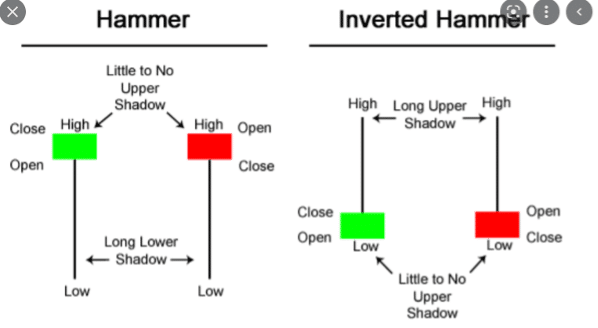

Hammers are some of the most popular and easily recognisable patterns in candlestick analysis. They can be a powerful and bullish reversal signal. The hammer is probably best defined as being a signal that comes at the end of a phase of selling pressure.

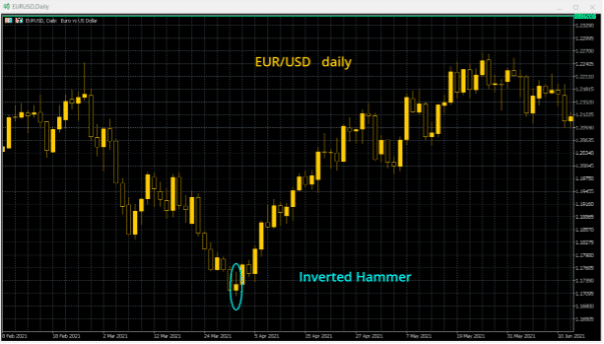

After the open, the price falls to hit a new low, before a strong intraday rally and a price close at or around the high of the candlestick. The price is “hammering” out a recovery form a low. The price then continues higher in the next candlestick and the reversal takes hold.Inverted Hammers are also bullish reversal candlesticks (although they are considered to be low conviction candlesticks). The price opens at or near the session low before an intraday rally. Although the rebound is unable to hold up before a falling back, the close of the candlestick is above the open. It signals that a reversal could be forming.

| HAMMERS | |

| Price action | An intra-period decline before a rally to Close above the candlestick Open. |

| Time horizon | Hammers can be effective across all time scales from 5-minute charts up to hourly, daily and weekly. The longer-term the horizon, the higher the conviction. |

| Psychology | A phase of preceding selling pressure has come to an end as the market has rejected a new low. A close at the period high suggests a “V” shaped bottom into a new recovery phase. |

| Confirmation | Ideally, the price continues higher in the next candlestick to confirm the reversal. |

| Conviction | Closing at the period high suggests the bulls have convincingly won the session. The longer the lower candlestick shadow, the more convincing the rebound. Ideally, there would be little or no upper candlestick shadow. Hammers can have a close below the open, but this would reduce the conviction in the reversal. |

| Aborting the pattern | If subsequent candles break below the low of the hammer this aborts the pattern. |

| INVERTED HAMMERS | |

| Price action | The price is rallying from the Open which is at or close to the Low. The Close is well below the candle High. |

| Time horizon | As with Hammer candlesticks, Inverted Hammers work on all horizons. |

| Psychology | A rally has been unable to sustain, but the market is trying to recover. This gives notice of a potential shift to a more positive outlook. |

| Confirmation | The Close of the next candle is above the Close of the Inverted Hammer. |

| Conviction | An Inverted Hammer is a relatively low conviction move. For confirmation of a reversal, there needs to be a higher Close in the next candle. If the Close is above the High of the Inverted Hammer then the conviction will be stronger. |

| Aborting the pattern | A decline below the Low of the Inverted Hammer, especially on a Close below the previous Low. |