Macroeconomic/ geopolitical developments

- A 0.5% hike by the Fed as expected, but Jerome Powell stated that a hike of 0.75% was “not something we are actively considering.”

- Stock indices initially rallied strongly on this information Wednesday, then reversed these gains and more on Thursday and Friday.

- Friday’s US Jobs reports saw 428K jobs added in April, slightly above consensus of around 390K, but the prior months’ gains were revised lower by almost the same gap (39K).

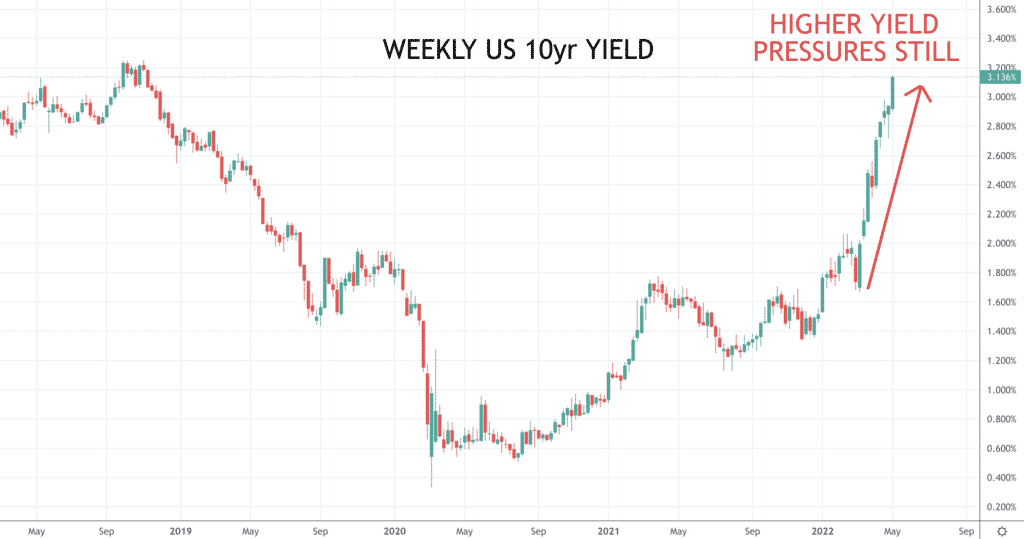

- US 10yr yields broke up through the psychological 3% barrier.

- The Bank of England (BoE) hike rates by 25 basis points to 1% on Thursday as expected, but has delayed quantative tightening, so a slightly dovish hike.

- Pandemic lockdowns in China continue to weigh on domestic growth potential and increase global supply chain and inflation worries.

