General

Features

Pros

- 24/5 Shares Trading

- 0% Commission

- 300 plus trading instruments.

- Deal cancellation feature.

- Fixed spreads.

Cons

- No bonus offer.

easyMarkets Review

Review Sections:

easyMarkets was originally founded as easyForex in 2001 but changed its name when it expanded its product offerings to include other asset classes. By 2013, the company had grown to have more than 100,000 active traders using its trading platform to amass over $1.5 trillion in accumulated trade turnover in its first decade in business.

easyMarkets is based in Limassol, Cyprus and is licensed and regulated by the Cyprus Securities Exchange Commission or CySEC under CIF license number 079/07. In Australia, the company is regulated by the Australian Securities and Investment Commission or ASIC under AFSL number 246566. They also hold a FSA license for their global customers. With the oversight of three regulatory agencies, easyMarket’s customers are ensured greater deposit safety and client funds are held in segregated accounts with Top Tier banks.

Please note that easyMarkets does not presently accept customers residing in the United States.

The company’s official website is located at www.easyMarkets.com and a screenshot of its home page appears below:

easyMarkets Features

The company provides only VIP Account to European Clients with maximum leverage up to 1:30 due to regulatory reasons. The minimum deposit is 100 EUR and you can have Personal Account Manager who can provide you with information about market trends, economic events, investing strategies and more. Further you can have trading insights such as daily fundamental and technical analysis, trading central indicators. The spreads for this type of account are low. For Non – European Clients, the company provides three types of account the Standard, Premium and VIP. The spread change depends to the account you choose. For standard account the minimum deposit is 100 USD, the Premium, 2000 USD and for VIP 10.000 USD. The maximum leverage for all accounts is 1:400. Personal account managers are assigned to all account holders. Daily emails on fundamental and technical analysis are also provided. easyMarkets supports the use of 18 account currencies

Those who like to trade a greater variety of markets can access as many as 200+ different trading instruments on any given day via this broker. Those focused on the forex market can trade a wide variety of currency pairs ranging from the majors to exotics, while easyMarkets’ formerly forex centered product offering has now expanded to include forex forward contracts, commodity and index CFDs, and vanilla forex options.

As far as minimum spreads are concerned, the width of the spread depends on the type of trading account the trader is executing transactions in. For a standard account, spreads start from three pips, while premium account holders get more competitive spreads beginning at 2.5 pips. The VIP account holders have access to the lowest dealing spreads, which start at 0.9 pips.

While easyMarkets spreads, the company has decided to keep things simple and transparent, offering fixed spreads for that reason. Having fixed spreads allows the trader a higher level of certainty on executions, especially during volatile trading conditions.

Further the company provides you with exceptional trading conditions such as free guaranteed stop loss / take profit, no slippage on easyMarkets platform guaranteeing that your trade will placed at the exact price you clicked on, negative balance protection and tight fixed spread. Fixed spread, instead of variable spreads ensures price transparency. The company has lowered its spreads and now offers some of the lowest fixed spread in the market and competitive to floating spread:

EUR/USD: From 0.9 pips | GBP/USD: From 1.3 pips | USD/JPY: From: 1 pip | GOLD: From $0.35 pips.

Cash Indices

| Symbol | Name |

|---|---|

| EUC/EUR | Euro 50 Cash Index |

| HKC/HKD | Hong Kong Cash Index |

| NKC/JPY | Japan 225 Cash Index |

| UKC/GBP | UK 100 Cash Index |

| SPC/USD | SP 500 Cash Index |

| DJC/USD | Dow Jones Cash Index |

| CAC/EUR | France 40 Cash Index |

| Symbol | Name |

|---|---|

| SWC/EUR | Switzerland 20 Cash Index |

| CNC/USD | China 50 Cash Index |

| AUC/AUD | Australia 200 Cash Index |

| DEC/EUR | German Cash Index |

| NQC/USD | Nasdaq 100 Cash Index |

| ESC/EUR | Spain 35 Cash Index |

| MIB/EUR | Italy 40 Cash Index |

Deposits and Withdrawals

Traders can use credit cards and electronic payment services to fund an easyMarkets trading account. The company currently accepts deposits via: Visa, American Express, Maestro, Giropay, Ideal, SoFortüberweisung, JCB, China Union Pay, Skrill (formerly Moneybookers), Webmoney, Uemadai and Neteller, in addition to via wire transfers from local and international banks.

The time delay for receiving deposits and withdrawals varies from virtually instant for those using Visa, American Express, Yemadai, China Union Pay, Ideal and Maestro, to two hours for Giropay, Skrill, Neteller and SoFortüberweisung. Using Webmoney and local and international bank wire transfers can take from three to five working days.

