Macroeconomic/ geopolitical developments

- The financial markets have again been dominated by developments in the Russian invasion of Ukraine, with shifts between “risk off” and “risk on” themes.

- More punitive sanctions have seen European and U.K. stocks under particular pressure given the likely impact on global trade and the global economy.

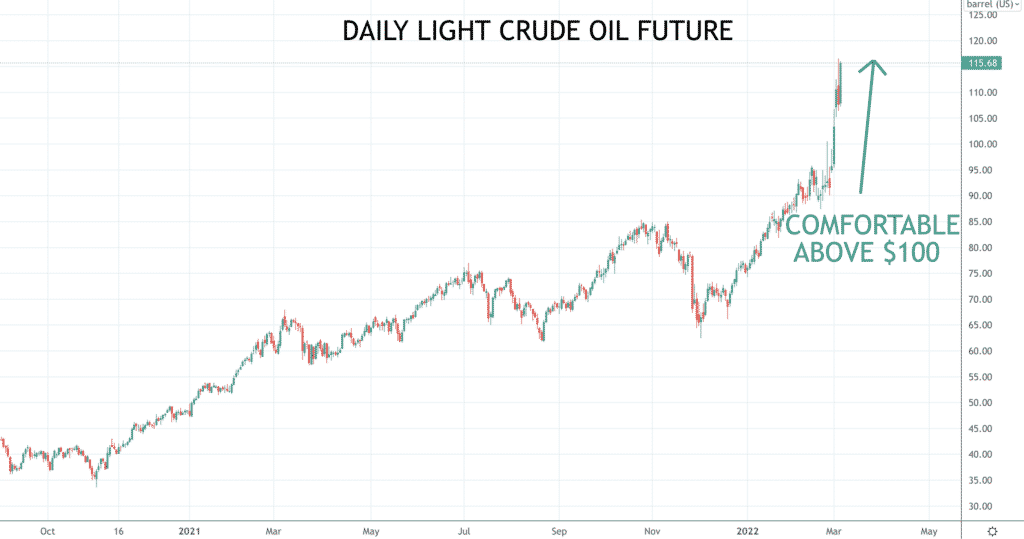

- Global commodity prices have risen aggressively, with wheat, aluminium and energy prices surging higher

- The S&P GSCI, a commodity index benchmark on 24 commodity markets, posted its third largest weekly rise on record (from 1970).

- Additional inflation pressures from surging commodity prices alongside already high levels of inflation has maintained market worries about higher interest rates from major central banks.

- Jerome Powell’s testimony to Congress highlighted an ongoing hawkish tone from the US Federal Reserve, despite the Russia/ Ukraine conflict.

Global financial market developments

- Global stock averages were erratic last week with concerns over the developing conflict in Ukraine.

- Share indices were mostly lower, led by the tech sector (the Nasdaq in the US) and European/ U.K. averages.

- Higher yield pressures eased again last week, with the global safe-haven bond rally extending, driven by the Russia/ Ukraine fears.

- The US Dollar and Japanese Yen rallied against the Euro and Pound, as safe havens.

- “Risk/ commodity currencies” the Australian, New Zealand and Canadian Dollars all rallied.

