Daily Digest:w/c 22 July - Macro focus on global Flash PMI Wednesday, US GDP and Durable Goods Thursday, US PCE Friday. Earnings spotlight on Alphabet and Tesla on Tuesday

-

Home

- >

- Author: Stephen Pope

Stephen Pope is the Managing Partner of Spotlight Group. He has worked in the world of finance since 1982 and has performed duties as a market making trader, salesman and analyst. Stephen brings this wealth of experience gained at American, British, French, and Japanese institutions to bear in his analytical work.

He traded Euro Dollar Bonds for Japanese, Scandinavian and Supranational names, using risk weighted analysis to hedge the trading books. As a trader he often had telephone calls from Tokyo in the early hours to make prices for Far East clients.

He has a broad base of client service and his career progressed rapidly as he rejected a “smile and dial” approach in favour of methodical client profiling and building an open exchange of information with traders. This led to actively scanning the markets for “Rich/Cheap” analysis for relative value trades that could maximise portfolio switches either in a similar maturity or via modified duration weighted yield curve plays.

This progress led him to being a leading figure in the world of central banks bond sales as he advised national agencies such as the Abu Dhabi Investment Authority, Bahrain Ministry of Finance, The Central Bank of Kuwait, Saudi Arabian Monetary Agency, Central Bank of Oman, State General Reserve Fund of Oman, Bank of Botswana and South African Reserve Bank.

Portfolio management by state authorities actively uses the repo market. In this area, Stephen provided all clients with an active list of repo opportunities, especially highlighted issues that were on “Special” as against just “General Collateral”. Indeed, he brokered the first repo trade with the Central Bank of Iran and Nordic Investment Bank.

In an active career clients have been covered in all geographic regions and time zones embracing 36 nations.

As an analyst/strategist Stephen was a regular speaker at investor meetings and conferences as well as a much-sought guest on global financial television: ABC (Australia), ABC (U.S.), Al-Jazeera, BBC, Bloomberg, BNN (Canada), CNBC, CNN, Fox, New Delhi Markets, Reuters and Saxo Bank TV. With Reuters Stephen was the first guest to be interviewed for a “live” broadcast into The People’s Republic of China.

In addition to FxExplained.co.uk, Stephen is also currently writing for Forbes and previously for Saxo Bank. His insight into the tobacco industry is regularly used by The Winston Salem Journal. On the radio he is a regular guest on the Resonance FM programme that covers the hedge fund industry, “The Naked Short Club”.

Stephen gained his BA (HONS) Economics (II.I) from the University of Warwick in 1982 and his MBA from Henley Management College in 1995.

He gained professional examination awards from the Association of International Bond Dealers (Now called the International Capital Markets Association) in 1988, is a member of the Financial Conduct Authority and has been a Fellow of the Chartered Institute for Securities and Investment.

He currently lectures as an adjunct Professor with the University of Maryland in the field of Business Management and Economics. In addition, he is a guest lecturer for Economics at the London Academy of Trading and the London School of Wealth Management as well as training summer interns and new graduate recruits at leading commercial and investment banks in Europe and the U.S.

Beginner

There can be no denying that 2022 has proven to be a challenging year for all investors. For example, the FTSE All World Index has a 1-Year change of -17.26%. Similarly, the S&P Global 100 has a 1-Year change of -13.45%. (As at 10:30 on Friday, December 16th, 2022). A similar tale of poor performance … Continued

The New Year is just around the corner and so it is quite an appropriate time to take stock and consider what trends may shape our investment outlook heading into 2023. One cannot say that COVID-19 and/or its variants has fully been vanquished. Coupled with the risk of a larger scale war in Europe, a … Continued

Beginner

As the coldest days of the Northern Hemisphere winter arrive one can expect energy stocks to receive fresh impetus as global investors seek positions that will derive economic benefit from expected increase in prices and the shortages expected. In September, as autumn leaves were starting to fall, 66% of the respondents to a survey conducted … Continued

Intermediate

Euro posts major positives against the US Dollar and on the cross rates (EURUSD, EURCAD, EURAUD, EURNZD, EURGBP forecast) Positive on Pound (GBPUSD forecast) Aussie and Kiwi hold major support (AUDUSD and NZDUSD forecasts) US Dollar-CAD posts fresh negative (USDCAD forecast)

Intermediate

Crude oil has recovered all the lost ground of 2020 The global market is in deficit OPEC+ is ready to increase supply whilst shattering the current price structure Look for the market to test the localised high of October 2018 “…Give me one more oil boom before I die …..Give me one more chance to say … Continued

Intermediate

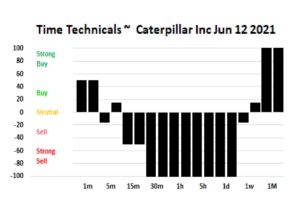

Caterpillar has endured a torrid week The long-standing impulsive channel is under threat The company is looking to pay a larger dividend Look for the market to start buying this stock as the week wears on Caterpillar Inc. (NYSE:CAT) ended the week in poor form as it closed down by 5.03, or 2.23% to print … Continued

Intermediate

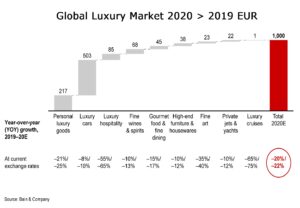

The deal for LVMH to fully acquire Tiffany was completed in January The market for luxury goods was under pressure throughout 2020 The sentiment over sales performance in 2021 is much improved LVMH SE has enjoyed a good run; there is more to come Looking back to January, the decision by LVMH SE, the world’s … Continued

