Macroeconomic/ geopolitical developments

- The UK mini-budget on Friday 23rd September that saw tax-cuts, the cancellation of national insurance and corporation tax increases, supply-side reforms, plus a GBP 60 billion energy support package had serious impacts on global financial markets last week.

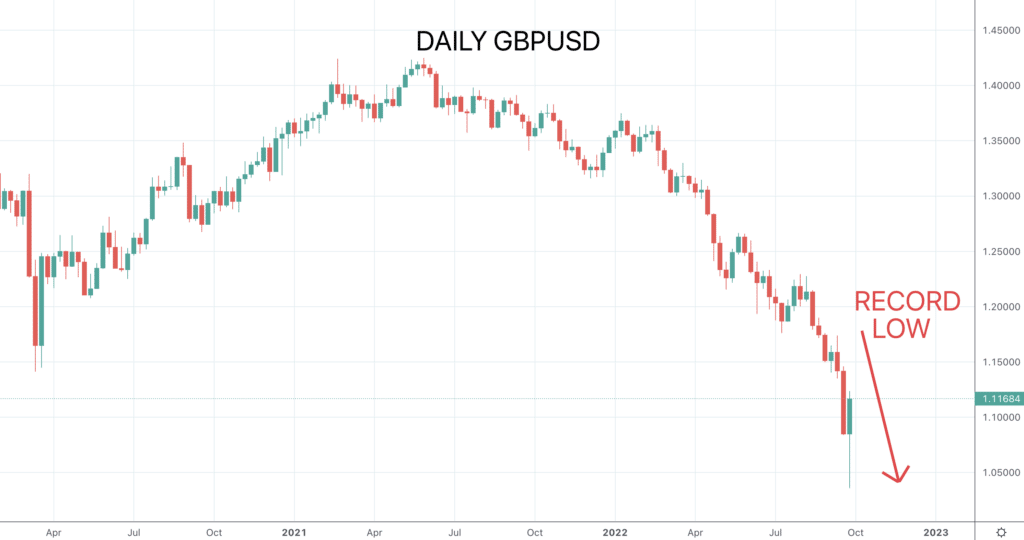

- The Pound plunged across the Forex board, which saw Cable, GBPUSD, hit an all-time-low, also creating panic that saw the Euro lower versus the US Dollar as the US currency surged again as a safe haven.

- UK gilts imploded, with yields surging and at one point UK money markets were pricing in a 2% rate rise at the next Bank of England Meeting.

- This has global contagion impacts, seeing global Bonds surge to higher yields and also causing stock markets to extend lower.

- The BoE stepped in through mid-week to calm markets, committing to the purchasing of Gilts to stabilise the Rates markets and halt the higher yield surge.

- Federal Reserve speakers remained hawkish in comments throughout last week, even in the face of the aforementioned turbulence from UK assets.

Global financial market developments

- The major US stock averages suffered significant losses last week with the major averages pushing below their June 2022 lows to level now seen since 2020.

- The third quarter saw the S&P 500 post three successive quarterly declines for the first time since 2009.k.

- European and Asian equity indices were also significantly lower to 2022 lows.

- US 10yr yields moved up extend even further through the June yield peak to touch 4%.

- US Dollar strengthened again as DXY hit a new multi-decade peak, but did correct lower after the BoE market announcement

- GBPUSD plunged in the wake of the UK mini-budget to a record low then bounced, as the Pound slumped and rebounded across the FX board.

- Gold hit another new multi-month low before rebounding.

- Oil posted another new multi-month low, with risks still lower.

- Copper sold off and bounced but retains a bear tone.

Key this week

- Central Bank Watch: We get the Reserve Bank of Australia (RBA) interest rate decision and statement on Tuesday, and the same from the Reserve Bank of New Zealand (RBNZ) on Wednesday. We also get Fed speakers throughout the week.

- Macroeconomic data: It is Golden Week in China, markets are closed all week. Key data this week will be the global Manufacturing PMI data on Monday, the global Services PMI data on Wednesday and the US Employment report on Friday.

| Date | Key Macroeconomic Events |

| 03/10/22 | Golden week in China, markets closed all week; global S&P Global and US ISM Manufacturing PMI data |

| 04/10/22 | RBA interest rate decision and statement |

| 05/10/22 | RBNZ interest rate decision and statement; global S&P Global and US ISM Services PMI data; ADP Employment change |

| 06/10/22 | EU Retail Sales |

| 07/10/22 | German Retail Sales; US and Canadian Employment reports |