General

Features

Pros

- Fast order execution

- Tight spreads

- Zero commissions

- Big variety of deposit methods

- Risk-management for beginners “AvaProtect”

- Negative Balance Protection

- Innovative mobile apps (AvaTradeGo, AvaOptions, AvaSocial)

- Wide range of educational materials

Cons

- Max Leverage 1:400

- Not FCA Regulated

AvaTrade Review

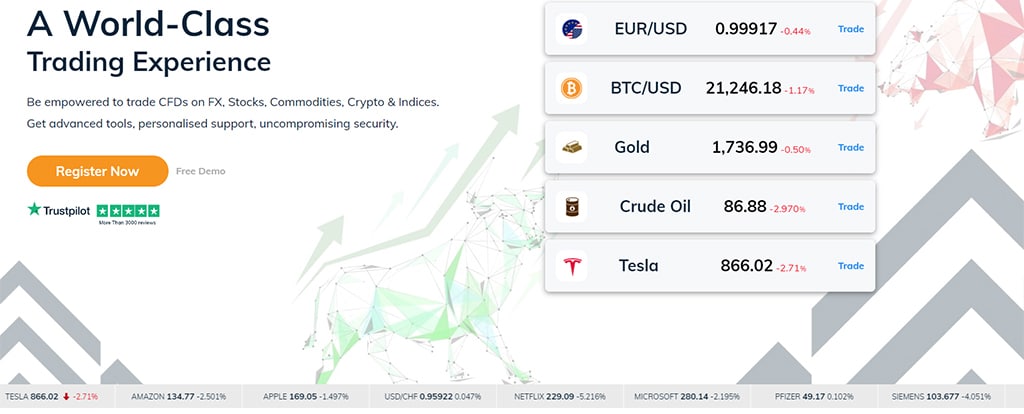

AvaTrade operates as a multi-national corporation, and it has regional offices and sales centers in Dublin, Paris, Tokyo, Milan and Sydney. The company bases its administrative headquarters in Dublin, Ireland. Its official website is located at www.avatrade.com and a screenshot of its home page appears below.

From a regulatory perspective, AVA Trade EU Ltd is incorporated in Ireland and regulated by the Central Bank of Ireland under reference number C53877. AVA Trade EU Ltd operates as a licensed investment firm and complies with the MiFID or Markets in Financial Instruments Directive that provides a standardized regulatory system for investment services companies operating inside the European Economic Area. The MiFID helps increase operating efficiency and transparency from a financial perspective, in addition to providing enhanced consumer protection for those doing business with investment services companies.

AvaTrade has expanded considerably in the past few years – now boasting more than twenty thousand global customers who collectively execute over two million transactions per month. Overall, the forex broker’s monthly trading volume has now exceeded $60 billion, and AvaTrade has been given 15 awards within its industry since 2009.

AvaTrade Features

AvaTrade features firm financial backing and a user-oriented approach to its online forex brokerage business that helps distinguish it from the competition. The company offers 24-hour customer support in multiple languages and a wide range of trading platforms and educational services in order to help foster an ideal operational situation for traders of every level. The broker also makes a variety of asset classes available for trading, including currency pairs, equities, indexes and commodities.

No matter if you are a very experienced trader or new to trading, AvaTrade offers flexible trading platforms and brokerage services that offer you a good balance between ease of use and sophisticated functionality. AvaTrade provides a fully integrated software trading platform capable of providing access to multiple asset markets. For example, traders can execute transactions in commodities, equities, indexes, CFDs and ETFs using the same trading platform.

AvaTrade permits a maximum account leverage of 400:1, where permitted. Two basic account types are available that include a live funded trading account and a demo trading account. Demo accounts expire in 21 days and provide traders with $100,000 of virtual money. This can assist them in learning and practicing trading before they feel confident switching to a live funded account.

Interest on balance for diamond clients

AvaTrade’s Diamond clients will receive a monthly interest payment credited to their balance starting from 1st October, 2023. This new offering will benefit a select group of clients, with the aim of eventually rolling out the offering to more users.

The interest rate imbursement will be automatically delivered to the accounts of AvaTrade’s Diamond clients. There is no need to sign up or take any action to benefit from this new feature. The offering, based on clients free margins, will be calculated annually and henceforth, from the start of October, a monthly credit will be delivered to select clients. Fixed interest rates apply* – USD 2.7%, EUR 1.8%, GBP 2.2% on free margin (excluding active bonus).

