General

Features

Pros

- 180+ Tradable Instruments

- Up to 1:500 Leverage

- $200 minimum deposits

- 15 Trading Platforms

- 50 US Share CFDs, 50 UK&EU Share CFDs, and 50 Hong Kong Share CFDs available to trade from MT4/MT5

Cons

- Not regulated in Europe, yet.

Vantage Review

Review Sections:

Vantage is one of Australia’s top Forex/CFD brokers, regulated by ASIC, CIMA and the FCA. Some may be confused by the fact that the broker’s international site used to list CIMA as its only regulator and the Cayman Islands as its sole headquarters.

The confusion was caused by ASIC’s moves to prevent Australian brokers from servicing international clients. To address this problem, the broker launched its Cayman Island branch, which can service international clientele. This branch is CIMA-regulated. The broker has, however, retained its compliance processes. All client moneys deposited through vanatagefx.com are kept in segregated accounts with National Australia Bank.

The regulatory status of the brokerage is the following:

- Vantage International Group Limited is the Cayman Islands-based, CIMA-regulated entity. Its address is Artemis House, 67 Fort St, PO Box 2775, Grand Cayman KY1-1111.

- Vantage Global Prime Pty Ltd is the Australian entity. Its address is level 29, 31 Market St, Sydney, New South Wales, 2000, Australia. The regulatory body behind this company is ASIC. The AFSL registration number of the operation is 428901.

- Vantage Global Prime LLP is registered and based in the UK, at 30 Moorgate, London EC2R 6PJ. This operation is licensed by the FCA. Its FRN number is 590299.

- As of May 4th 2023 Vantage now holds a license from FSCA and can accept traders from South Africa

The reputation of the broker seems to be decent among actual traders. Certainly, there are some complaints out there. These mostly concern issues with withdrawals, alleged spread manipulation and unpaid commissions from the perspective of IBs.

From a regulatory perspective, the question is: can Vantage accept traders from any of the major markets? While US users cannot access it, it seems to accept traders from the EEA (European Economic Area) without problems.

Why should you join Vantage? The broker features a couple of cutting-edge trading platforms. It offers ECN spreads from 0.0 pips on MT4 and MT5 and its account-opening process is simple and quick.

Platform & Tools

| Feature | Vantage |

|---|---|

| Virtual Trading(Demo) | |

| Desktop Platform (Windows) | |

| Desktop Platform (Mac) | |

| Web Platform | |

| Social Trading / Copy Trading | |

| Proprietary | |

| MetaTrader 4 (MT4) | |

| MetaTrader 5 (MT5) | |

| cTrader | |

| Currenex | |

| ZuluTrade | |

| MirrorTrader | |

| Charting - Drawing Tools(Total) | |

| Charting - Indicators / Studies (Total) | |

| Watchlists | |

| Order Type - Trailing Stop |

As far as trading platforms go, Vantage has most of the angles covered. It offers MT4 and MT5 in various versions. It also provides access to social trading services through ZuluTrade and MyFXBook AutoTrade.

In addition to the above, it supports a WebTrader as well as a selection of mobile trading apps.

