What to expect from US PPI data

The upcoming US Producer Price Index (PPI) report, scheduled for release on Thursday, March 14th at 13:30 GMT, is poised to offer critical insights into inflationary pressures within the economy, particularly at the producer level. Analysts’ consensus estimates for February’s PPI report indicate expectations for modest inflationary growth.

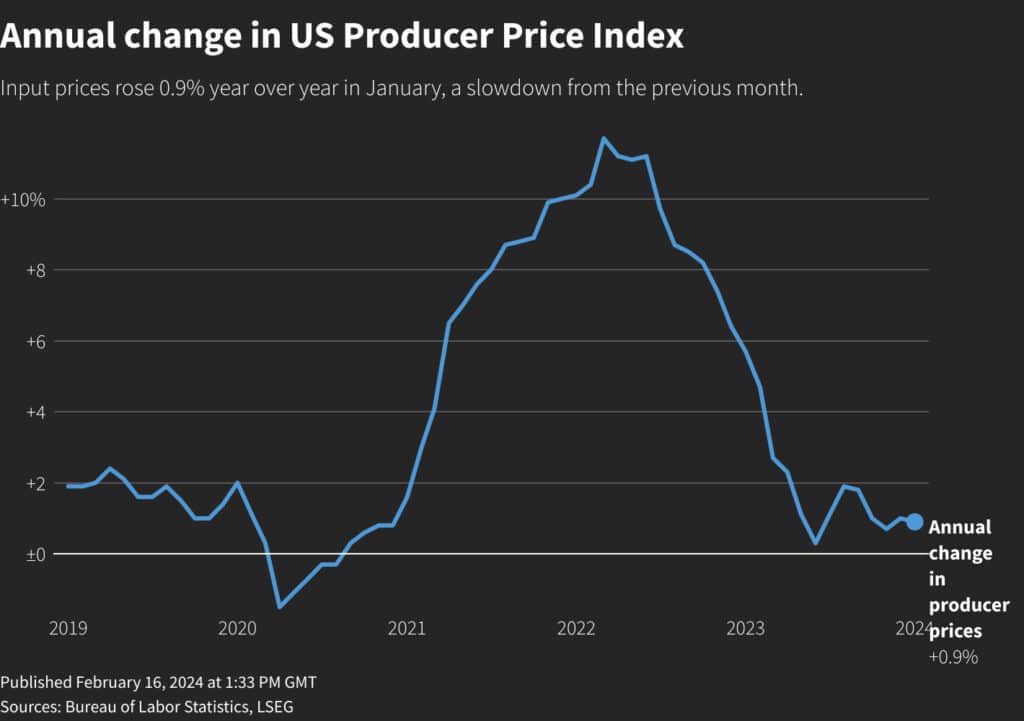

In February, the Producer Price Index for final demand is projected to increase by 0.3% month-on-month (MoM), maintaining the same growth rate as the previous month. On a year-on-year (YoY) basis, the index is expected to rise by 1.1%, above last month’s 0.9%. The consensus estimate for the Producer Price Index ex Food & Energy YoY stands at 1.9%, slightly lower than the previous month’s figure of 2.0%. For the MoM change, analysts expect a 0.2% increase, down from 0.5% in the prior month.

If the PPI report indicates unexpected inflationary pressures, it could influence the Fed’s monetary policy decisions, including adjustments to asset purchase programs or interest rates, which are in particular focus right now. Investors and traders will react to the PPI report, with financial markets sensitive to any surprises in inflation data. A higher-than-expected PPI reading could lead to concerns about inflationary overheating, potentially prompting market volatility and adjustments in asset prices, including bonds, stocks, and currencies.

What to expect from US Retail Sales data

US Retail Sales data is set to release on Thursday, March 14th at 13:30 GMT, and is anticipated to provide crucial insights into consumer spending patterns, offering valuable indications of economic activity and consumer sentiment. Analysts’ expectations for February’s Retail Sales figures suggest a rebound from the previous month’s decline.

