The Standard and Poor 500, or S&P 500 is a market cap weighted index, built upon the 500 US companies with the largest market capitalization. To be included in the S&P 500, companies need to have common stock listed at NASDAQ and NYSE or the CbOE BZX Exchange.

The role of the S&P 500 and indexes similar to it is not just to provide a quick and relevant glimpse into the state of the US economy. It is also meant to offer investors various comprehensive ways to invest in the US economy. Not many entities interested in such investments would be able to directly purchase shares of all 500 S&P constituents. Through the index however, and through the derivatives based on it, such investments are possible to all interested.

What exactly does a “large cap” company mean in S&P’s case? The market capitalization of individual components needs to exceed the $10 billion mark.

How does the index work?

As mentioned, the S&P 500 is a market cap weighted index. What this means is that the weight of individual components is directly proportional with their market capitalization.

The simple formula that determines individual constituent weight is: component market cap/total market cap of all S&P 500 components.

The market cap is obviously a function of the individual share price. Market cap = share price*total number of shares issued by an individual index constituent.

An important thing to bear in mind about S&P 500 is that it uses free floating shares, or shares available for public trading.

The actual value of the index is the result of a more intricate mathematical exercise, which also involves a divider. This divider is the proprietary information of S&P and it is not publicly available.

In regards to company weighting: it is obvious that an upswing in the stock price of a more heavily weighted S&P 500 company exerts a bigger upward effect on the S&P value, than a similar upswing in the price of a lesser company.

The S&P 500 selects its components through a committee. What this means is that inclusion in the index is not exclusively rule-based. The said committee uses 8 selection criteria:

- market capitalization (as explained above)

- liquidity (the shares of the company need to be readily available for purchase, without impacting the share price)

- domicile (while the index is focused on US companies, there are a number of companies included that are either headquartered or incorporated abroad)

- financial viability

- sector classification

- public float (percentage of shares held by the public)

- length of time for which the company has been a publicly traded entity.

- monthly trading volumes.

The last of these criteria requires volumes of at least 250,000 shares traded per month, for all 6 months leading up to inclusion.

Also, the rules of S&P 500 identify a number of securities that are ineligible for inclusion, such as: limited partnerships, tracking stocks, ETFs, ETNs, equity warrants, royalty trusts etc.

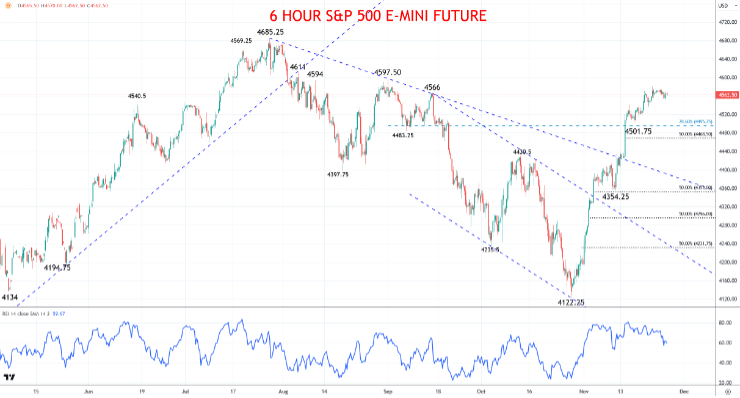

S&P 500 December 2023 E-Mini Futures Contract

Price Stays Resilient; Staying Bullish

A Monday prod down to 4552.00 before easing off lows, to remain consolidated under the trend highs from last week at 4850.50, to sustain bullish pressures from the early-November ricochet from 4354.25, breaking past the July downtrend line and 4430.50 October high, to sustain the late-October surge, setting a trend bottom at 4122.25, to keep risks bullish for Monday.

Day trade setup

- We see an upside bias above 4580.5 for 4597.50; breakout targets 4611.00, 4644.75 and 4673.50.

- However, below 4536.75 targets 4512.75; under here aims for 4501.75/4495.75 and 4468.50.

S&P 500 Index Calendar

11/29/2023 EU Consumer Confidence; German CPI; US GDP and PCE (QoQ)

11/30/2023 Chinese PMI; German Retail Sales; German Unemployment; EU CPI; US PCE (MoM and YoY); Canadian GDP; OPEC+ Meeting

12/01/2023 Global PMI from S&P Global; US ISM PMI; Fed Chair Powell speaks

View Full Calendar