Oil rebounded yesterday as traders have taken progress in the talks over the US debt ceiling as a positive for market sentiment. This near-term boost may still have legs to run, but the path to sustainable upside looks restricted. There is a whole catalogue of mixed signals impacting the oil price right now, but for oil to drive higher it needs the outlook for the demand in the US and China to improve. For that, the waters look fairly muddied.

- The positives for oil include progress in the debt ceiling, an upward revision to demand forecasts and the US Government re-stocking the SPR.

- The negatives come with the US economy slipping towards recession and a sagging recovery in China.

- Meanwhile, the technical analysis shows resistance is restrictive.

What is propping up the oil price right now?

Mixed signals are impacting the oil price, but the price has been picking up recently. How oil traders view the market is being driven near term by the outlook for demand, and for that we need to consider the US and China.

Finally, there seems to be progress in the US debt ceiling. It has been reported that there might be enough common ground to reach an agreement by the weekend. This has boosted oil as it would remove a sizable reason for traders to be wary of taking on risk. A US debt default would have global ramifications and cause a huge shock across financial markets.

Now, as newsflow develops in the coming days, on the assumption that there is not a breakdown in the talks, this opens for near-term upside in a bit of a relief rally for oil.

Other factors could play into a rebound too surrounding the demand side. China is refining oil at near record levels, with Refinitiv reporting that imports by China in May could be up towards 11m barrels per day (up from 10.67m in April). Furthermore, the IEA (International Energy Agency) monthly oil report recently showed an upward revision of the 2023 forecast and that Chinese demand “continues to surpass expectations”.

Additionally, the US Government is starting to re-stock its Strategic Petroleum Reserve after selling down its emergency stockpile last year in the wake of the Russia/Ukraine war. The Department of Energy has announced that it will repurchase 3m barrels of oil. It previously said that it would buy back oil priced between $67 to $72, around where it is now.

The US recession and a soggy China re-opening are a drag

The positives may be putting a floor under the oil price, but the rebound is also facing some headwinds. Looking at the bigger picture, the economic slowdown in the US and a spluttering re-opening of China in 2023 are still restricting any sustainable recovery in oil.

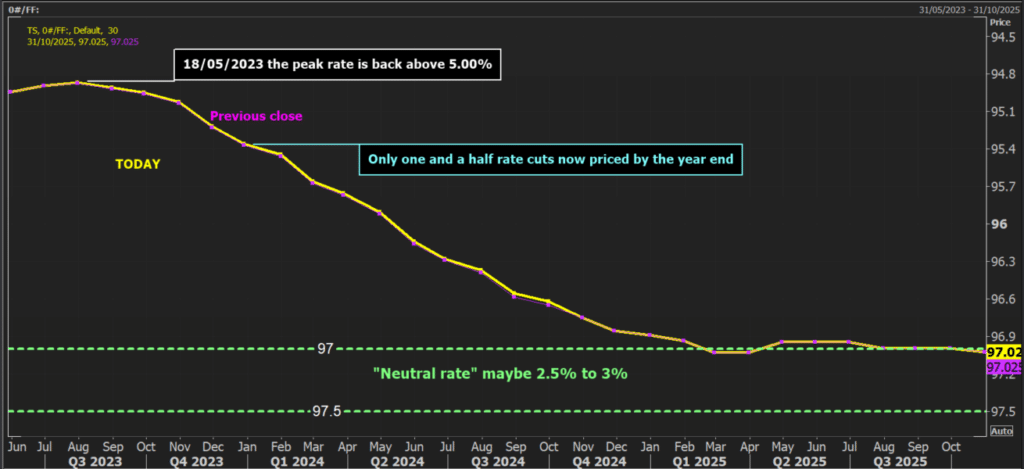

The US continues to show signs of an economic slowdown that will likely pull the economy into recession. The banking crisis may be past its worst, but lending levels are down. Consumer indicators also continue to point to a faltering in growth. However, with the strong labour market and inflation that still needs to be tamed, we are still getting Fed speakers such as Thomas Barkin (who leans hawkish but is not a voter in 2023) being “comfortable” with further rate hikes. With the threat of the debt ceiling easing, according to the CME Group FedWatch tool, markets are pricing a 27% probability of another +25bps hike in June. US Treasury yields have picked up and the USD has rebounded. Tighter US interest rates at a time of slowing economic growth trends are a drag on oil.

Furthermore, even though the IEA has increased its demand forecasts for China, the economic data out of China have not been positive recently. Inflation (both CPI and PPI) fell further than expected last week. There have also been disappointing industrial production retail sales and fixed asset investment for April which paint a picture of a spluttering economic recovery.

So with the US slowing and China underwhelming, the two big drivers of oil demand are still not firing in a way that would be aligned to driving oil higher.

Technicals show a mixed picture for NYMEX

Looking at the technical analysis of NYMEX oil futures, I have seen the one-month downtrend broken by the strong move higher yesterday. This has at least helped to put a floor under the price near term. I will be watching the support at $69.41 now.

However, for a recovery back towards the range highs to take hold, some barriers need to be overcome.

- The resistance at $73.78/$73.90 which has been a basis of a mid-range pivot needs to be broken.

- The daily Relative Strength Index (RSI) has been restricted under 50 for the past three weeks. A move above 50 would be more positive.

A close above $73.90 would complete a small bull flag pattern which would imply upside above $80 again. This would open a test of the medium-term range highs once more.

However, these all remain near-term moves. The bigger picture outlook remains one of lower highs and bull failures. I would continue to remain cautious of chasing oil too much higher and expect that whilst the narrative of a US recession remains dominant, the upside will remain restricted.