AvaTrade is one of only a very small number of brokers to offer this new benefit, which is available for Diamond clients, from all countries**. With this client focused approach, AvaTrade aims to fulfill its clients’ needs by providing unique perks and flexibility. Ensuring clients funds are accessible to seize market opportunities and watch their funds grow is a step towards achieving this goal.

Commenting on this unique new benefit, Daire Ferguson, AvaTrade CEO, said “For more than 16 years, AvaTrade has prided itself on developing a trading platform which offers multiple opportunities for traders. By providing select users with this credit on their free margin, we want to give back to our clients. We continue to offer our traders these unique benefits and, hopefully, in due course we can offer this feature to more users.”

* Published rates may be changed periodically without prior notification

** Aside from those clients with an Islamic accounts

Deposit & Withdrawals

To open an account with AvaTrade, you will need a $100 minimum initial deposit if made by credit card or a $500 initial deposit if made by wire transfer. You can fund a trading account with debit cards, credit cards like Mastercard, Visa and JCB, POLi, and by using wire transfers. AvaTrade also permits electronic payments from providers like Paypal, Neteller, Webmoney and Skrill for all clients with the exception of those who reside in Australia and the EU. AvaTrade’s customer support confirmed that a $100 minimum deposit can be made using Paypal. AvaTrade offers many different solutions around the world regarding deposit and withdrawal. Here is an extensive list:

Credit card

Wire transfer (NatWest, Barclays, UniCredit)

Neteller

Webmoney

DinPay

FasaPay

Moneybookers

Safecharge

VoguePay (PraxisCC55)

Skrill

F2P CUP

Paysec

G-Card

UnionPayBT

UnionPay

Tranzilla

Veritrans

POLi (Australian clients only)

Ideal –An Instant Bank Wire Transfer for Netherlands.

– Min deposit: 100 Euro

– Max 30K Euro

Klarna (Sofort) – An Instant Bank Wire Transfer for Germany, Austria, Belgium, Netherlands, Italy, France, Poland, Hungary, Slovakia, Czech.

– Min deposit: 100 Euro

– Max 30K Euro

Rapid Transfer

WebMoney

Perfect money

*Deposit methods vary between countries (per regulation)

Banks

Barclays

Natwest UK

ANZ Australia

Barclays SA

OCBC Singapore

GT Bank Nigeria

UniCredit Italy

If you wish to start trading quickly, the fastest way to fund an account involves using your Visa or Mastercard credit card. You will need to select “My account” and then “Deposit” and fill out the required information. You will also need a clear color scan or photo of a valid government issued photo identification card and a clear copy of a recent (within the last 60 days) utility bill from your water or electric company, for example. A bank statement with your complete name and address could also suffice. Also, you will need a clear color scan or photo of the front and rear sides of your credit or debit card that shows all four corners. The picture must have your name clearly shown along with the first and last four digits of the card’s number and the expiration date. All this is needed because of the anti money laundering laws.

In order to make a withdrawal, you must first log into your AvaTrade account and select “My Account” at the upper right of the webs page. You can then fill out the withdrawal form carefully according to the instructions presented. Once the information is all filled out, you can then submit the form by clicking on “Upload Documents”, which is also in the “My Account” page. A withdrawal can take anywhere from 24 to 48 business hours for the funds to be removed from your account, and then up to five business days for the funds to arrive in the receiving account. Saturday and Sunday are not business days for AvaTrade.

