Macroeconomic/ geopolitical developments

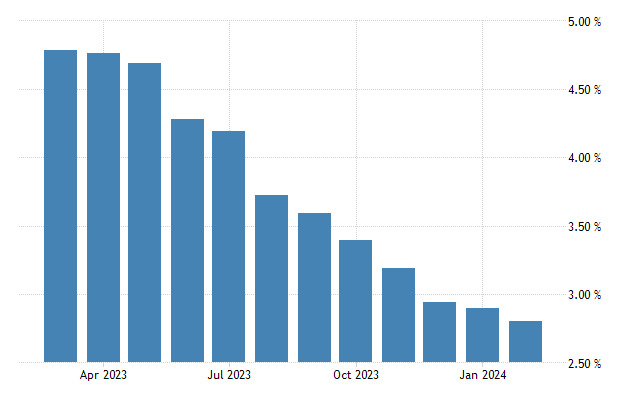

- US data this week was mixed, with GDP being revised upwards to 3.4% for 2023 Q4. US consumer confidence remained relatively steady in March, while inflation data was relatively in line with expectations, but still above the 2% target.

- Fed Bank of Chicago President Austan Goolsbee and Fed Governor Lisa Cook reinforced the central bank’s position regarding interest rate cuts. Goolsbee anticipates three rate reductions this year, emphasising the need to balance the dual mandate. Cook echoed caution, highlighting the necessity for careful deliberation before implementing rate adjustments.

- Japan’s major monetary authorities including the Bank of Japan held an emergency meeting. They expressed their willingness to implement currency intervention as the yen touched a 34-year low against the dollar.

Global financial market developments

- Global equity averages consolidated with a positive bias last week, with US indices nudging to multi-year and record highs.

- US and European bond markets rallied in price with a lower yield bias within March ranges.

- The US Dollar Index rallied further now close to the February multi-month high.

- Gold futures spiked again to another new record.

- Oil futures consolidated and pushed higher to another new 2024 high.

Key this week

Central Bank Watch: No Central Bank activity of note, but we are watching for further indications for the path of future US interest rates from FOMC speakers.

Macro Data Watch: Global PMI data is released through the week, with the US ISM PMI data of particular note on Monday and Wednesday. But the standout for the week is the US Employment report on Friday,

Other: US and European cash and futures markets are closed for an Easter holiday on Monday 1st April. This may cause US markets to experience reduced liquidity.

| Date | Major Macro Data |

| 04/01/2024 | JChina Caixin Manufacturing PMI; Canada S&P Global Manufacturing PMI; US ISM Manufacturing PMI |

| 04/02/2024 | Germany and Italy HCOB Manufacturing PMI; German CPI (MoM, YoY); US Factory Orders and JOLTS Job Openings |

| 04/03/2024 | China Caixin Services PMI; EU CPI (MoM, YoY); US ADP Employment Change; US S&P Global Composite PMI and ISM Services PMI |

| 04/04/2024 | German HCOB Composite and Services PMI; EU HCOB Composite PMI; EU PPI (MoM, YoY) |

| 04/05/2024 | EU Retail Sales (MoM, YoY); US and Canada Employment Reports |