Forex Videos

In this section we have gathered all forex forecasts and market analyses that contain a video. If you like to listen to a video explaining the analysis based on a chart pattern, instead of a long text where you have to read the analysis, you have come to the right place. The headings below should give you a pretty good picture on what the respective video is about. If you’re looking for analyses of specific currency pairs, please visit our forex rates section, where you can see the latest analyses and videos for the respective currency pairs. Most analyses in the videos below are based on technical analysis primarily looking at support and resistance levels, and we would greatly appreciate any feedback from you as a reader here, contact us.

Go back to all forex news.

Positive US Dollar Signals

-Positives on the Dollar Index, US Dollar-Yen, US Dollar Swiss and US Dollar-CAD -Negatives on Euro-Dollar and Cable.

US Dollar Sends Multiple Positive Signals

Negatives on Euro, Pound, Aussie, Kiwi (EURUSD. GBPUSD, AUDUSD, NZDUSD forecasts) Positive on US Dollar-CAD (USDCAD forecast)

US Dollar positives emerging

US Dollar Index threatens to break up (DXY forecast) Positive US Dollar-Yen (USDJPY forecast)

US Dollar bounces

Downtrend ends on US Dollar index (DXY forecast) Euro/ Dollar and Cable have no immediate strong resistance (EURUSD and GBPUSD forecasts)

US Dollar stays strong

New highs for the US Dollar Index (DXY forecast) Fresh lows for Cable (GBPUSD forecast)

US Dollar Levels in Focus

US Dollar Index holds support (DXY forecast) Positive US Dollar-Yen (USDJPY forecast) Aussie approaching major support (AUDUSD forecast)

US Dollar gains again!

US Dollar Index breaks up (DXY forecast) Euro and Pound breakdown (EURUSD and GBPUSD forecasts) US Dollar-Yen reverses lower (USDJPY forecast)

Forex markets waiting for the US election results

Global currency markets were in consolidation, ahead of:

Mixed Signals from the US Dollar

Positive US Dollar Index (DXY forecast) US Dollar-Yen attacks major support (USDJPY forecast)

US$ downtrend questioned

US Dollar Index downtrend ends, for now Aussie, Kiwi and CAD underperform

Forex Technicals – USDJPY negative, EURUSD support holds

Negative US Dollar-Yen (USDJPY forecast) Euro holds support (EURUSD forecast)

Fear Index Special

Shaun Downey, expert technical analyst, looks at what the charts are telling him about the current fears gripping financial markets. Remember Shaun’s great call for Gold back at the end of January. Gold and Silver trends remain bullish!

US Dollar Rallies

US Dollar Index Gains (DXY forecast) EuroYen breaks up (EURJPY forecast) Aussie reaches major downside target (AUDUSD forecast)

Commodities analysis 8 February

Gold bearish engulfing candle on the daily chart & then the weekly chart suggested the 3 month rally in Gold just ended. Silver huge bearish engulfing candle on the weekly chart is a sell signal as we take out all the candles for the 7 weeks last week. WTI Crude April unexpectedly recovered all of … Continued

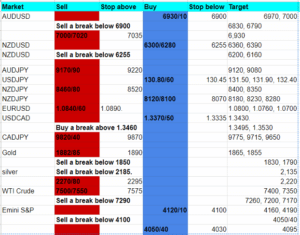

Forex Forecast 6 February

AUDUSD rejected the 100 week & the 500 day moving averages at 7160/80 & collapsed through support at 7060/50 on Friday for a sell signal targeting 6990/80 & 6930/20. A low for the day exactly here in fact. This is key 23.6% Fibonacci & 3 month trend line support at 6930/10. Longs need stops below … Continued