Macroeconomic/ geopolitical developments

- At time of press, there is still no agreement to raise the limit on the $31.4 trillion US debt ceiling, although ongoing rhetoric sounds positive.

- According to the minutes from the FOMC meeting in early May, “some” members believe that there is more work to be done to tame stubbornly high inflation.

- An incredible set of quarterly numbers have sent the shares of Nvidia soaring. The tech company is predicting a huge jump in demand for its chips as artificial intelligence products such as ChatGPT take off.

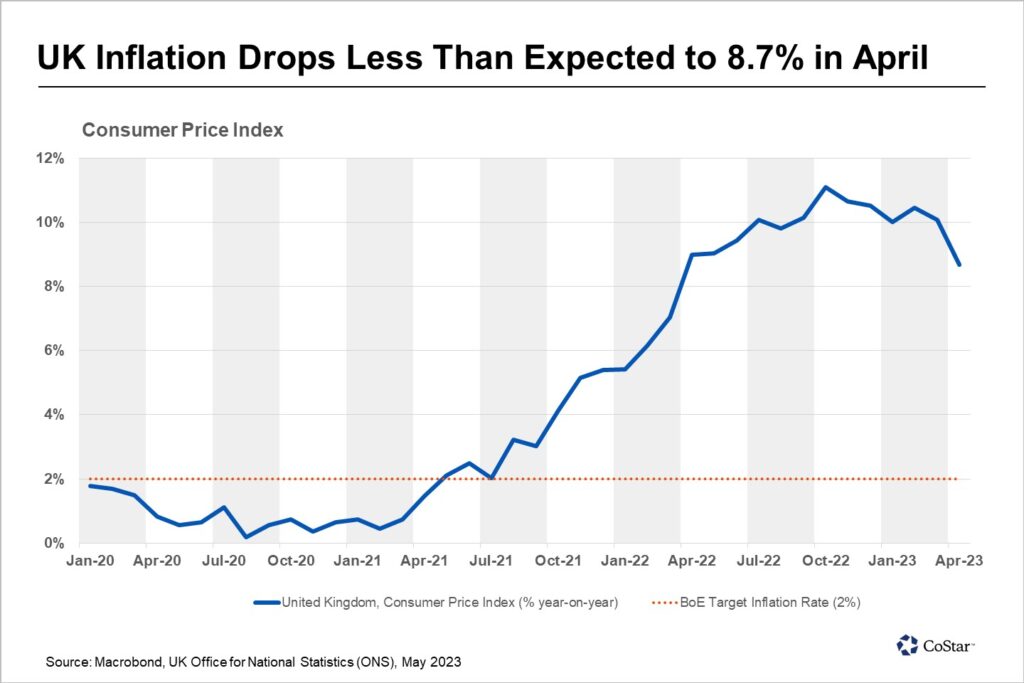

- In the UK, headline CPI finally dropped below 10%, but at 8.7% was much higher than forecast, whilst core CPI increased sharply as services inflation continues to bite.

- Hawkish noises are once more coming out of the European Central Bank from various sources.

