Fundamental Analysis is the assessment of a business or a whole economy based on data pertaining to that business or economy. For an individual company this would include an analysis of the balance sheet, liabilities, assets, revenues, earnings, profits etc. For a country’s economy, fundamental (or macroeconomic) analysis would look at and analyse many factors including; GDP, Employment, Inflation, interest rates, production as well as many other data points. Traders can then use their analysis to derive a valuation about the true fundamental value for a security, asset, commodity or FX rate. The fundamental (or macroeconomic) analyst or trader can then compare this valuation with the current price (of the security, asset, commodity or FX rate) and then make a decision of whether it is overvalued or undervalued, then decide whether to sell or buy. In this section we will look at fundamental and macroeconomic analysis in more detail. Furthermore, we will deliver articles aimed at developing the readers’ understanding and use of this approach. Read more of our forex education articles here.

Macroeconomic and Fundamental Analysis Today in 2022

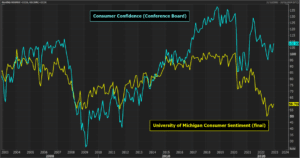

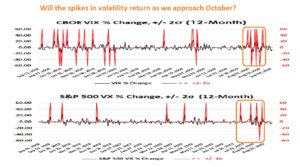

The global financial market world of trading and investing has seen some seismic shifts in 2022! The events we describe below that have seen high volatility in all financial markets asset classes, have meant macroeconomic and fundamental analysis is all the more important in assessing and understanding trading and investing opportunities. Obviously, a strong knowledge of market fundamentals and macroeconomics has always been important in the world of trading and investing, but given the erratic and unpredictable nature of the current and developing world economic and geopolitical environment, a good foundation of macroeconomic and fundamental analysis is all the more important.

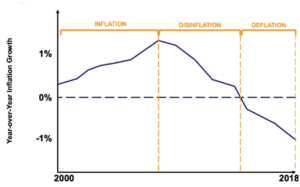

Surging inflation rates (increases in prices) primarily driven by the war in Ukraine, has seen energy prices scorching higher in 2022 and has also produced large increases in the price of other commodities, notably food. In addition to the war in Ukraine, the high global inflationary pressures have been increased by supply chain bottlenecks as the global economy has continued to emerge from the impact of the Covid-19 pandemic.

Inflation rates in the world’s major economies have hit levels not seen for over 40 years in many countries . These extreme, higher price pressures have seen central banks (that were super dovish for most of the 21st century), quickly and aggressively shift to a far more hawkish position.

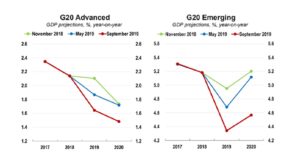

This central bank hawkish shift has been at different paces across central ban, meaning that interest rate differentials across global economies have widened and narrowed. These differing interest rate differentials have had notable impacts on global bonds markets, Foreign Exchange markets, stock markets and also the commodity markets.

The uncertainty from the war in Ukraine, plus the combination of shifting global central banks, moving inflation rates and interest rates differentials between, and the likely recessions that are coming in 2023, means that volatility in global financial markets is likely to stay elevated well into 2023.

A solid, knowledge foundation of market fundamentals and macroeconomics is key to understanding financial market price movements and being able to successfully invest and trade in 2022 and on into 2023!