Macroeconomic/ geopolitical developments

- Markets had interpreted Fed Chair Jerome Powell’s post-meeting press conference after the July 26-27 policy meeting as a dovish “pivot”.

- Last week several Fed officials pushed back against this dovish market narrative and indicated that the central bank is still steadfast in raising rates until inflation is under control

- House Speaker Nancy Pelosi’s visit to Taiwan raised U.S.-Sino tensions, and saw China launch the largest-ever military drills in the Taiwan Strait, as well as breaking off diplomatic talks on the military and climate.

- Friday saw the release of the US Employment report, with the unemployment rate falling to 3.5%. The key payrolls report showed employers added 528K nonfarm jobs in July, more than double the expectation of around 250K. Furthermore, May and June estimates were revised up by a combined 28K.

- The Bank of England raised interest rate by 0.50% to 1.75%, the largest increase in 27 years and projected that inflation would hit 13.3% by October, due to surging energy prices.

Global financial market developments

- The major US stock averages were only modestly higher last week, during an erratic start to August, but still building on bullish technical signals from July, having posted their best monthly gains since 2020.

- European and Asian equity indices were also slightly positive

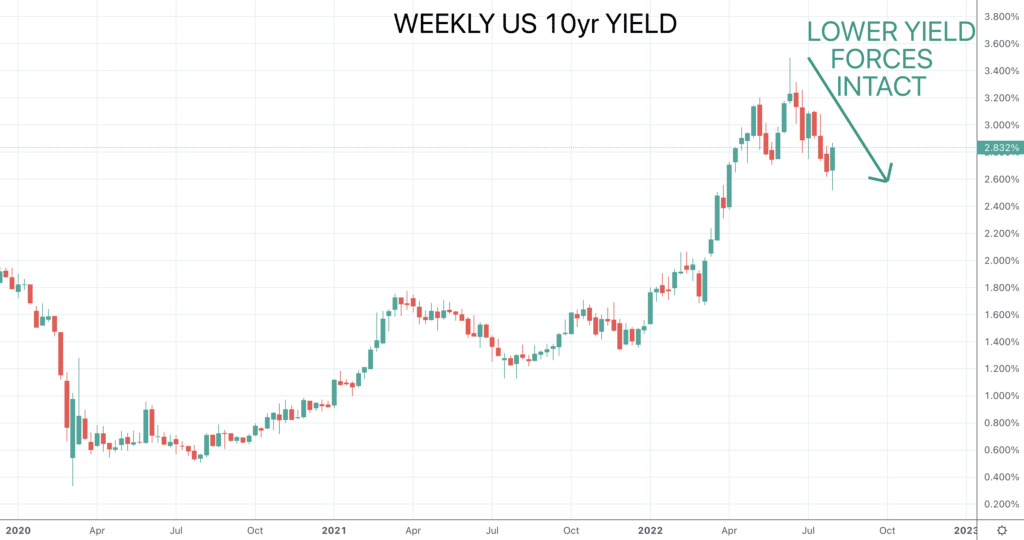

- US 10yr yields moved back higher given the hawkish Fed tone and strong US Employment report, although bigger picture lower yield pressures remain intact.

