-

Home

- >

- Author: Michael Pento

Michael Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services. The firm also provides research for individual and institutional clients through its weekly podcast called, The Mid-week Reality Check. Additionally, PPS’ Inflation/Deflation and Economic Cycle Model Portfolio SM is replicated by major financial institutions in order to allow their clientele access to the firm’s proprietary Model. Mr. Pento is the author of “The Coming Bond Market Collapse: How to Survive the Demise of the U.S. Debt Market” . Michael is a well-established specialist in markets and economics and a regular guest and has been featured on CNBC, CNN, Bloomberg, USA Watchdog, FOX Business News and other international media outlets. His market analysis can also be read in most major financial publications.

Prior to starting PPS, Michael served as the Senior Economist and Vice President of the managed products division of Euro Pacific Capital.

Additionally, Michael has worked at an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career, he worked on the floor of the New York Stock Exchange. Michael has carried series 7, 63, 65, 55 and Life and Health Insurance Licenses. He graduated from Rowan University in 1991.

Michael Pento is the President and Founder of Pento Portfolio Strategies, produces the weekly podcast called, “The Mid-week Reality Check”, is Host of The Pentonomics Program and Author of the book “The Coming Bond Market Collapse.”

Intermediate

The Federal Reserve believes inflation is no longer a concern for consumers and the time has come to ensure the rate of change of prices does not decline any further. To this point, Susan Collins, the Boston Federal Reserve President, said recently that if you take out food, energy, and shelter, inflation is pretty much … Continued

Intermediate

The FOMC meeting and press conference for September was projected to be a dovish one. Fed Chair Powell was expected to cut rates by 50 bps. The preponderance of Wall Street lackeys were busy begging for a series of immediate and deep reductions in borrowing costs. Some in D.C., like Senator Elizabeth Warren, were obsequiously … Continued

Intermediate

Global debt has soared to a record $307 trillion, rising by a staggering $100 trillion over the past decade, and now represents 340% of world GDP. This is why there is no easy escape from the upcoming recession. The salve to bring economies back after a drop in asset prices and contraction in growth has … Continued

Intermediate

The recent spate of economic data continues to point to a weakening economy, but one that is not yet precipitously falling into recession. The Philly Fed Index was released late last week. The diffusion index for current general activity declined 11 points to 4.5 in May. The index for new orders declined from 12.2 to … Continued

Expert

The Inflation Deflation and Economic Cycle Model measures the liquidity impulse from fiscal and monetary policies. This is how we determine what will occur with the ROC of inflation and economic growth. The current liquidity factors that must be measured are the Treasury General Account (TGA), Reverse Repurchase Agreement (RRP), Fed’s balance sheet, Federal Funds … Continued

Intermediate

This year promises to be one of the most interesting years economically, politically, and market-wise in history. We have two significant global conflicts/wars ongoing, just as President Xi of China is reiterating his promise to annex Taiwan, and Kim Jong Un of North Korea threatens to wipe the US off the map. Meanwhile, we have … Continued

Intermediate

So far this year, companies have planned 604,514 job cuts, a 198% increase from the 209,495 cuts announced through September 2022. It is the highest January-September total since 2020 when 2,082,262 cuts were recorded. Apart from that COVID year it is the highest January to September total since 2009. The real story behind the labor … Continued

Beginner

The CPI (Consumer Price Index) is used to measure the level of inflation (and potentially deflation) in an economy. Although not used everywhere, it is a standard gauge that measures general price increases for countries. It is used by governments, central banks and market participants and is considered to be a benchmark to compare inflation … Continued

Beginner

The Bank of England (also known as the BoE) is the central bank for the United Kingdom of Great Britain and Northern Ireland (i.e. the UK). It has the power to set monetary policy for the UK. The powers of the Bank of England A brief history of the Bank of England The BoE’s mandate … Continued

Intermediate

The major issue with the bond market right now is the overwhelming amount of bond issuance combined with the notable absence of the usual buyers. In other words, the illiquidity is already causing U.S. sovereign debt to trade like a microcap penny stock. This dysfunctional trading environment should become exponentially worse by the end of … Continued

Intermediate

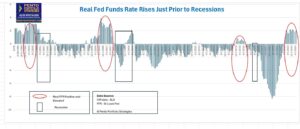

The US recession is merely delayed, not canceled. The soft-landing narrative is a myth. The government’s fiscal stimulus in 2023 has temporarily lifted the GDP growth rate. However, fiscal stimulus is not a reliable source of economic growth. It undermines productivity in the long term. It also creates problems such as higher taxes, higher interest … Continued

Intermediate

The Fed’s minutes for their latest meeting held in July showed the committee’s interest in raising interest rates further due to upside risks to inflation that is already well above their target level. The Fed is also perpetually worried about growth, which of course has nothing to do with inflation. After all, people working and … Continued

Expert

According to the Congressional Budget Office, the U.S. government posted a $225 billion budget deficit for June, up 156% from a year earlier. This means, the first nine months of fiscal 2023 showed a deficit of $1.4 trillion, which is up 171% from the amount seen during the first nine months of fiscal ’22. Debt … Continued

Intermediate

The Bank of Canada paused its rate hiking cycle in January but then hiked rates at its last meeting. The Royal Bank of Australia paused in April but then had to start hiking again in June. The Fed also paused at its June meeting or at least skipped a rate hike. This was the case … Continued

At his May FOMC press conference, Mr. Powell tried his hand at stand-up comedy by saying “banking conditions have broadly improved since March.” Could it really be possible that he can be so blind to what is actually happening within the banking system? A banking system can only function properly when certain parameters are in … Continued

Intermediate

First Quarter GDP increased at only a 1.1% seasonally adjusted annual rate. That was down from 2.6% in Q4 of last year, which was down from 3.2% during Q3. Despite the clear slowdown in economic growth, there still exists a battle between Wall Street’s soft-landing narrative, where inflation comes down in the context of robust … Continued

Beginner

Inflation is supposedly on its way to falling gently back to 2% like a fluffy snowflake while the US economy roars ahead. Or at least that is what the deep state of Wall Street needs you to think. However, the US economy is in the eye of the hurricane right now; and the other outer … Continued

Fed Chair Jerome Powell remains unimpressed with the reduction of the rate of inflation; down to 7.1% in November, from 9.1% June. The Summary of Economic Projections shows a desire of the Fed to increase their forecast for the Fed Funds Rate to 5% in 2023, up from the 4.6% projection made in the last … Continued

Intermediate

This latest bear-market bounce was predicated on good seasonality, the hopes for a typical mid-term election boost, and the rumors of a Fed pivot. Wall Street always finds a narrative for rallies in a bear market. But the negative economic and liquidity cycles remain unchanged: The Fed is hiking rates into a recession. Powell may … Continued