Macroeconomic/ geopolitical developments

- US stocks climbed to new record highs as the S&P 500, Nasdaq, and Dow gained around 2% for the week, supported by strength in technology and industrials, broader participation from small- and mid-cap shares, and renewed global momentum across Europe and Asia.

- Markets remained resilient as easing US-China trade tensions and new US sanctions on Russia’s top oil producers highlighted a week of heightened geopolitical activity but limited market disruption.

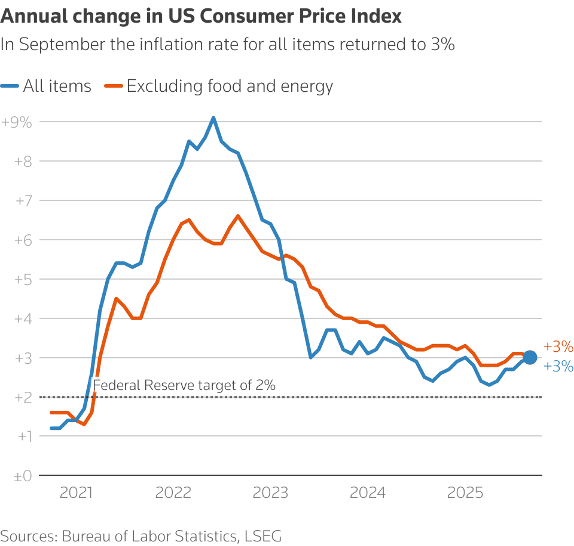

- September inflation came in softer than forecast, with both headline and core CPI rising 3.0% year-over-year, reinforcing the disinflation trend and strengthening expectations for a Federal Reserve rate cut at the upcoming October meeting.

- The third-quarter reporting season is accelerating, with mixed results from Netflix and Tesla giving way to a pivotal week featuring five of the Magnificent Seven (Microsoft, Alphabet (Google), Meta Platforms, Apple, and Amazon), as investors look to big tech’s earnings and AI investments to sustain market momentum amid high valuations and a maturing bull run.

- The Federal Reserve is expected to cut rates by 25 basis points this Wednesday amid a softening labor market and limited economic data from the government shutdown, with markets focused on Chair Powell’s guidance for the outlook and the potential path of future cuts into 2026.

Global financial market developments

- US and global equity averages were higher, many at record levels..

- US and European bond yields were slightly higher on the week

- The US Dollar Index moved higher on the week.

- Gold futures plunged lower from a record high.

- Oil futures prices rallied from midweek from a multi-month low.

Key this week

Central Bank Watch: Central bank activity takes center stage this week, led by the Federal Reserve’s Interest Rate Decision, Monetary Policy Statement, and Press Conference on Wednesday. Other key events include the Bank of Canada’s Policy update on Wednesday, followed by the Bank of Japan and European Central Bank, both delivering their Policy Statements, Rate Decisions, and Press Conferences on Thursday.

Macro Data Watch: With the US government shutdown still ongoing into next week, US data releases remain sparse, US GDP and PCE are scheduled to be released on Thursday and Friday respectively (but it is unclear if these data points will be released). Key non-US highlights include EU GDP and German CPI on Thursday, followed by Japanese CPI and EU HICP on Friday.

Earnings Watch: The US third-quarter earnings season is in full swing, with focus this week on five of the Magnificent Seven: Microsoft, Alphabet (Google), and Meta report on Wednesday, followed by Apple and Amazon on Thursday.

| Date | Major Macro Data |

| 10/27/2025 | US Durable Goods Orders |

| 10/28/2025 | German Consumer Confidence; ECB Bank Lending Survey; US Housing Price Index and Consumer Confidence |

| 10/29/2025 | Australian CPI; BoC Monetary Policy Statement, Press Conference and Interest Rate Decision; Fed Monetary Policy Statement, Press Conference and Interest Rate Decision |

| 10/30/2025 | BoJ Monetary Policy Statement, Press Conference and Interest Rate Decision; German Unemployment Rate, GDP and CPI; EU Consumer Confidence, GDP and Unemployment Rate; US PCE (QoQ), GDP and Initial Jobless Claims; ECB Monetary Policy Statement, Press Conference and Interest Rate Decision |

| 10/31/2025 | Japanese CPI, Retail Trade and Unemployment Rate; German Retail Sales; EU HICP; Canadian GDP; US PCE (MoM) (YoY), Factory Orders, Personal Income and Spending |

| Date | Major Earnings Data |

| 10/27/2025 | Welltower |

| 10/28/2025 | Visa A; UnitedHealth; Booking; PayPal |

| 10/29/2025 | Microsoft; Alphabet (Google); Meta Platforms; Caterpillar; ServiceNow Inc; Boeing; Verizon; Starbucks |

| 10/30/2025 | Apple; Amazon; Eli Lilly; Mastercard; Merck&Co; Gilead; S&P Global; Stryker |

| 10/31/2025 | Exxon Mobil; AbbVie; Chevron; Linde PLC |