Macroeconomic/ geopolitical developments

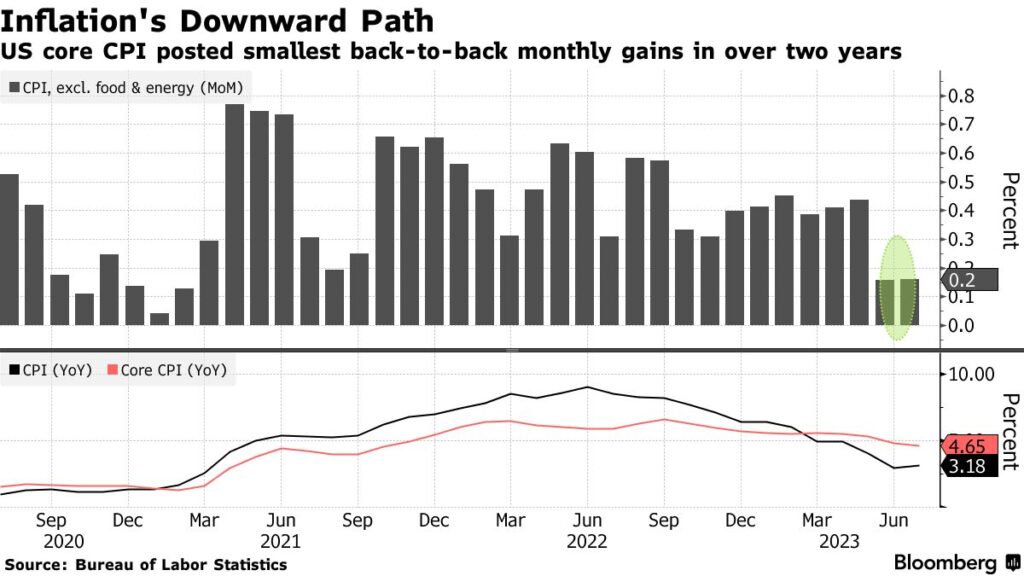

- It was a fairly quiet week last week, but the main focus was on US inflation. US CPI showed softening signs on both core and headline metrics. However, 24 hours later the US PPI surprised to the upside. US Treasury yields jumped around, ultimately closing out the week marginally higher than the last.

- According to Bloomberg, data suggests that a risk-off bias is developing, with flow into safe-haven assets. There were net outflows from US equity funds last week. This came amid net inflows into cash funds and bond funds.

- The USD remains in the driving seat as the preferred asset of the moment. Even the dovish implications of the softening US CPI did not last too long before traders moved back into the USD once more. A stronger USD is coming with a negative risk appetite. This is weighing on index futures and metals prices.

Global financial market developments

- US earnings season is all done bar the shouting and the impact on US index futures has been rather disappointing. Reaction to a decent batch of positive earnings surprises has not translated through to gains on markets. Traders appear to be far more interested in the economic calendar than the corporate calendar.

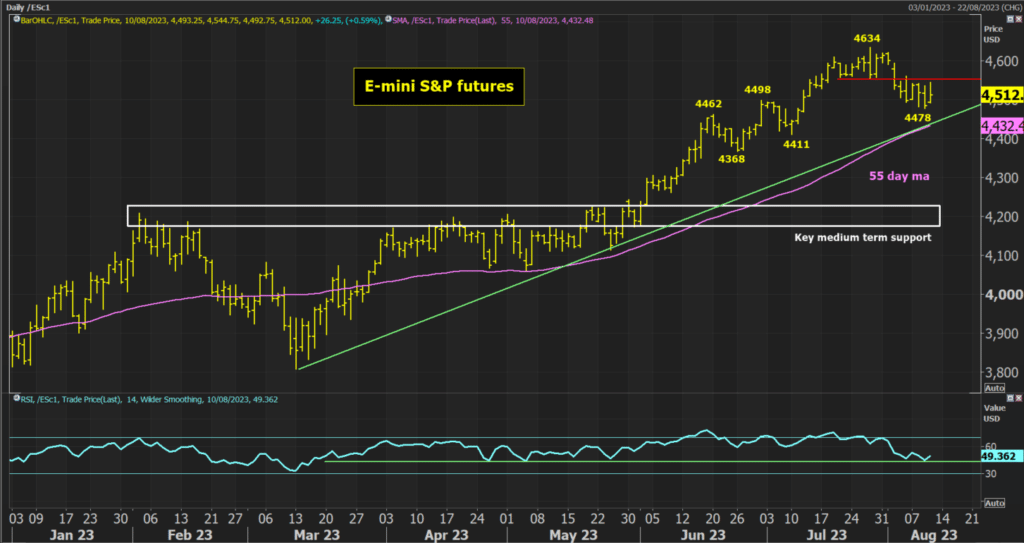

Index futures are breaking, or are threatening to break below key support areas. The e-mini NASDAQ 100 futures have broken below the higher low at 15063, whilst the e-mini S&P 500 futures are threatening the support at 4411. If these breaks are confirmed, they come as outlook-changing moves.

- The US 2-year Treasury yield is rising back towards 4.90% again. The 10-year yield has moved decisively back above 4.00% and is moving quickly towards a test of the 4.20% August high.

- The rally in the US Dollar Index has been slightly more choppy in the past week but is still putting pressure on the important high at 102.84. Importantly, support at 101.74 is also now forming.

- Gold continues to drift lower as the USD remains supported. Gold futures are closing in on a test of the important gauge of support at $1892.50.

- Oil futures have continued to be supported and if a move above the April high at $83.53 can be sustained, it would open the way towards $90 and above.

Key this week

- Central Bank Watch: The RBNZ monetary policy is on Wednesday. Also watch out for FOMC minutes, also on Wednesday.

- Macroeconomic data: US Retail Sales and Industrial Production, with FOMC minutes. Chinese Retail Sales and Industrial Production will impact risk appetite on Tuesday. A raft of UK data with unemployment, wages, inflation and retail sales all due.

| Date | Key Macroeconomic Events |

| 08/14/2023 | N/A |

| 08/15/2023 | Australian Wage Price Index; China Industrial Production & Retail Sales; UK Unemployment and wage growth; German ZEW Economic Sentiment; Canadian inflation; US Retail Sales and Empire State Manufacturing |

| 08/16/2023 | Reserve Bank of New Zealand monetary policy; UK CPI & PPI; Eurozone flash GDP; US Building Permits and Housing Starts, US Industrial Production, FOMC meeting minutes |

| 08/17/2023 | Australian Unemployment; US Weekly Jobless Claims and Philly Fed Manufacturing |

| 08/18/2023 | UK Retail Sales; Final Eurozone HICP inflation |