Monetary policy is the way that a central bank manages an economy. It is effectively the control of the supply of money in the economy. A central bank aims to promote stable economic growth. It looks to achieve this via monetary policy.

Over time, an economy can either overheat or contract too much. The central bank will subsequently adjust its monetary policy tools to bring the economy back to where it considers being a stable economic position.

Here are the main tools of monetary policy:

- Interest rates – The central bank will change the level of interest it charges when it lends to domestic banks. The higher the interest rate, the higher the cost of debt. Banks then pass on this rate rise to their customers in the form of higher rates on bank loans and mortgages.

- Open Market Operations – Central banks directly buy or sell bonds (usually government debt) from/to investors and banks. This increases the liquidity of funds on the balance sheets of institutions and increases the availability of money in the economy.

- Reserve Requirements – Central banks can change the required level of reserves that financial institutions need to hold to meet their liabilities. Lower reserve requirements increase the availability of funds to lend or invest.

How can a central bank react when the economy moves away from a position of stable growth?

The Federal Reserve uses monetary policy to stabilise the US economy. Here is how we can expect the Fed to react to various economic conditions:

- Overheating economy (inflation is too high) – the central bank will use contractionary monetary policy. This will involve tightening monetary policy to choke economic activity. It can raise interest rates, sell bonds and increase reserve requirements.

- Contacting economy (too low or negative inflation, economic slowdown or negative growth, unemployment is too high) – The central bank will look to use expansionary monetary policy to stimulate economic activity. It can lower interest rates, buy bonds and reduce reserve requirements.

Why use monetary policy?

There are several factors behind the need to use monetary policy:

- Inflation is too high… or too low – If inflation is too high, it hits consumers and businesses and has a detrimental impact on economic activity. However, if inflation is too low or even negative this can also harm economic prospects. “Why buy something today when it will be cheaper tomorrow?” Central banks use monetary policy to moderate inflation, often to achieve a mandated target.

- Economic Activity and Unemployment – Stagnant economic activity is often reflected in rising or high unemployment. The central bank can use monetary policy to adjust the cost of borrowing to encourage (or discourage) economic activity.

- Exchange Rates – Central banks do not often admit to explicitly targetting the exchange rate. However, if the value of a currency adjusts too far, then this can impact levels of inflation (with inflation imported from abroad) and economic activity. Subsequently, the central bank can adjust the interest rate to increase or decrease the level of demand in a currency to either strengthen it (to protect against imported inflation) or weaken it (protects against deflation and encourages exports of goods)

Quantitative Easing vs Quantitative Tightening

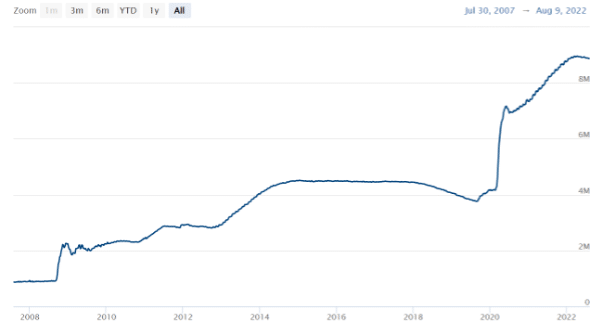

Until the Global Financial Crisis of 2008/2009, central banks would traditionally focus on interest rates as the primary tool of monetary policy. However, despite cutting interest rates to zero, central banks felt the need to go further. Some banks took interest rates into negative territory, however, some also started buying bonds. This operation was known as Quantitative Easing or “QE”.

Further economic shocks in the years since then have seen additional rounds of QE as a monetary policy response. Central bank enormously expanded their balance sheets.

However, in the wake of the COVID-19 pandemic, the huge inflation that QE has helped to produce has resulted in a reversing of the policy. Quantitative Tightening or “QT” involves the selling of bonds that are held by central banks. This reduces the assets on the balance sheet.

The Federal Reserve started to engage in QT in 2022. The size of total assets on the Federal Reserve’s balance sheet peaked at just over $8.9 trillion.

Trading Monetary Policy decisions

| Monetary policy decision | Likely market reaction |

| Tighter than expected monetary policy | Bond yields higher |

| Domestic currency strengthens | |

| Domestic equities may fall | |

| Looser than expected monetary policy | Bond yields lower |

| Domestic currency weakens | |

| Domestic equities may rally | |