Macroeconomic/ geopolitical developments

- Fed Minutes on Wednesday continues to suggest that the hawkish hike in the June meeting will be seen as a mere blip in the tightening cycle. The Minutes suggested that “almost all” participants believed that rates would be higher by year end.

- US ISM Services PMI on Thursday hit 53.9, the highest level since February, notably above consensus.

- Thursday’s ADP Employment came in with a huge 497K, against an expected 228K.

- The US Employment report featuring the Non-Farm Payroll data on Friday, however, came in at 209K jobs added, below consensus.

- Global financial market developments

- The major US stock averages were lower last week, as were European and Asian indices.

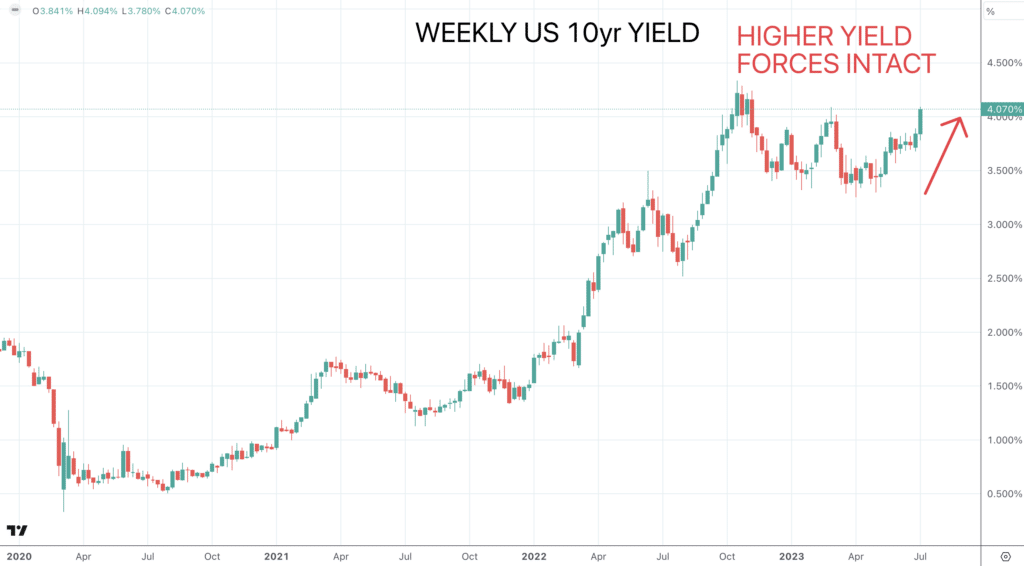

- US and European Bond saw yields aggressively breakout from the upper end of consolidation ranges, to multi-month yield highs.

- The US Dollar Index plunged on Friday.

- Gold rebounded within consolidation, from near a multi-week low.

- Oil broke out to the upside to a multi-week high.

Key this week

- Central Bank Watch: Central bank focus is on the Reserve Bank of New Zealand (RBNZ) and Bank of Canada (BoC) both on Wednesday.

- Macroeconomic data: US CPI inflation will be a massive release this week on Wednesday. Through the week we also get Chinese CPI, UK Unemployment and GDP and German ZEW Economic Sentiment.

| Date | Key Macroeconomic Events |

| 07/10/2023 | China CPI & PPI |

| 07/11/2023 | UK Unemployment and wage growth; German ZEW Economic Sentiment |

| 07/12/2023 | Reserve Bank of New Zealand monetary policy; US CPI; Bank of Canada monetary policy |

| 07/13/2023 | UK GDP (monthly); US PPI and Weekly Jobless Claims |

| 07/14/2023 | Michigan Sentiment (prelim) |