Macroeconomic/ geopolitical developments

- US equities edged lower as the Nasdaq led declines and Treasury yields climbed, while energy and utilities outperformed on surging oil prices, whilst gold gained nearly 2%.

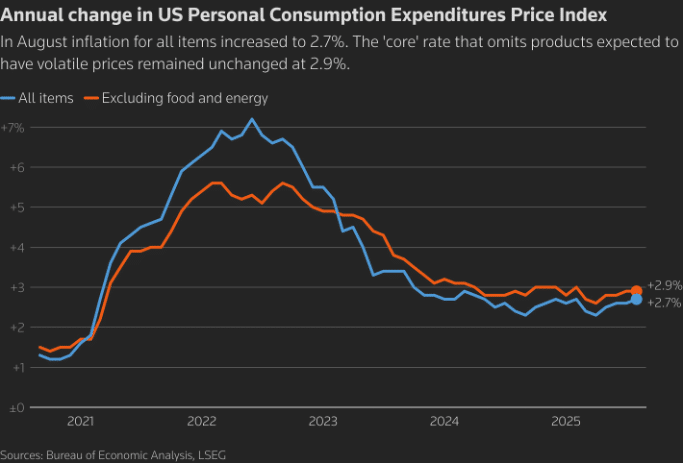

- Robust US Q2 GDP growth of 3.8% and steady US August PCE inflation of 2.9% highlighted continued consumer resilience, while short-term Treasury yields climbed as markets scaled back expectations for aggressive Fed rate cuts.

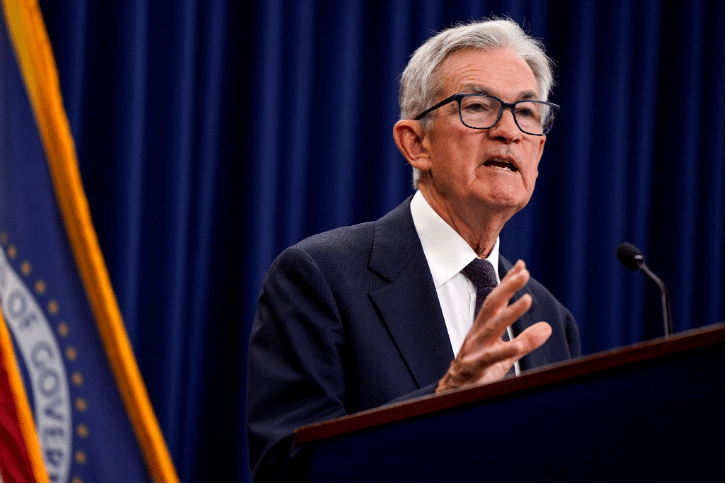

- Fed officials, including Chair Powell, struck a cautious tone last week, signaling that while some members push for faster rate cuts, persistent inflation and labor market risks keep the central bank’s overall stance relatively hawkish, tempering expectations for aggressive easing.

- This week, investors will focus on Global PMI surveys and key US labor market releases, to gauge economic momentum, inflationary pressures, and potential guidance for future Federal Reserve rate cuts.

Global financial market developments

- US and global equity averages were modestly lower.

- US and European bond yields were higher on the week, notably the US short end.

- The US Dollar Index moved higher on the week, rebounding from a multi-year low.

- Gold futures pushed higher, hitting a new record high.

- Oil futures prices rallied, just moving above the mid-point of a wider $61-69 multi-month range.

Key this week

Central Bank Watch: Central bank activity is relatively quiet this week, with the key event being the Reserve Bank of Australia’s Interest Rate Decision, Press Conference, and Monetary Policy Statement on Tuesday. Additionally, markets will monitor speeches from Fed, ECB, and BoE officials throughout the week.

Macro Data Watch: It’s a packed week for macroeconomic releases, with the highlights being the Global PMI data on Wednesday and Friday, and the US Employment Report on Friday. Other key releases include German Retail Sales, CPI, and UK GDP on Tuesday, as well as the EU HICP on Wednesday.

| Date | Major Macro Data |

| 09/29/2025 | EU Business Climate, Consumer Confidence and Economic Sentiment Indicator; US Pending Home Sales |

| 09/30/2025 | RBA Interest Rate Decision, Press Conference and Monetary Policy Statement; German Retail Sales, Unemployment Rate and CPI; UK GDP; US Housing Price Index, Consumer Confidence and JOLTS Job Openings |

| 10/01/2025 | Japanese Tanken Large Manufacturing Index; Global Manufacturing PMI; EU HICP; US ADP Employment Change |

| 10/02/2025 | EU Unemployment Rate; US Challenger Job Cuts, Initial Jobless Claims and Factory Orders |

| 10/03/2025 | Japanese Unemployment Rate; Global Composite and Service PMI; EU PPI; US Employment Report |