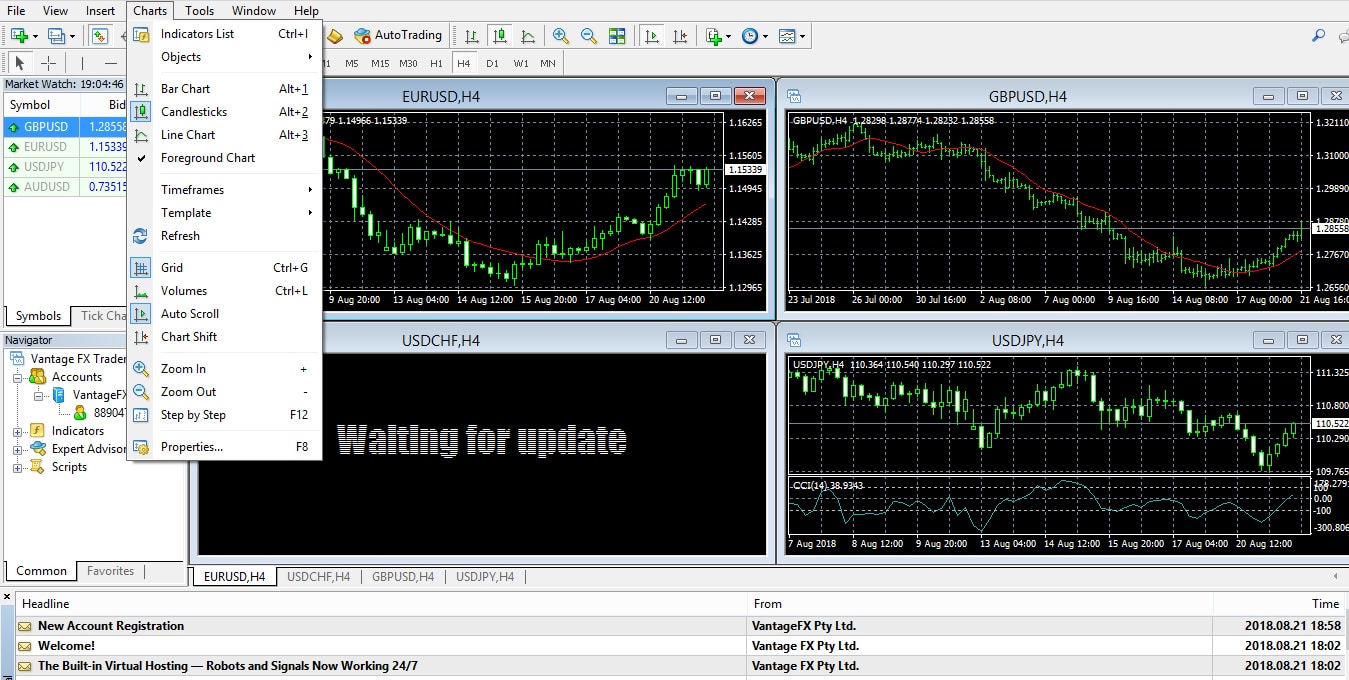

MT4 is available in a “regular” version, as well as in a version for Mac. Metaquotes’ MT4 is renowned for its charting capabilities. Vantage’s MT4 supports 9 different time frames and no fewer than 3 different chart types.

Scores of indicators and studies back up the charts. In fact, MT4 is a fully customizable trading environment. What this means is that traders are not only free to use all the preinstalled indicators and tools, they can create and install their own too.

EAs (Expert Advisors) represent the cherry on top of the MT4 cake. Through these advisors, coupled with custom scripts, traders can automate their trading to a certain degree. Vantage does indeed support EAs.

Traders are free to acquire and install their own EAs and scripts and they can even create brand new ones from scratch.

The WebTrader platform is MT4’s readily accessible, somewhat simplified version. Even so, the capabilities of the browser-based platform are impressive. Through it, traders can access some 45 tradable assets, covering Fx pairs, indices and commodities.

MT5 is not just the evolutionary offspring of MT4. It is focused on some different angles altogether. For instance, it supports no fewer than 21 time frames. It comes with 80 preinstalled technical indicators and it supports 65 tradable assets.

It too supports EAs.

Vantage’s mobile apps cover the iPhone, iPad as well as various Android devices. The apps can be downloaded for free from the Appstore and Google Play, or directly from the official website of the broker.

In addition to the trading tools already mentioned, the broker also offers a VPS service (a must-have for EA users), a Client Sentiment Indicator, access to Trading Central, an Economic Calendar as well as Smart Trader Tools.

Asset Classes

The FX pair selection of the broker consists of more than 40 tradable assets. These cover majors, minors and exotics and feature some of the best trading conditions at the brokerage. The spreads on Raw ECN accounts start from 0.0 pips. On FX pairs, the maximum available leverage is 1:500.