Global financial market developments

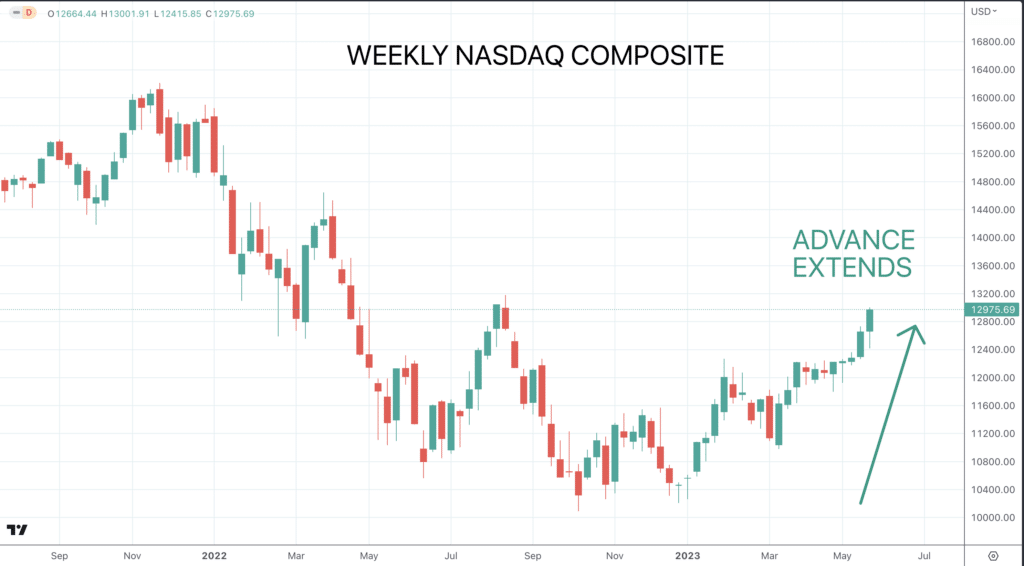

- Already in the top 5 largest stocks in the S&P 500 index, a 25% jump in Nvidia shares the day after the results significantly helped a rebound in the major US stock averages, with the Nasdaq hitting another multi-month high.

- European indices were mostly lower for the week, underperforming their US counterparts as the German Dax setback from the prior week’s record level.

- The Japanese benchmark, the Nikkei 225 hot another new multidecade high to levels not seen since the 1990s.

- US and European Bond yields surged to still higher yields.

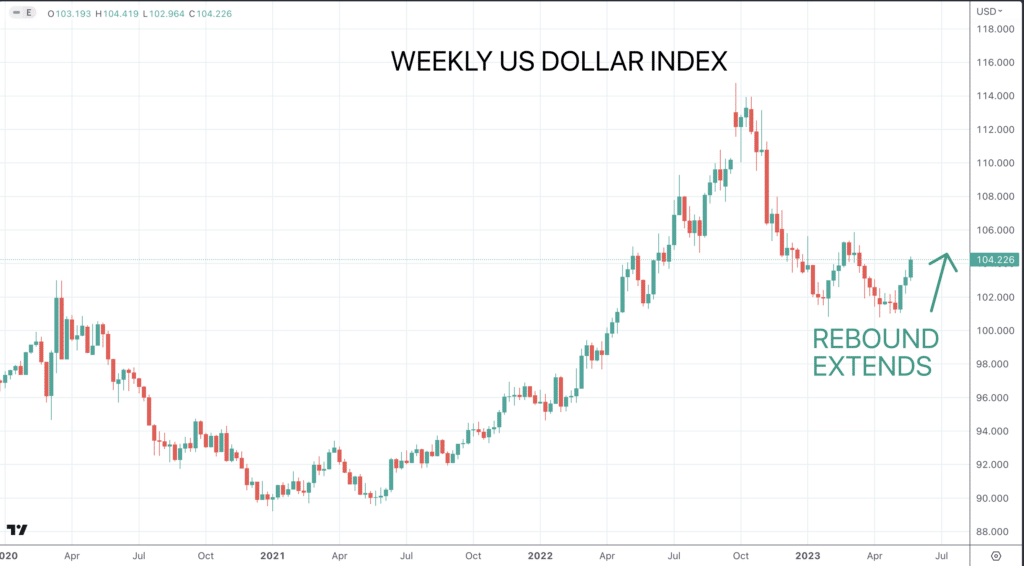

- The US Dollar Index surged again from near a multi-month low at the start of May to hit another multi-week high, retaining a positive tone.

- Gold plunged lower again from an early May multi-month high to a multi-week low, in reaction to the US Dollar strength.

- Oil continues to consolidate the early May rebound from a multi-week low.

Key this week

- Geopolitical Events: It will be a very quiet day for markets on Monday with a whole swathe of bank holidays including, Memorial Day for the US, the Spring bank Holiday in the UK with markets closed for both, plus the Whit Monday holiday across Europe, though markets are open there.

- Central Bank Watch: Little to note from the major global central banks, but Fed speakers stay in focus.

- Macroeconomic data: Data is loaded to the second half of the week, though we do get US Consumer Confidence on Tuesday. Then, with Thursday being the first day of the new month, Manufacturing PMIs are the focus along with Eurozone flash inflation, then the US Employment report takes centre stage on Friday.

| Date | Key Macroeconomic Events |

| 29/05/2023 | US Memorial Day and UK Spring bank Holiday, markets closed |

| 30/05/2023 | Eurozone Sentiment; US Consumer Confidence, Dallas Fed Manufacturing Index |

| 31/05/2023 | Japanese Retail Sales and Industrial Production; Chinese PMIs (official); German inflation; Canadian GDP; US JOLTS jobs openings |

| 01/06/2023 | Final PMIs for Eurozone & UK; Eurozone flash HICP inflation; ADP Employment Change; US ISM Manufacturing |

| 02/06/2023 | US Employment Situation (Nonfarm Payrolls) |