Macroeconomic/ geopolitical developments

- Inflation concerns remain, after the recent spike in US CPI data.

- The Fed Minutes on Wednesday highlighted an improving US economy but still far from the Fed’s goals, this did not have a significant impact on global financial markets.

- Tensions in Gaza have eased with an Israel-Hamas ceasefire announced.

- The Indian COVID variant continues to spread in the UK and Europe, though still without a significant impact on death rates.

- Cryptocurrencies stayed volatile suffering further liquidation pressures after further statements from Elon Musk.

Global financial market developments

- Global stock averages were mixed last week, but still capped below record and multi-month highs.

- Big Tech has again underperformed, with inflationary fears limiting upside for this sector.

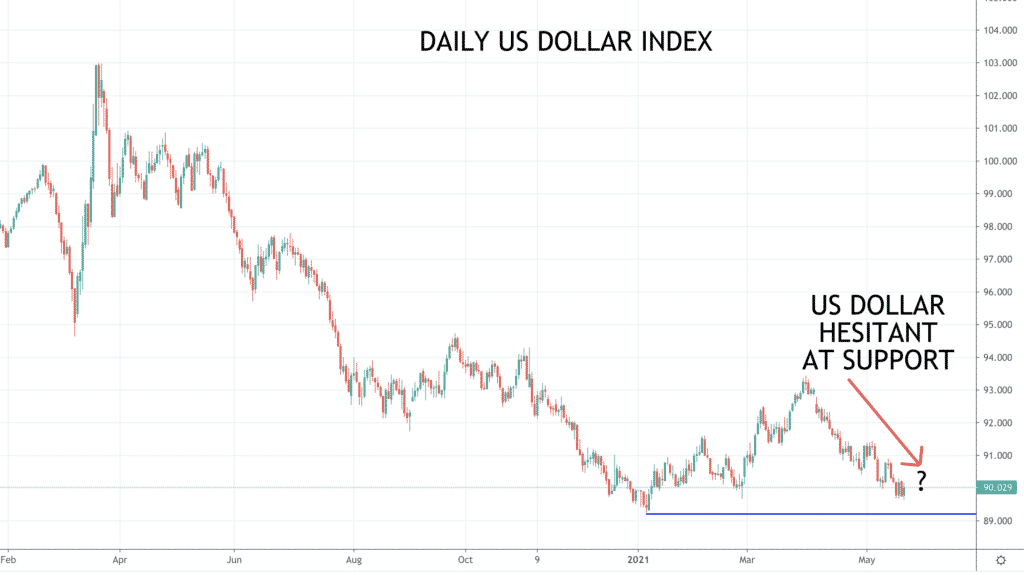

- The US Dollar was mixed but remains on the back foot.

- The Euro was indecisive but did manage to post gains versus the USD.

- GBPUSD spiked close to the multi-year high.

- Gold pushed higher, leaving an upside bias.

- Oil sold off but managed to bounce late in the week.

- Copper also corrected lower from a mid-May multi-year high, bounced into the end of the week.

Key this week

- Geopolitics:

- Monitoring easing of lockdown measures, notably in Europe.

- Still looking at COVID-19 cases, hospitalisations and deaths globally, plus the spread of the Indian variant in the UK and Europe.

- Looking for the ceasefire in Gaza to hold.

- Central Bank Watch: A quiet week for central banks, with the Reserve Bank of New Zealand (RBNZ) interest rate decision, statement and press conference on Wednesday.

- Macroeconomic data: Also, a quiet data week with the US GDP, Durable Goods Orders and Personal Consumption Expenditure (PCE) the standouts on Thursday and Friday. See the table below for details and more.

| Date | Key Macroeconomic Events |

| 24/05/21 | Nothing of note |

| 25/05/21 | German GDP and IFO |

| 26/05/21 | RBNZ interest rate decision, statement and press conference |

| 27/05/21 | US GDP, Durable Goods Orders and PCE |

| 28/05/21 | Japan CPI; US PCE and Michigan Consumer Sentiment |