Global financial market developments

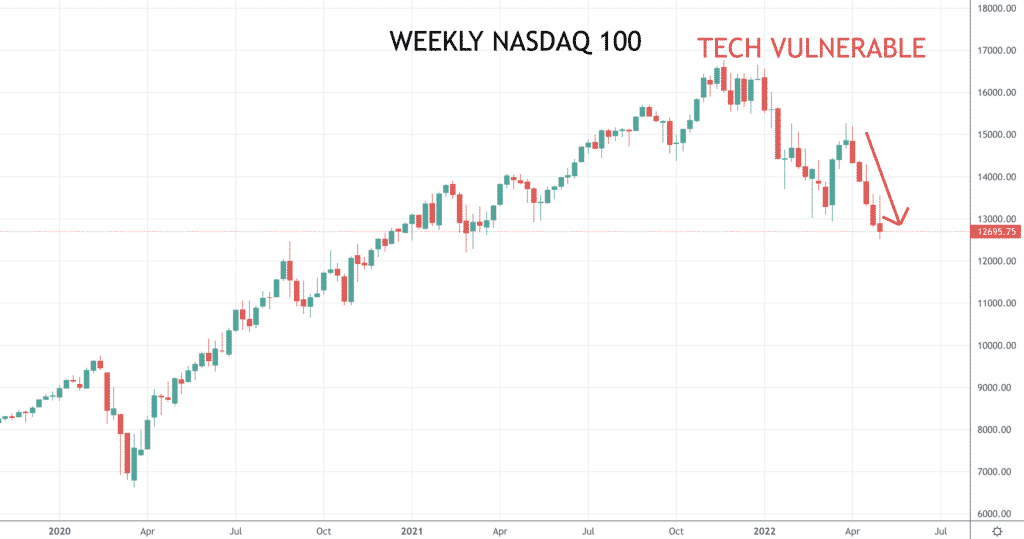

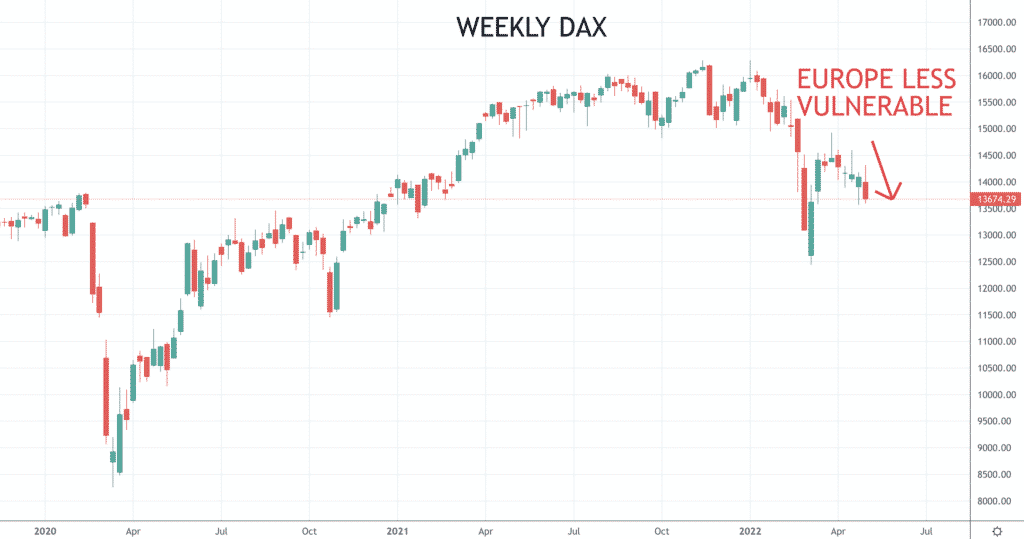

- Growth/ tech stocks lead US stock averages lower again, in some instances to new 2022 lows.

- Global stock averages were also lower last week, although European and UK indices are still outperforming their US counterparts.

- US 10yr yields broke up through the psychosocial 3% barrier as US and global bonds move to new high yields.

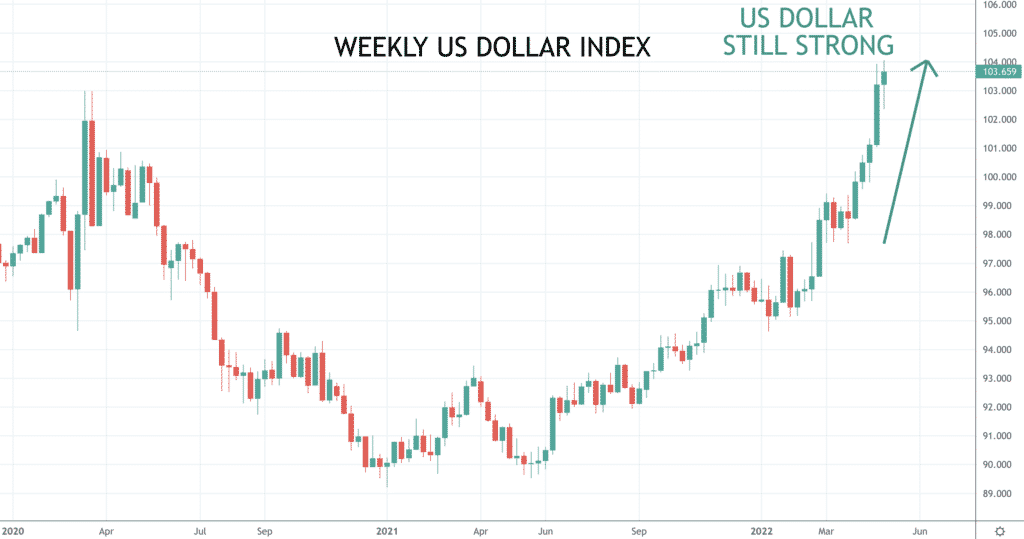

- US Dollar strength has stalled slightly, through the greenback stays strong across the board.

