Data Watch: Global CPI data … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: No Central Bank activity of note, but we are watching for further indications for the path of future US interest rates from FOMC speakers. Macro Data Watch: Global PMI data is released through the week, with the US ISM PMI data of … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: No Central Bank activity of note, but we do get the Bank of Japan Monetary Policy meeting minutes on Monday. This should give further insight after last week’s interest rate hike. Plus, after last week’s Fed meeting we are watching for further … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: A busy week for Central Banks highlighted by interest rate decisions from the BoJ and RBA Tuesday, the PBoC and FOMC Wednesday and the BoE Thursday. Macro Data Watch: Lots of data to be released this week with the focus being global … Continued

Intermediate

What to expect from US Industrial Production data Scheduled for release at 14:15 GMT on Friday, March 15, the US Industrial Production data for February is highly anticipated by economists, policymakers, and investors. This report provides crucial insights into the performance and trends within the manufacturing, mining, and utility sectors, offering valuable indications of economic … Continued

Intermediate

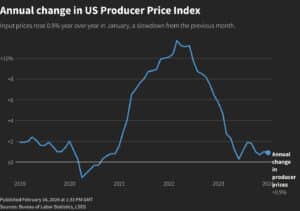

What to expect from US PPI data The upcoming US Producer Price Index (PPI) report, scheduled for release on Thursday, March 14th at 13:30 GMT, is poised to offer critical insights into inflationary pressures within the economy, particularly at the producer level. Analysts’ consensus estimates for February’s PPI report indicate expectations for modest inflationary growth. … Continued

Intermediate

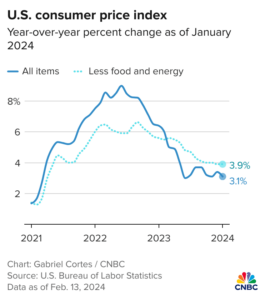

What to Expect from the US CPI Report Scheduled for release on March 12th, 2024, at 12:30 GMT, the US Consumer Price Index (CPI) report for February is poised to attract significant attention from economists, policymakers, and investors alike. This report offers crucial insights into inflationary trends, guiding monetary policy decisions and shaping market expectations. … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Nothing of note from central banks this week, but as ever Fed speakers must be watched. Macro Data Watch: The standout data for the week will be US CPI on Tuesday, plus we also get the UK Employment report and German CPI … Continued

Intermediate

What to Expect from the US Employment Report As anticipation builds for the release of the US Employment Report, economists and market analysts are closely scrutinising various indicators to gauge the health of the labour market and broader economy. Here’s what to expect from the upcoming report based on recent data and expert forecasts. Economists … Continued

Intermediate

Current Climate: US Economy and Fed Speakers Outlook Federal Reserve officials have recently conveyed a cautious stance regarding the possibility of swift interest rate cuts, reflecting their assessment of the current state of the US economy. Governor Michelle Bowman, among others, emphasised the importance of maintaining the policy rate steady, citing potential risks to inflation … Continued