EasyMarkets uses the same methods to process withdrawals, and no commissions are charged for deposits to or withdrawals from an easyMarkets trading account. The company processes all withdrawal requests within two business days, but depending on the bank and the location where the funds are being sent, the process could take from 3 to 10 business days. There is no minimum withdrawal amount, and all withdrawals are sent back using the same payment method as the original deposit was made with.

Platforms & Tools

| Feature | easyMarkets |

|---|---|

| Virtual Trading(Demo) | |

| Desktop Platform (Windows) | |

| Desktop Platform (Mac) | |

| Web Platform | |

| Social Trading / Copy Trading | |

| Proprietary | |

| MetaTrader 4 (MT4) | |

| MetaTrader 5 (MT5) | |

| cTrader | |

| Currenex | |

| ZuluTrade | |

| MirrorTrader | |

| Charting - Drawing Tools(Total) | |

| Charting - Indicators / Studies (Total) | |

| Watchlists | |

| Order Type - Trailing Stop |

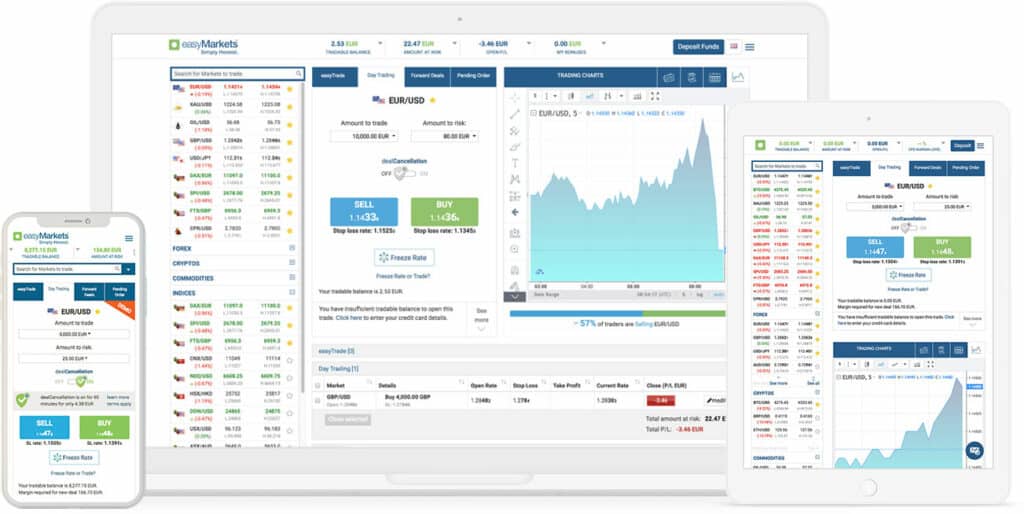

EasyMarkets offers a web based trading platform that allows traders to execute deals from just about any online computer in the world with a browser. In addition, the company offers an MT4 trading platform that has its usual extensive support for technical traders.

This platform gives traders access to quote for more than 200+ instruments, including forex, commodities, metals and indexes, all with online access 24/7 and without the need to download and install any software. One click trading is available from the platform’s Market Explorer, which includes advance charting options, news, technical analysis and market sentiment, all on one screen.

The screenshot below illustrates easyMarket’s trading platform that allows traders to execute deals in forex pairs, vanilla currency options, CFDs, commodities, precious metals and indices, as well as perform technical and fundamental analysis functions.

EasyMarkets’ trading platform runs on Internet Explorer’s Version 10 and above, FireFox, version 31 and above, Google Chrome version 31 and higher, Opera version 24 and above, Android version 4.1 and above, Google Chrome for Android version 37, and Safari version 7 and above. Non-supported browsers remain fully functional despite displaying some stylistic elements differently.

EasyMarkets users can unlock a third trading platform: easyTrade. easyTrade can be accessed from the EasyMarkets platform. In the top right corner, there is a Menu button. Hit that and a number of options will roll out, with easyTrade being at the bottom.

In addition to dealCancellation, the broker also offers a unique trading tool called Freeze Rate. This feature lets traders freeze the price they see, thus gaining a few seconds to place their trade. To those skilled enough, such a feature offers a great advantage.

Asset Classes

easyMarkets enables traders’ access to over 200 markets such as forex, indices, shares, agriculture commodities, energies, metals, cryptocurrencies and vanilla options and the ability to trade them in many different ways such as day trading, forwards, pending orders, options and of course easyTrade.

Commission & Fees

In this regard, Easymarkets’ offer is a more than reasonable one. The broker does not charge any commissions, or fees on account maintenance and deposits/withdrawals.

How does it make its money then? Through the spreads. The fixed spreads featured by EasyMarkets are 1 pip on the EUR/USD pair, for traders who use the web app, and 1.8 pips on the same pair for those using MT4.

