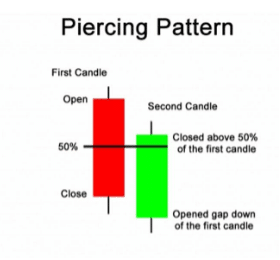

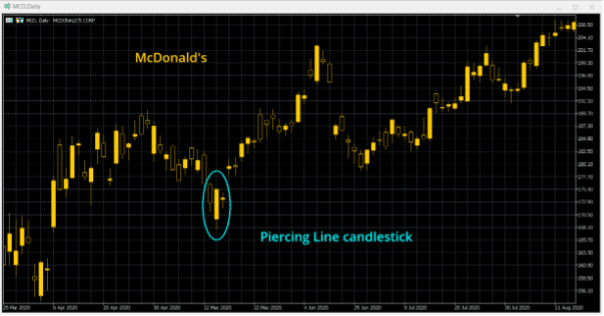

A Piercing Line is a two candlestick pattern that is a bullish set-up that implies that the price has finished falling and is ready to start moving higher. It is best seen after a downtrend in the price.

Candle 1 is a decisive bearish candle. It has a strong move lower from OPEN to CLOSE along with small or no upper and lower shadows. Candle 2 is a strong positive candle. The price gaps lower at the OPEN of Candle 2 only to then recover strongly. There is a decisive and solid positive body to Candle 2, with the CLOSE price being above the mid-point (above 50% of the daily range) of Candle 1.

Due to the need for a gap lower at the OPEN of Candle 2, the Piercing Line is a candlestick set-up most associated with stock markets (i.e. markets that do not trade 24 hours per day). The opposite of the Piercing Line candle is the Dark Cloud Cover. This is a bearish candlestick set-up at the top of an uptrend in the price. It signals the beginning of a new negative phase.

| Piercing Line | |

| Price action | A two candlestick set-up that signals the end of an downtrend phase. Candle 1: A decisively strong bearish candle. The OPEN is towards the HIGH of the candle, with the CLOSE towards the LOW.Candle 2: The price gaps lower at the OPEN with the price hitting a new low. The price then rebounds to trade strongly higher. The CLOSE is near the HIGH of Candle 2 and is above of the mid-point of the range (50%) on Candle 1. KEY REQUIREMENTS: A gap down at the OPEN on Candle 2 and a CLOSE above 50% of the daily range of Candle 1. |

| Psychology | The price has gapped lower in Candle 2, but this is an exhaustion move. The sellers have dried up at the end of the downtrend phase.The exhaustion move then encourages buyers and a price recovery develops. |

| Confirmation | Only after the CLOSE of Candle 2 is above the mid-point of Candle 1. Trading positions can then be taken during the next candle. |

| High Conviction | Extremely small or no shadows to both candles.The CLOSE of Candle 2 is significantly above the mid-point line of Candle 1 (perhaps even near to the OPEN of Candle 1). |

| Lower Conviction | The preceding price action is only a shallow (or tentative) downtrendLong shadows on both candles – indicates a more uncertain market.The LOW of Candle 1 is below the LOW of Candle 2. |

| Potential Stop-Loss | The Piercing Line is seen as a key low in the downtrend. Stop-losses should therefore be placed below the LOW of Candle 2. |