German Industrial Production Worse Than Expected

Why is German Industrial Production Data Important?

In the financial world, the German industrial production data is more than numbers; it’s the heartbeat of Europe’s economic engine. Here’s why it’s a focal point for trading economic news:

Eurozone Foundation: Germany, the Eurozone’s economic powerhouse, lays the foundation. The data offers a glimpse into the Eurozone’s economic health.

Manufacturing Leader: Germany’s precision in manufacturing sets global standards. Industrial production figures reflect trends in this key sector, impacting global manufacturing.

Global Supply Chain Barometer: Disruptions in Germany resonate globally, making the data a valuable indicator for investors and businesses navigating the intricate supply chain.

Euro’s Barometer: A performance gauge for the Euro, strong production uplifts the currency, while a decline raises concerns about its stability.

Employment Impact: Beyond machines, it influences job security. Healthy production not only boosts investor confidence but also signifies a positive labour market outlook.

Forward-Looking Insight: It’s a forward-looking indicator, offering insights into future economic trends. A surge signals growth, while a dip may indicate caution and potential economic challenges.

German Industrial Production Performed Worse Than Expected

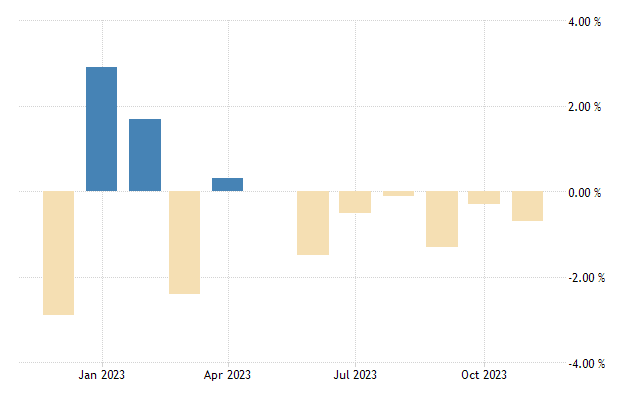

Breaking expectations, German industrial production faced an unexpected setback in November, marking a sixth consecutive monthly decline. The Federal Statistics Office reported a 0.7% decrease, contrary to the consensus anticipated 0.2% rise. Contributing factors include a modest 0.3% increase in industrial orders and a widespread slump across sectors, with capital goods, intermediate goods, and consumer goods production all affected.

The decline, attributed to diminishing order books, was exacerbated by a 3.9% surge in energy production and a 2.9% drop in construction output. Analysts suggest this downturn places German industry in a recessionary phase, with a carry-over effect projecting a potential 1.7% quarterly fall in industrial production for Q4, following a 2% slide in Q3.

Stock Reaction

European stock markets had a relatively muted reaction to the data, with marginal movements. This was due to investors processing both the discouraging German economic data and a positive overnight closure on Wall Street. The DAX index in Germany showed a marginal dip, the CAC 40 in France saw a 0.1% increase, and the FTSE 100 in the U.K. rose slightly.

Eurozone Unemployment Data

Why is Eurozone Unemployment Data Important?

Eurozone unemployment data is another key data release that affects financial markets. Below are some of the reasons why:

Economic Health Gauge: It reflects the overall economic health of the Eurozone, with rising rates indicating distress and falling rates signalling prosperity.

Consumer Impact: Employment stability influences consumer spending and confidence, shaping economic growth dynamics.

Monetary Policy Driver: Central banks use unemployment data to formulate policies, adjusting interest rates to stimulate economic activity or control inflation.

Corporate Performance Link: Job market health directly impacts corporate performance, affecting investor decisions and business outlook.

Political and Inflationary Significance: Unemployment rates influence political landscapes and contribute to inflationary pressures, key considerations for investors.

Investment and Risk Guide: Investors use unemployment data to assess opportunities and manage risks, making it a crucial factor in strategic decision-making.

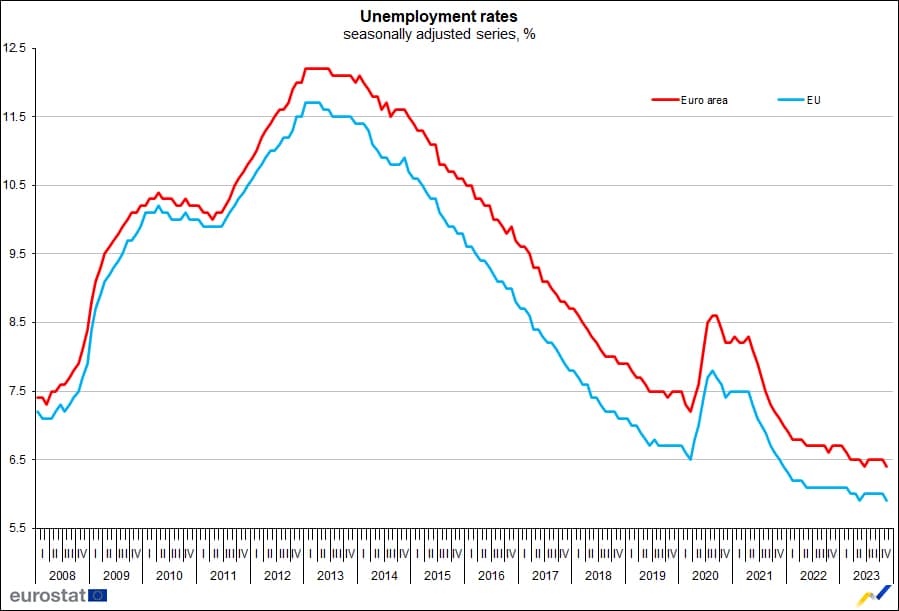

Eurozone Unemployment Data Performed Better than Expected

Eurozone unemployment retreated to a record low of 6.4% in November, defying economic concerns and slightly better than Economists’ anticipated unchanged rate of 6.5%. The jobless count dropped nearly 100,000 from the previous month, showcasing the resilience of the region’s labour market. This unexpected strength prompts caution among European Central Bank policy makers regarding potential interest rate cuts, as rapid wage growth could sustain inflationary pressures. The Eurozone’s job market seems immune, for now, to broader economic weaknesses.

Eurostat reported that the number of jobless people in the Eurozone fell to 10.97 million, down 99,000 from the previous month and 282,000 from a year earlier. The Eurozone’s unemployment rate of 6.4%, was down from 6.5% the previous month and 6.7% the previous year. The EU’s overall unemployment rate was 5.9%, signalling a positive trend from the previous month and the same period in 2022.