On other currency pairs (like the GBP/USD for instance) the spreads are even higher. Overall, the spreads charged by EasyMarkets are at the higher end of the spectrum.

Research & Education

| Feature | easyMarkets |

|---|---|

| Daily Market Commentary | |

| Forex News | |

| AutoChartist | |

| Trading Central (Recognia) | |

| Delkos Research | |

| Acuity Trading | |

| Social Sentiment - Currency Pairs | |

| Client Webinars | |

| Client Webinars (Archived) | |

| Videos - Beginner Trading Videos | |

| Economic Calendar | |

| Calendar Includes Forexcasts | |

| Economic News Sentiment | |

| Trade Ideas - Backtesting |

The Market Analysis section of the broker contains some educational material and a number of useful extras, such as a Trading Charts section and a Financial Calendar.

The Forex News Blog takes the reader to an altogether different site, www.forex.info, where scores of strategy- and other trading-related articles are available for free. The educational value of this feature is perhaps the best the broker can offer in this regard.

Customer Service

EasyMarkets’ customer service is available with representatives on call 24/5 during normal forex market hours. Representatives will answer any Forex or account related questions and can provide guidance and instruction to clients. Customer service is available via live chat, email, telephone or fax, with company staffed regional offices located around the world in Limassol, Cyprus, Sydney, Australia, Warsaw, Poland and Shanghai, China.

The company also offers educational material through their learning centers. Educational material includes videos, glossaries, eBooks and training articles for every level of trading expertise. An economic calendar, daily market commentary, technical charts and various trading tools round out the company’s educational and market analysis offerings.

Mobile Trading

| Feature | easyMarkets |

|---|---|

| Android App | |

| Apple App | |

| Charting - Draw Trend Lines | |

| Charting - Can Turn Horizontally | |

| Charting - Technical Studies/Indicators | |

| Watchlist - Syncing | |

| Trading - Forex CFDs | |

| Trading - CFDs | |

| Alerts - Basic Fields |

The broker offers mobile apps for Android and iOS devices. Both apps look great on smaller screens and allow traders to go about their trading business without the need to leave the app.

Indeed, traders can access market news and live prices within the apps. More than 150 markets are available on mobile.

Conclusion

Basically, easyMarkets provides straightforward access to 200 plus trading instruments – including forex options – and this is clearly one of the broker’s main advantages. The company’s comprehensive trading platform, educational information and free trading signals are additional benefits. Other good features include the broker’s transparency, guaranteed order levels, negative balance protection and deal cancellation ability.

Nevertheless, easyMarkets’ relatively wide and fixed spreads as a market making broker with no option for variable spreads or Interbank spreads from STP/ECN trading clearly works against this broker’s popularity. In addition, the easyMarkets website is only available in three different languages, so some traders who wish to communicate in their native language might be disappointed.

FAQ

EasyMarkets is indeed a legitimate broker in the sense that it does not trick its users into believing its services are different from what they really are.

Unlike most of its peers, EasyMarkets has a decent reputation among its users as well.

The operation is a regulated one, which serves more than 200 global markets. It offers transparent trading conditions, with no hidden fees. It has thus far executed more than 56.3 million orders, having turned over some USD 2.92 trillion. The broker currently features more than 200 tradable assets.

Easy Markets is the official sponsor of the Spanish football team Real Betis.

Some people consider EasyMarkets an outstanding broker. Others have complaints about its services. For a broker that has been in business since 2001, this is hardly surprising.

What do people appreciate about EasyMarkets?

• Customer service is great according to most users.

• Some users have praised the beginner-friendly nature of the operation.

• Others like the platforms.

Complaints are always more numerous than positive accounts. This is the nature of the feedback process. Those who feel cheated are always more motivated to raise their voices.

• Some EasyMarkets customers have slammed customer service. They pointed at the broken English of the support staff as a clue that the operation is a scam.

• Some customers have complained that the broker blocks MT4 trading for profitable traders.

The minimum deposit required for all account types at EasyMarkets is currently EUR 100. It appears, however, that the broker only supports the VIP account type.

Yes. The company behind the EasyMarkets brand is Easy Forex Trading Ltd. Based in Cyprus, the company is a registered business entity. Its local registration number is HE 203997. The authority that currently regulates the activity of the brokerage is CySEC. The CySEC registration number of the operation is 079/07.

Its CySEC license theoretically makes EasyMarkets MiFID-compliant. Such compliance entitles the broker to make its services available in most EEA countries.

As mentioned, EasyMarkets is a brokerage based in Cyprus. The exact address of the operation is Kriel Court 3rd Floor, 1 Griva Digheni, Limassol, Cyprus Cy 3035, Cyprus. This is the address at which it is registered with the UK Companies House. The website of the broker does not feature an address.