What are continuation patterns?

Continuations are patterns that are consolidations in the price that once completed enable the continuation of the established price move. The important feature of a continuation pattern is that the price consolidates within an existing trend, with the breakout that completes the pattern moving in the direction of the prevailing trend. The stronger the trend, the more likely the pattern will be a true continuation.

- A bullish continuation is a consolidation pattern that comes during an uptrend. It involves the price breaking decisively above the key resistance of the consolidation and then continue the prevailing uptrend.

- A bearish continuation is a consolidation pattern seen during a downtrend. The pattern completes as the price breaks below the key support of the consolidation. The move continues the prevailing downtrend.

Waiting for confirmation

It is important to wait for a continuation pattern to be completed before taking any trading signals from a consolidation. This is because the building consolidation pattern could turn out to be a reversal. The best conviction for the completion of the continuation pattern will come from confirmation.

An intraday move through important support or resistance can complete a continuation, however, the confirmation would come with a closing breakout (or even a two-day closing break). A breakout coming on strong volume would also add further confirmation of a shift in market positioning.

Pullbacks and Consolidations

Often when key support or resistance has been broken to complete the continuation pattern, there will be a retest of this level. These are known as pullbacks and can be seen as part of the confirmation of the pattern

- A bearish pullback – a technical rally that is a minor rebound in the price back towards the old key breakdown. The old support becomes new resistance.

- A bullish pullback – a minor unwind lower back to the breakout level of the pattern, where old resistance has become new support.

These pullbacks can act as another opportunity to trade the continuation of the trend.

Types of continuation patterns

With continuation patterns, “the trend is your friend”. It is possible to identify specific patterns of consolidation in the price action that once completed can signal the continuation of the price move.

Continuation patterns form through consolidation in the price following a trending move. The stronger the trend that precedes a consolidation, the stronger the case for it to turn into a continuation pattern.

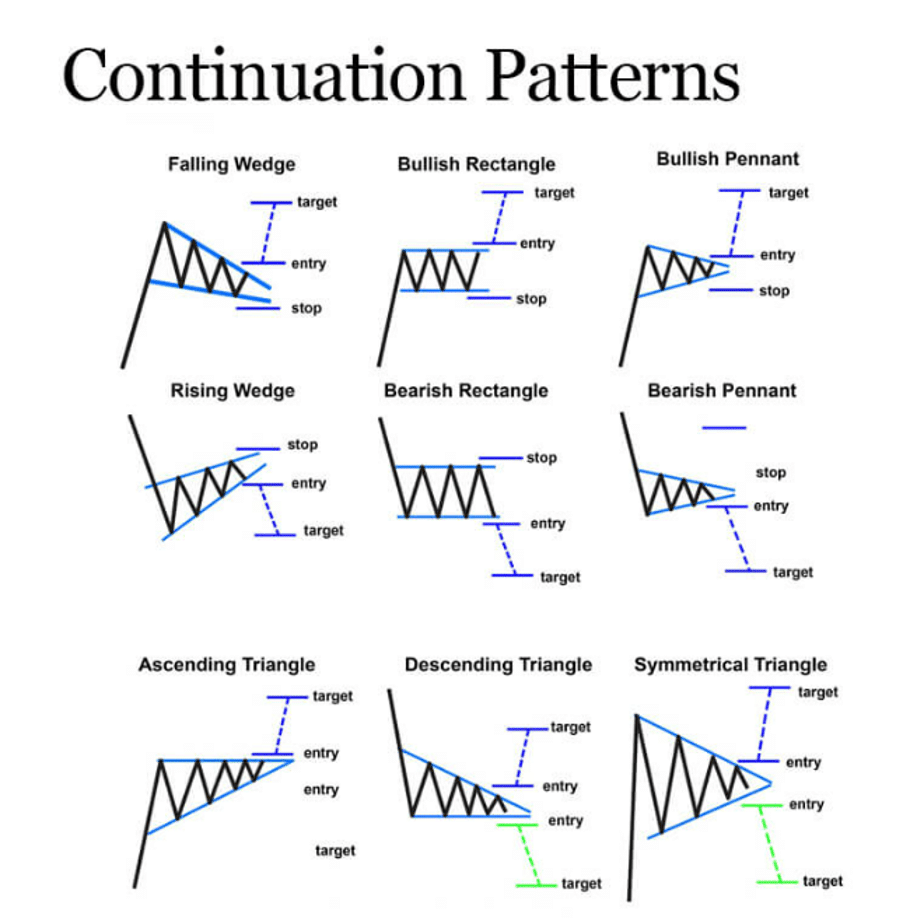

The patterns will often develop into identifiable shapes, including triangles and rectangles, but there are also wedges, flags and pennants.

Bullish continuation patterns:

- Bull Flag / Bull Pennant

- Falling Wedge

- Bullish Rectangle

- Ascending triangle

Bearish continuation patterns:

- Bear Flag / Bull Pennant

- Rising Wedge

- Bearish Rectangle

- Descending triangle