The broker offers 10+ world stock exchange indices. Execution speeds on these assets are superb and the maximum available leverage is 1:200.

The commodities section includes energy, precious metals and soft commodities. Thus, clients can trade oil, natural gas, gasoline and heating oil.

In regards to soft commodities, cocoa, coffee, cotton, orange juice and sugar are available.

The precious metals section offers gold, silver and copper.

Last but not least, we have the share-based CFDs, where US and Hong Kong shares are available. Obviously, the trading of commodities is done via CFDs as well. There is no actual delivery and reception involved in any shape or form.

The broker has recently added more than 70 UK and European share CFDs. Some 50 Australian share CFDs will also be added.

Share CFDs can all be accessed through the MT4 platform. The maximum leverage on these CFDs is 1:20.

Commission & Fees

The broker does not charge any account fees. As far as commissions and spreads are concerned, these depend on the account type for which one opts.

The Standard STP account is the cheapest one, requiring a minimum deposit of only $200. This account type does not charge any commission. Its spreads start from 1.4 pips.

Next is the Raw ECN account, which is apparently the most popular account option at the brokerage. The minimum deposit here is $500. There is a $3/lot/side commission charged. Spreads on the other hand start from 0.0 pips.

The Pro ECN account is for high-volume traders. Its minimum deposit requirement is $20,000. Its commissions are very attractive however, at $2/lot/side. Like the Raw ECN account, the Pro one features spreads starting from 0.0 pips.

Research & Education

| Feature | Vantage |

|---|---|

| Daily Market Commentary | |

| Forex News | |

| AutoChartist | |

| Trading Central (Recognia) | |

| Delkos Research | |

| Acuity Trading | |

| Social Sentiment - Currency Pairs | |

| Client Webinars | |

| Client Webinars (Archived) | |

| Videos - Beginner Trading Videos | |

| Economic Calendar | |

| Calendar Includes Forexcasts | |

| Economic News Sentiment | |

| Trade Ideas - Backtesting |

In this regard, Vantage features a rather standard offer. That said, its education section does cover all the essentials.

The Forex Education Academy is aimed at ushering beginners into the realm of currency trading. To this end, it features a number of articles and webinars. Traders can make use of the Demo Account to put their newly acquired skills to the test.

The MT4 manuals and videos are meant to get traders acquainted with the ins and outs of the trading platform. There is indeed plenty to learn in this regard.

The video section seems extremely useful in this respect. It covers everything from the basics, all the way to How to Install an Expert Advisor.

The SmarTrader Tools are covered by a similar video section. This includes video tutorials on everything from the Trade Terminal to the Alarm Manager.

Customer Service

The Vantage support staff can be contacted through email (support@vantagefx.com), phone (1300 945 517) as well as Live Chat.

A selection of local-specific phone numbers are also available, such as: 400-120-9301 for China, +44 207 100 8625 for the UK, 1-888-442-4106 for Canada and +61 2 8999 2044 for international clients.

Mobile Trading

| Feature | Vantage |

|---|---|

| Android App | |

| Apple App | |

| Charting - Draw Trend Lines | |

| Charting - Can Turn Horizontally | |

| Charting - Technical Studies/Indicators | |

| Watchlist - Syncing | |

| Trading - Forex CFDs | |

| Trading - CFDs | |

| Alerts - Basic Fields |

As mentioned, the broker has apps covering iOS as well as Android-based devices. These apps are effectively MetaQuotes’ mobile apps, offering access to the MetaTrader trading account. As such, their functionality is outstanding.

Conclusion

Vantage’s regulatory profile may not be the best, but its overall reputation among traders is a positive one. For a broker launched back in 2009, this certainly means something.

The commission/fee structure of the broker is decent, as is its tradable asset selection. Its trading platforms and education section are quite superb.