Intermediate

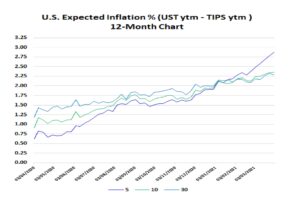

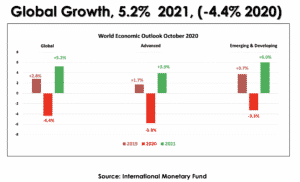

The top question right now is “What is the outlook for inflation?” The expectation is for higher prices in both the U.S. and U.K. The U.S. Manufacturing PMI data for May, out this week looks set to turn lower Look for the proof of higher lows on Monday as a reason to plug into cable … Continued

Intermediate

Copper has been moving higher since November 1 The research whilst mixed, has a bullish bias The need for infrastructure rebuilding and electrification of the auto space bodes well Look for prices to test U.S. Dollars 3.62/lb “… Even the old folks never knew Why they call it like they do I was wondering … Continued

Intermediate

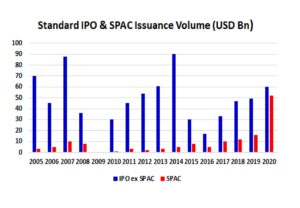

SPAC issuance value almost matched IPO’s Listing process needs sensible and firm regulation Investors must evaluate each prospectus fully Collateralized SPAC funds of funds could arise What Is a Special Purpose Acquisition Company (SPAC)? A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed specifically to raise capital through … Continued

Intermediate

Published

April 19, 2021

by: Stephen Pope

Updated May 11th, 2021

Share:

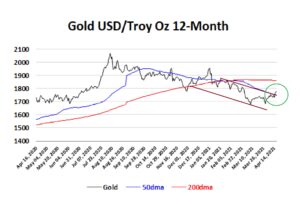

In the past year “Risk On” assets have been in favour The past path of gold has not looked appealing, nut now that is changing The economic path to recovery is improving as are inflation prospects There is a case to open a speculative long on gold as the technicals look encouraging In times of … Continued

Beginner

Published

April 5, 2021

by: Stephen Pope

Updated April 19th, 2021

Share:

Non-Farm Payrolls booked the best gain in seven-months The contrast in vaccine strategy and stimulus spending between the U.S and Europe is striking The economic paths of the U.S. cf. Eurozone and Japan are diverging The Dollar Index is set to rotate higher in an impulsive channel It is an odd fact that Good Friday … Continued

Intermediate

EURGBP is in a corrective channel The contrast in vaccine strategy between the U.K and Europe is striking The Eurozone economy is heading toward another recession Sterling is going to continue its outperformance If one looks at the One-Month chart, shown below in Figure 1, one can see the spot price of EURGBP has shown … Continued

Intermediate

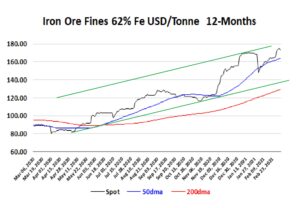

Iron Ore Fines spent the last month rotating in an impulsive channel There is disruption to shipments from Brazil Chinese mills are at over 90% capacity and growth plans are ambitious Prices are going to rise early in the week and a break over USD200/Tonne is seen If one looks at the One-Month chart, shown … Continued

Beginner

Initial Parameters: Chart analysis is technical and taken from medium-term historical pattern Technical projections based on a twelve-month time horizon Targets set are based on the most recent, significant technical adjustment Analysis is based on Elliot Wave and Fibonacci techniques Technical analysis only guides; exogenous factors can shock any market Markets, being capricious, forecasts are … Continued

Intermediate

Since the 1960’s supply chains have gone global Cost control and profitability were key drivers Coronavirus has crashed the global economy There is a new drive to build local chains In the traditional teaching of economic theory, the argument suggests that global GDP will increase when the principle of comparative advantage [1] is applied by … Continued

Intermediate

Published

September 23, 2019

by: Stephen Pope

Updated April 3rd, 2020

Share:

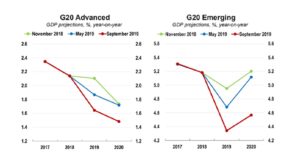

OECD has a gloomy economic outlook for 2019 and 2020 The only inflation is in financial assets It is time to put all banks through a series of radical stress tests and let the weak fail The required reforms do not include nationalising the banking system The Organisation for Economic Cooperation and Development (OECD) recently … Continued

Intermediate

Published

September 11, 2019

by: Stephen Pope

Updated May 11th, 2021

Share:

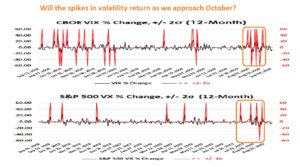

The world economy is slowing President Trump is driving a trade war The Eurozone is suffering from fading growth and confidence The writing is on the wall as far as the yield curve is concerned Be in no doubt, the world’s financial markets are in a funk as bond yields race to a bottom that … Continued

Intermediate

Published

March 28, 2019

by: Stephen Pope

Updated December 16th, 2019

Share:

Market psychology; the overall feeling that impels buying or selling. Conventional financial theory assumes all investors are rational. Emotional aspect of the market can lead to outcomes that can’t be predicted. The majority of the most successful marketing campaigns have employed the science of “Psychology” in appealing to consumers. It is used in an intelligent … Continued

Intermediate

Published

October 13, 2017

by: Stephen Pope

Updated June 7th, 2019

Share:

Here we have an interview with FXExplained.co.uk contributor Stephen Pope (also Managing Partner of Spotlight Group PLC) and Trade.com Chief Economist Bill Hubard. They discuss the Fed Meeting Minutes released in early October and its impact on the US bond markets. Furthermore, the lack of follow-through on the fiscal side from the Trump administration. Also, … Continued