Crude oil is without a doubt one of the most important commodities and resources the world economy currently needs/handles. The problem with it is that it is a non-renewable resource, meaning that it is finite and as such, it is guaranteed to run out at one point.

Without oil and the products derived from it, the global economy would collapse. For the time being, no reasonable alternatives have been found to petroleum-based products, although renewable energy sources are being studied and solutions are being developed.

The term “crude oil” denotes the unrefined substance obtained through drilling, which consists of hydrocarbon deposits and various organic materials, usually accompanied by natural gas and briny water. Sometimes however crude oil is also referred to as “petroleum”, a wider term which also covers various petroleum products refined from crude oil.

The process leading to the formation of crude oil starts off deposits of dead organisms, mostly algae and plankton. As these deposits are buried under sedimentary rock and subjected to intense heat and pressure over millions of years, they turn into “black gold”

Contrary to what that moniker implies, crude oil is not always black. In fact, its color can be anything from black to yellow.

The current oil consumption of the world is some 95 million barrels per day. The limited nature of the world’s crude oil supplies is not the only problem plaguing this commodity.

Its burning releases a menagerie of toxic gases into the atmosphere, severely contributing to pollution, global warming and the acidification of the oceans.

To prevent irreversible, grand-scale environmental damage, the world economy needs to wean itself off of petroleum by the end of this century, the latest.

While simple on paper, the implications of such a proposition are almost impossible to fathom at this time. The uses of crude oil far exceed the energy and the chemical sectors.

Petroleum derivatives are used for asphalt, plastics, pharmaceuticals and pesticides among a number of other applications.

The main drivers of crude oil price

– global demand is obviously a main factor in crude oil prices. Since oil is used in almost everything (probably including the clothes that you wear), demand seems insatiable and ever-growing. While the introduction of alternative technologies to power the world’s automobiles would deal this demand a major blow, no sustainable and feasible solutions are on the horizon in this regard.

– geopolitics has always been a major global energy price driver. Given that the largest crude oil deposits are concentrated in the hands of a few countries, this is doubly true for oil. The individual needs of major economic powers such as China can also be filed under this category.

– production costs are always a factor in any economic equation. With new technologies put to use, this factor has re-emerged as a major oil price driver.

– governmental policies and regulations are also in the mix. Various demands aimed at reducing the negative impact of fossil fuels on the environment continue to add to the costs of production.

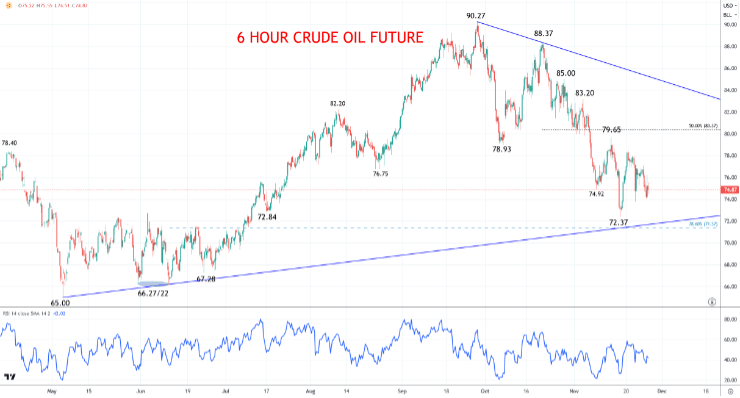

Crude Oil Jan 2024 Futures Contract

Remains Bearishly Pressured

A Monday nudge down to 74.06, to retain last week’s turn lower from 78.46, to maintain the mid-November downtrend from 79.65, to sustain bearish pressures from the November and October swing highs at 83.20 and 85.00 remain intact, to sustain the major October top at 88.37 and latter September cycle high at 90.27, to just about keep risks lower on Monday.

Day trade setup

- We see a downside bias below 73.79 for 72.37; break here targets 71.37, 70.23 and 69.40.

- However, above 78.46 targets 79.65; break aims for 80.37, 81.90 and 83.20.

Crude Oil Calendar

11/29/2023 EU Consumer Confidence; German CPI; US GDP and PCE (QoQ)

11/30/2023 Chinese PMI; German Retail Sales; German Unemployment; EU CPI; US PCE (MoM and YoY); Canadian GDP; OPEC+ Meeting

12/01/2023 Global PMI from S&P Global; US ISM PMI; Fed Chair Powell speaks

View Full Calendar