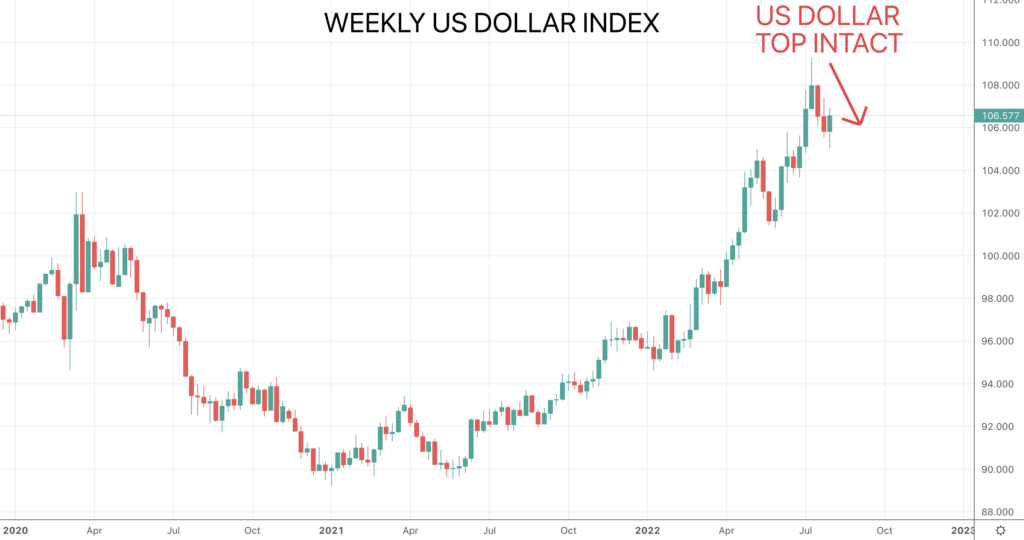

- The US Dollar Index bounced with the higher Treasury yields, but the sell off from the mid-July multi-year high leaves bigger risks lower.

- EURUSD again consolidated July’s rebounded for a still developing base, aiming higher.

- Gold advanced again, after the recent bounce and surge from 2021 supports, confirming upside risks.

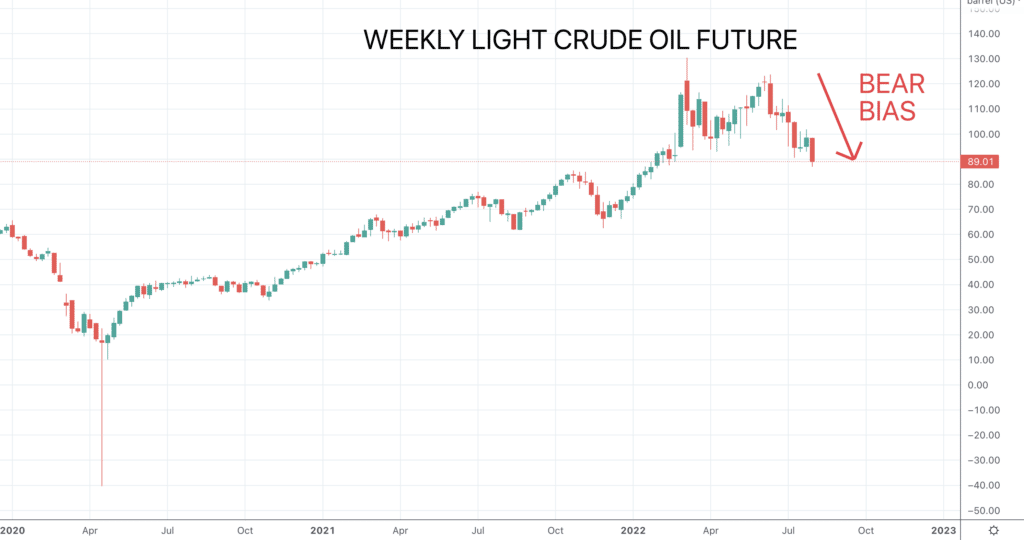

- Oil pushed lower again, with bigger risks still skewed lower.

- Copper consolidated the late July surge higher for an ongoing rebound effort, to stay positive.

Key this week

- Geopolitical focus: Still monitoring the war in Ukraine.

- Central Bank Watch: No central bank activity of note.

- Macroeconomic data: A quiet data week overall, but we do get CPI readings from China, Germany and critically the US, all on Wednesday.

| Date | Key Macroeconomic Events |

| 08/08/22 | Nothing of note |

| 09/08/22 | Nothing of note |

| 10/08/22 | China CPI; German CPI; US CPI |

| 11/08/22 | Australian CPI; US PPI |

| 12/08/22 | UK GDP, Industrial and Manufacturing Production; US Michigan Consumer Sentiment |