Retail Sales for February are expected to show a significant increase of 0.8% month-on-month (MoM), following a notable decline of -0.8% in the previous month. This rebound is indicative of potential renewed consumer confidence and spending momentum after a temporary slowdown in January. Excluding automobile sales, Retail Sales are forecasted to rise by 0.5% in February, contrasting with a -0.6% decline in the previous month. This metric provides further insight into consumer spending habits, particularly in discretionary spending categories.

The January Retail Sales report indicated a broad-based decline across various retail categories, attributed in part to severe winter weather conditions and a potential post-holiday slowdown. The Retail Sales Control Group, which excludes volatile sectors such as automobiles, gasoline, building materials, and food services, reflected the January trend, showing a decline of -0.4%.

Given the crucial role of consumer spending in driving economic activity, any unexpected deviations from consensus estimates in the Retail Sales data could have significant implications for market sentiment and monetary policy expectations. A stronger than expected Retail Sales report may bolster confidence in the resilience of the US economy, while a weaker-than-expected outcome could raise concerns about consumer demand and overall economic health.

Understanding the US PPI Report

The Producer Price Index (PPI) is a key economic indicator that measures the average change in selling prices received by domestic producers of goods and services over time. It tracks price movements at the wholesale level, reflecting shifts in input costs and inflationary pressures within the production process. The US PPI is published monthly by the Bureau of Labor Statistics (BLS) and encompasses three main indexes: the finished goods index, the intermediate goods index, and the crude goods index.

The PPI report provides valuable insights into inflationary trends within the manufacturing sector, offering policymakers, economists, businesses, and investors a gauge of price pressures upstream in the supply chain. Rising PPI figures may indicate growing inflationary pressures that could eventually filter through to consumer prices, impacting purchasing power and monetary policy decisions.

For investors, the PPI report serves as a leading indicator of inflation, influencing market sentiment, interest rate expectations, and asset allocation strategies. A higher-than-expected PPI reading may signal potential tightening by the Federal Reserve to curb inflation, leading to market volatility and adjustments in bond yields, equity prices, and currency exchange rates.

The US PPI report plays a crucial role in assessing the health of the economy, inflationary pressures, and the outlook for monetary policy, making it a closely watched economic indicator among market participants and policymakers alike.

Understanding the Retail Sales Report

The US Retail Sales report is another vital economic indicator that measures the total receipts of retail stores across various categories, reflecting consumer spending behaviour on goods and services. Published monthly by the US Census Bureau, the report provides valuable insights into consumer spending patterns, which account for a significant portion of overall economic activity.

This report encompasses data from a wide range of retail establishments, including department stores, grocery stores, clothing stores, electronic retailers, and online merchants. It tracks both the total sales volume and changes in sales figures compared to previous periods, offering a comprehensive view of consumer demand dynamics.

The US Retail Sales report is crucial for several reasons:

Economic Health: Consumer spending is a primary driver of economic growth, making up a substantial portion of the Gross Domestic Product (GDP). Therefore, retail sales data offers key insights into the health and trajectory of the economy. Rising retail sales often indicate economic expansion and confidence among consumers, while declining sales may signal economic slowdown or contraction.

Consumer Confidence: Changes in retail sales can reflect shifts in consumer sentiment and confidence. Strong retail sales figures suggest that consumers are optimistic about their financial prospects and willing to spend, contributing to overall economic vitality. Conversely, weak retail sales may indicate consumer caution or financial strain, impacting future spending patterns and economic growth prospects.

Inflationary Pressures: Retail sales data also plays a role in assessing inflationary pressures within the economy. Increases in retail sales may lead to higher demand for goods and services, potentially driving up prices and contributing to inflation. Central banks and policymakers closely monitor retail sales figures as part of their efforts to manage inflation and stabilise the economy through monetary policy adjustments.

Business Performance: Retail sales data is essential for businesses, providing valuable insights into market trends, consumer preferences, and competitive dynamics. Companies use this information to adjust their marketing strategies, product offerings, and inventory levels to meet changing consumer demands and maximise sales opportunities.

The US Retail Sales report is a critical indicator of economic health, consumer confidence, inflationary pressures, and business performance, making it a key factor in shaping monetary policy decisions, investment strategies, and market sentiment.