Platform & Tools

| Feature | AvaTrade |

|---|---|

| Virtual Trading(Demo) | |

| Desktop Platform (Windows) | |

| Desktop Platform (Mac) | |

| Web Platform | |

| Social Trading / Copy Trading | |

| Proprietary | |

| MetaTrader 4 (MT4) | |

| MetaTrader 5 (MT5) | |

| cTrader | |

| Currenex | |

| ZuluTrade | |

| MirrorTrader | |

| Charting - Drawing Tools(Total) | |

| Charting - Indicators / Studies (Total) | |

| Watchlists | |

| Order Type - Trailing Stop |

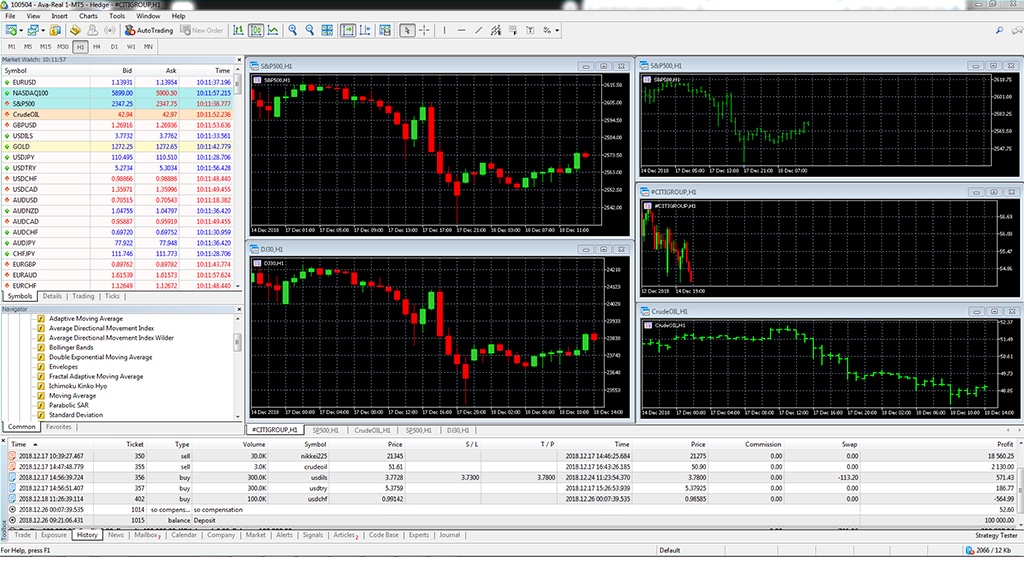

AvaTrade supports a wide variety of trading platforms. The brokers’ proprietary client side AvaTrader trading platform works on Windows XP, Vista and 7, and a Macintosh version is also available. All of them can easily be downloaded and installed directly on a desktop or laptop computer.

The screenshot below shows the extensive functionality of AvaTrader, including technical and fundamental analysis, reports, tutorials and account management features.