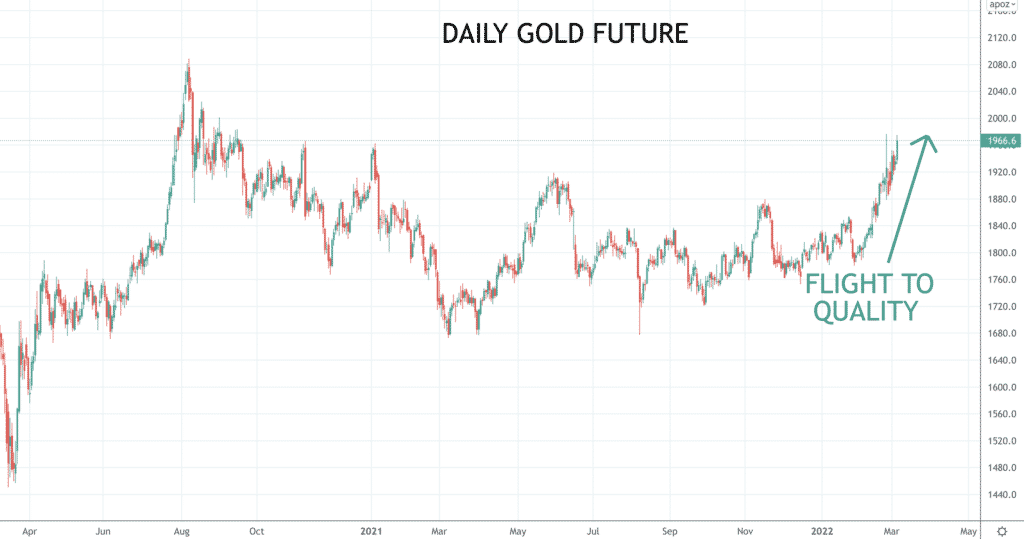

- Gold surged again as the ultimate safe haven.

- Oil surged to another new multi-year high, now significantly above $100.

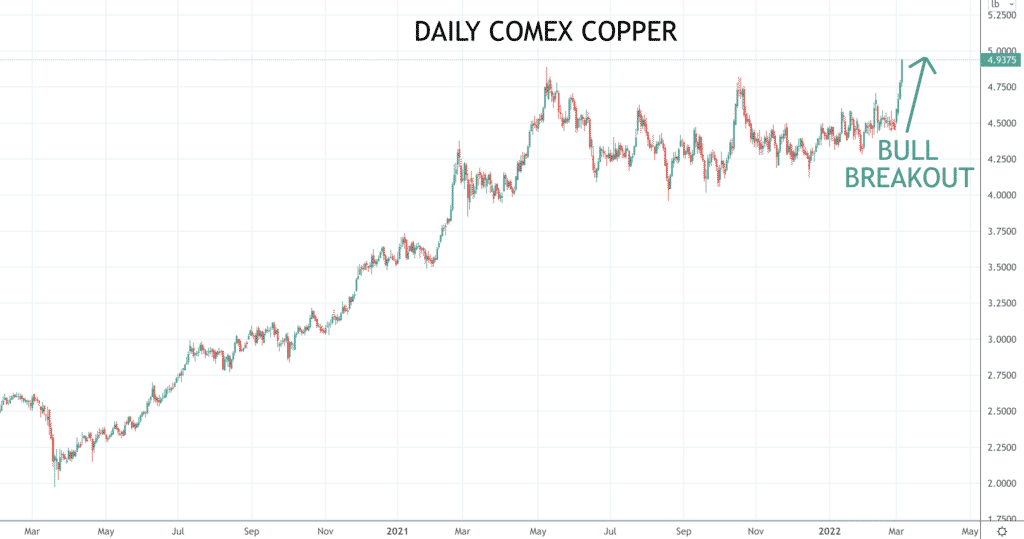

- Copper posted a strong rally for a bullish breakout from within a broader range to a multi-year high.

Key this week

- Geopolitical focus:

- Still closely watching for escalation of military developments in Ukraine

- Also watching for potential for a ceasefire and for talks to improve.

- Central Bank Watch: We get the European Central Bank (ECB) interest rate decision, statement and press conference on Thursday.

- Macroeconomic data: The key data point for the week will be the release of US CPI on Thursday.

| Date | Key Macroeconomic Events |

| 07/03/22 | German Retail Sales |

| 08/03/22 | EU GDP |

| 09/03/22 | Japan GDP; China CPI |

| 10/03/22 | Australian CPI; ECB interest rate decision, statement and press conference; US CPI |

| 11/03/22 | UK GDP; German CPI; Canadian Employment report |