Macroeconomic/ geopolitical developments

- US Retail Sales data came in at 1.7% in October, its biggest gain since March, whilst September data was also revised higher.

- US Industrial Production for October also beat estimates.

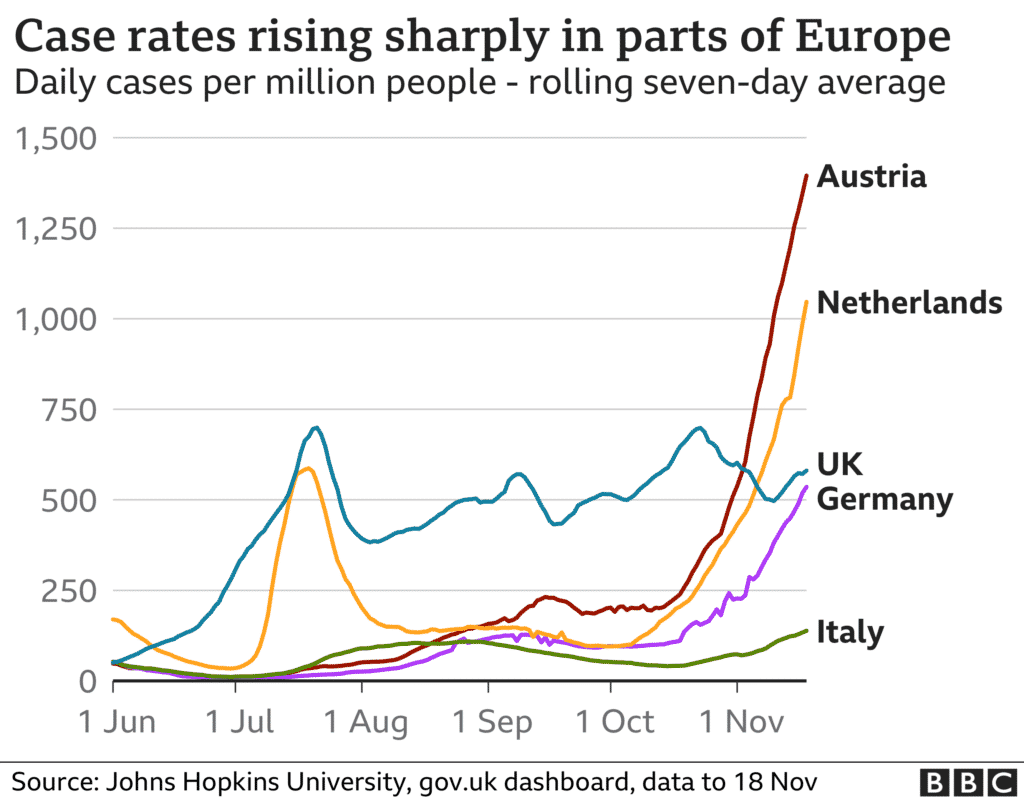

- This has sustained the “risk on” theme, despite headwinds of higher inflation and rising COVID-19 rates in Europe.

- The high COVID-19 rates in Europe have seen significant restrictions applied in several nations, including The Netherlands, Germany and Austria.

- October UK inflation hit its highest level in nearly a decade, at 4.2%, up from September’s reading of 3.1%.

- The rising COVID-19 rates and inflation worries have seen falling bonds yields in Europe, the UK and to a lesser extent in the US.

- The anticipation of an announcement of the next Federal Reserve Chair has added to a more dovish tone and lower yields, with the contenders being the incumbent Chair, Jerome Powell and Lael Brainard, who is seen as being amongst the more dovish Fed officials.

Global financial market developments

- Global stock averages hovered near cycle/ record highs last week, with the Nasdaq extending to a new all-time high.

- European, UK and to a lesser extent US yields posted firm gains to lower yields in reaction to COVID-19 rates in Europe and the possibility of a more dovish Fed Chair.

- The US Dollar extends still higher with the US Dollar Index hitting its highest level since July 2020.

- US Dollar gains and Euro weakness from rising COVID-19 rates in Europe saw EURUSD sell off further, sustaining short- and intermediate-term vulnerability.

- Gold marked time after the spike higher to start November, with risk for a more bullish tone.

- Oil has completed a topping pattern and looks negative.

- A bounce for Copper late last week, but retaining a negative tone within a broader range.

Key this week

- Geopolitical events: The US Thanksgiving Holiday is on Thursday, with markets closed all day Thursday and an early close on Friday.

- Central Bank Watch: Central Bank activity include the Peoples Bank of China (PBoC) interest rate decision on Monday and Wednesday brings the Reserve Bank of New Zealand (RBNZ) interest rate decision, statement and press conference, plus the release of the Federal Open Market Committee (FOMC) Meeting Minutes.

- Macroeconomic data: The standout data points are the global Markit Flash Purchasing Managers (PMI) data on Tuesday and US GDP and Durable Goods on Wednesday.

| Date | Key Macroeconomic Events |

| 22/11/21 | PBoC (China) interest rate decision |

| 23/11/21 | New Zealand Retail Sales; Global Markit Flash PMI |

| 24/11/21 | RBNZ interest rate decision, statement and press conference; German IFO; US GDP and Durable Goods; FOMC Meeting Minutes |

| 25/11/21 | US Thanksgiving Holiday, markets closed; German GDP |

| 26/11/21 | US Thanksgiving Holiday, markets close early; Australian Retail Sales |