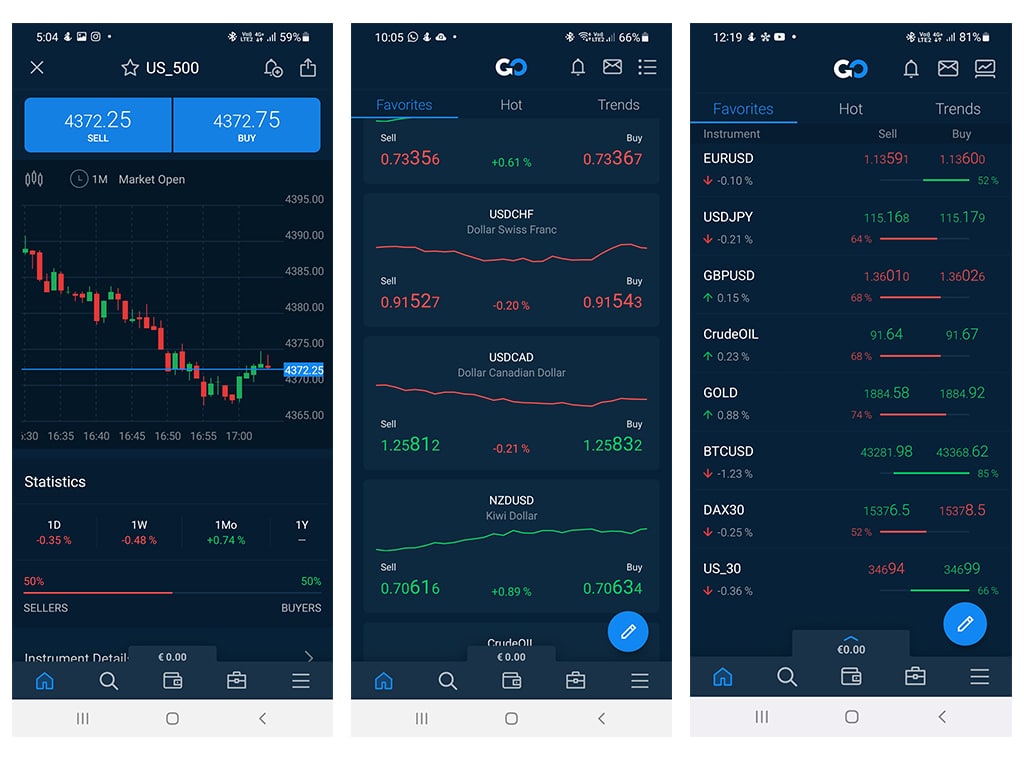

Also, the AvaOptions Web platform and the MT4 WebTrader allow you to sign in to your AvaTrade account using any Internet browser without having to install it on your computer. Finally, the AvaTradeGo app allows you to trade in an AvaTrade account using an iPad, iPhone and Android phones and tablets so you can manage and view your AvaTrade trading account while away from home.

In addition to its own AvaTrader trading platforms, AvaTrade also supports the following trading platforms: Metatrader 4, Metatrader 5. DupliTrader, and ZuluTrade. For those already using MetaTrader, AvaTrade offers their own version of the popular forex trading software to make account installation easier.

Asset Classes

AvaTrade offers FX trading on more than 50 currency pairs. The maximum leverage available on currencies is 1:30.

Bonds, stocks, indices, ETFs and commodities can be traded with the broker as well – obviously, only through CFDs. AvaTrade offers an impressive range of indices and stocks, as well as precious metals, energies and agricultural commodities.

The cryptocurrency section is apparently the main attraction of broker’s selection of tradable assets. Bitcoin, Bitcoin Cash, Bitcoin Gold, Litecoin, Ethereum, XRP and Stellar can all be traded via CFDs. What this means is that traders cannot purchase actual cryptocurrencies through the broker.

Commission & Fees

The opening of an AvaTrade account does not entail any fees. Traders will however pay for the broker’s services through a number of other channels.

- Spreads are calculated in secondary currency (the second currency of a pair) and they equal the spread multiplied by the trade size.

- Other fees shall be levied on maturity rollover, overnight interest (with the exception of account types that do not charge any interest), various corporate actions and yes: there is an inactivity fee.

Research & Education

| Feature | AvaTrade |

|---|---|

| Daily Market Commentary | |

| Forex News | |

| AutoChartist | |

| Trading Central (Recognia) | |

| Delkos Research | |

| Acuity Trading | |

| Social Sentiment - Currency Pairs | |

| Client Webinars | |

| Client Webinars (Archived) | |

| Videos - Beginner Trading Videos | |

| Economic Calendar | |

| Calendar Includes Forexcasts | |

| Economic News Sentiment | |

| Trade Ideas - Backtesting |

SharpTrader is AvaTrade’s trading academy. It offers a complete suite of beginner trading courses and it also covers order types and economic indicators. In addition to that, it features an impressive number of video tutorials, covering everything from advanced trading tools to strategies.

An eBook is also part of the broker’s education-focused offer. Traders are required to register for the eBook manually.

Customer Service

AvaTrade offers a friendly and helpful customer support service available 24/5 via e-mail, Fax and phone, as well as live online chats with a support agent. Their customer support service is also available in many languages and regions for the convenience of AvaTrade’s clients.

In addition, AvaTrade’s offers numerous different types of educational support for traders just starting out in the forex market. These include trading tutorials videos, Webinars, written instructions for novice traders, and an informational e-book series.

Mobile Trading

| Feature | AvaTrade |

|---|---|

| Android App | |

| Apple App | |

| Charting - Draw Trend Lines | |

| Charting - Can Turn Horizontally | |

| Charting - Technical Studies/Indicators | |

| Watchlist - Syncing | |

| Trading - Forex CFDs | |

| Trading - CFDs | |

| Alerts - Basic Fields |

As mentioned, Avatrade offers two options for mobile users. The AvaTradeGo app is its proprietary mobile trading solution, available for Android as well as iOS devices. The app comes with a trading behavior feature, as well as watch lists, live charts and prices. The other mobile option is provided by MT4’s mobile version. This app is available for Android as well as iOS and it brings most of MT4’s features and capabilities to phones and tablets. On the AvaTradeGo app AvaTrade also offers AvaProtect to introduce a new standard in risk reduction. This unique risk management feature allows you to protect a specific trade against losses of up to one million dollars over a chosen time frame, all of this is in exchange for a modest hedging cost paid at the time of purchase. This protection is only available on FX, Gold and Silver Trades. Terms and conditions do apply.