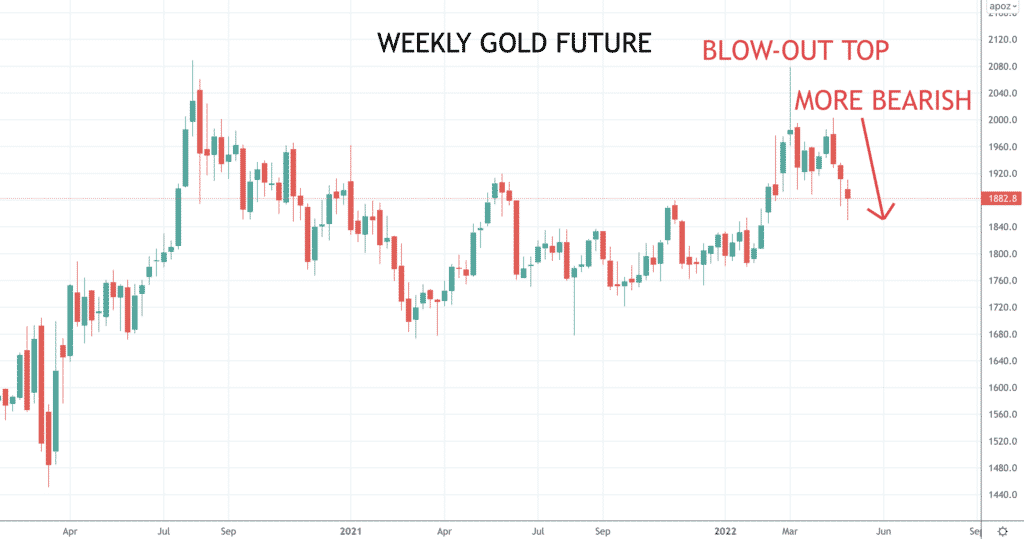

- Gold sold off further, staying more negative.

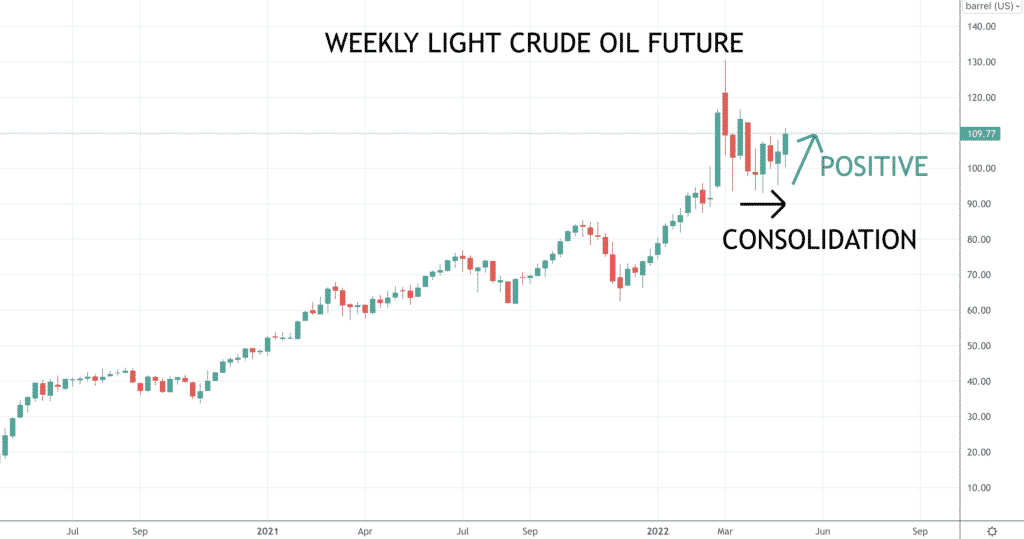

- Oil moved still higher, reinforcing a positive range environment.

- Copper plunged still lower for a still more negative tone.

Key this week

- Geopolitical focus:

- Victory Day in Russia, watching for comments from Putin

- Still closely monitoring the war in Ukraine

- Central Bank Watch: A light week for Central Banks, we just get the Bank of Japan (BoJ) Meeting Minutes on Monday

- Macroeconomic data: A light week for data, but some big standouts with release Wednesday of the Chinese, German, and US CPI data.

| Date | Key Macroeconomic Events |

| 09/05/22 | BoJ Meeting Minutes; Victory Day in Russia |

| 10/05/22 | German ZEW Survey |

| 11/05/22 | China CPI; German CPI; US CPI |

| 12/05/22 | UK GDP, Industrial and Manufacturing Production; US PPI |

| 13/05/22 | US Michigan Consumer Sentiment Index |