Tesla (NASDAQ: TSLA) has a lower ESG score than Chevron (NYSE: CVX) or Philip Morris (NYSE: PM). This is probably not how it should be for ESG stands for environmental, social and governance. That is, the grab bag of today’s fashionable ideas about what companies ought to be doing. Which does not include tobacco (PM) nor oil (CVX) but does include electric vehicles and saving the planet (TSLA). So how come Tesla gets the low ranking and the other two are higher?

And yes, this does matter, tens of billions, hundreds of billions, of investment decisions are being made on whether a stock meets the ESG requirements – has a high score that is. Well, OK, does this mean that we should be buying stock with high ESG scores then?

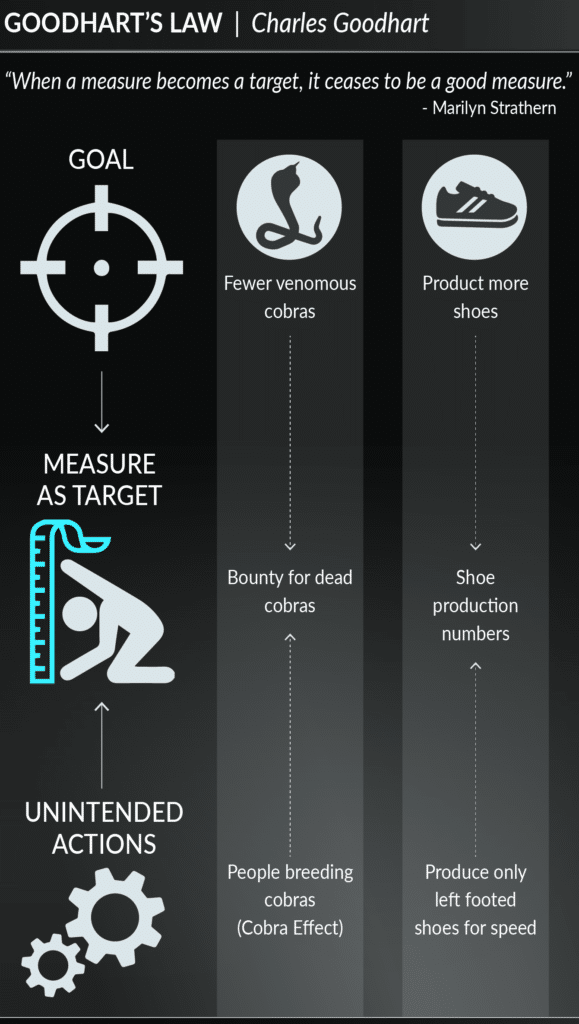

ESG is subject to Goodhart’s Law

Well, first, we should probably think of Goodhart’s Law “When a measure becomes a target, it ceases to be a good measure” and that’s the explanation for the Philip Morris one. They’ve looked at what gives a good ESG score, gone and done those things and carried on selling cancer stocks. Well, why not, why wouldn’t you? But it does mean that the ESG score itself is corrupted.

But that’s just humans being humans. What we really want to know is about money – we’re investors after all, not moralists. Does this observation make us money? Well, yes, it does – but only if we invert, it. Colloquially it has long been true that investing in sin stocks (booze, baccy, gambling, and if only we could do so, commercial sex) we know makes money because those are things that humans just will do. There’s even an ETF which does exactly this, the Vice Fund. Sadly, the performance isn’t, in fact, all that recently. Partly because the management fee is high, partly because gambling is going through such a technological revolution with online that the established names aren’t necessarily doing so well. But the idea exists at least.

Morals and ethics do matter in investing

But there’s more to it than that. OK, so vice stocks, sin stocks, people won’t buy them because that’s socially unfashionable. Therefore, they will be undervalued – the profits, dividends, are cheaper than other streams of income of similar risk. Now, that is true. But does the opposite also hold, that high ESG stock are worth buying? No, it doesn’t and for the same reason. It’s fashionable to buy high ESG shares – so, they’re over-valued for their level of profit and dividend income. This really has been proven, here.

Note that this is nothing at all to do with whether ESG is a good idea or not, we’re exploring the influence upon prices. And precisely, exactly, because ESG is fashionable therefore high ESG shares are over-valued, low ESG ones are under-valued. Thus, given that we’re cold-blooded pursuers purely of our own monetary interest we should be buying sins and selling saints.

It’s movement across ESG that matters

There is an exception here, one that’s important. If a share, or company, is moving up the ESG rankings then it will – it’s an inevitable part of the above analysis – become progressively over-valued. Which is something we just love – as those cold-blooded investors – the idea of a stock moving from undervalued to over-valued.

This is true whether Goodhart’s Law is true or not (hint, it’s true) and whatever we might think of ESG or morals in investing or anything else like that. Put all of that morality to one side for a moment and just think. We’ve discovered some little foible in human behaviour, it’s a trait which changes market prices – so, we can now trade that foible, that trait. We have achieved nirvana sa investors – even if not the salvation of our souls in doing so.

That move from un-fashion to fashion will change the capital value of the share and that’s something we can ride.

There’s money to be made getting ESG right

Unfortunately that capital move in the sin stocks themselves is something we cannot ride. For the entire point of the cheapness of the dividend stream is that people won’t buy – say, ‘baccy – for moral reasons. So we’ll not get the capital value change dependent upon the dividend stream. We just have to sit there and clip our higher dividends and get rich the long way.

There’s another much more understandable, simple, way of putting this. If everyone’s buying it for non-financial reasons then it’s too expensive. If everyone’s not buying it because ethics or morals then it’s cheap. Which just leaves us with the question – well, how moral do we want to be and how much do we want just the cash?