Conclusion

Overall, AvaTrade offers a remarkably complete online brokerage service that includes the ability to execute transactions in commodities, equities, indexes, CFDs and ETFs. Not only does this broker support MT4, but their proprietary AvaTrade trading platform is comprehensive, easy to use, and is available in desktop, web and mobile versions.

Deposits can be made by a variety of convenient methods, including electronic payment services like Paypal. Although the maximum leverage offered is only 400:1 – which is less than some other brokers – this might turn out to be a safer leverage level for newer traders.

FAQ

AvaTrade is a legitimate online provider of Forex and CFD trading services. Launched in 2006, the brokerage boasts some 200,000 clients these days.

AvaTrade has expanded into scores of markets, setting up physical offices in several countries.

The services provided by the broker may be appreciated by some and disliked by others. They are nonetheless legitimate and delivered with the blessings of an impressive number of national regulatory authorities.

Users tend to have very subjective opinions about the quality of the services AvaTrade delivers. As such, AvaTrade user feedback covers everything from scam allegations to praise-singing. The diversity of the feedback is very much in line with what we would expect from a broker that has been in business for 14+ years.

What people like about AvaTrade is:

• AvaTrade is well regulated and very trustworthy.

• The broker offers quick execution and seamless withdrawals.

• Solid trading platforms.

Complainers have railed against:

• Various issues with deposits.

• Subpar customer service experiences.

• Shifty account managers/educators.

• Alleged market making.

Whether AvaTrade is a good broker for you, depends on your needs, and possibly on luck. Bear in mind that the vast majority of unskilled beginners lose money trading FX and CFDs online. Those who lose money tend to be more motivated to leave feedback too.

AvaTrade observes a simple policy about minimum deposits. Its clients have to deposit at least USD/GBP/EUR/AUD 100.

Yes, it is. In regards to regulation, the broker has gone to great length. Its regulatory profile is, therefore, one of its main strengths/selling points.

• Ava Trade EU has secured an interesting regulatory backing. Its licensing authority is the Central Bank of Ireland. Its registration number is No.C53877.

• Ava Trade Ltd is registered in the British Virgin Islands and it is regulated by the local Financial Services Commission.

• Ava Capital Markets Australia Pty Ltd is licensed and regulated by ASIC (license no. 406684).

• The FSCA regulates the activity of the broker in South Africa. AvaTrade’s FSCA license number is 45984.

• In Japan, the local FSA has granted the broker a license with the number 1662.

• The ADGM (Abu Dhabi Global Markets) license of the broker is 190018.

AvaTrade has offices worldwide. Some of the more important such offices are located at:

• Five Lamps Place, Amiens Street, Dublin 1, Ireland.

• Level 13, 2 Park Street, Sydney NSW 2000.

• Minatoku Akasaka, 2-18-1,Tokyo.

• Nelson Mandela Square, Office towers West, 2nd Floor, Sandton, Johannesburg, South Africa.

• SOHO Shangdu, Chaoyang, District, Beijing.

I registered just yesterday and I am new to trading. They asked me to fund my account ,which I did and since then I have been sending emails stating that I need assistance but no response from customer service 😒 and this is really not nice.

Hi, what assistance do you need?

Also it can take up to more than 24 hours for their customer support to reply.

Have you tried calling them as well?

Does AvaTrade offer 40% bonus during Christmas?

Hi, they do for certain territories. Read their terms and service for more information.

The only way you know what a broker is like is from experience and i am with AVATRADE and i find them not good. Customer service is very poor with them. when i asked my account manager did they do bonus he said no that only scam companys do bonus. He promised to get back to me the following week in less than a week but i have not heard from him now in 2 weeks and i went into one trade with him. My view is that AVATRADE is only after the large investor. It was cold calling that i received from AVATRADE and she told me she would put me in touch with someone that would train me how to be a good trader but that has not happened. I will tell FCAin london about them.There head office is in DUBLIN IRELAND Regulation is IRELANDis very very weak and i know myself from experience with the CENTERAL BANK OF IRELAND.and i am from IRELAND myself, Would iike to hear your own views as to what you think about AVATRADE. I will finish Regards Gerry in IRELAND

As you can see AvaTrade is regulated all over the world by several regulators. If the regulator on Ireland is weak that is not AvaTrade’s fault and you should complain to your government about that.

It sounds like you have never traded before. Is that true?

How has your trading been going lately?

Thanks for your comment