In this article and accompanying video we look to explain the differences between Investing and Trading.

The four main ways we can categorise the differences between Investing and Trading are by looking at:

- Time Frame

- Flexibility

- Leverage

- Returns

Time frame

Investing

Investing is generally seen as a longer-term activity and by longer-term we tend to look at a speculating to profit from owning a financial asset for over three months. Investing holding periods, however, can have far longer time frames, for maybe many month, years or decades.

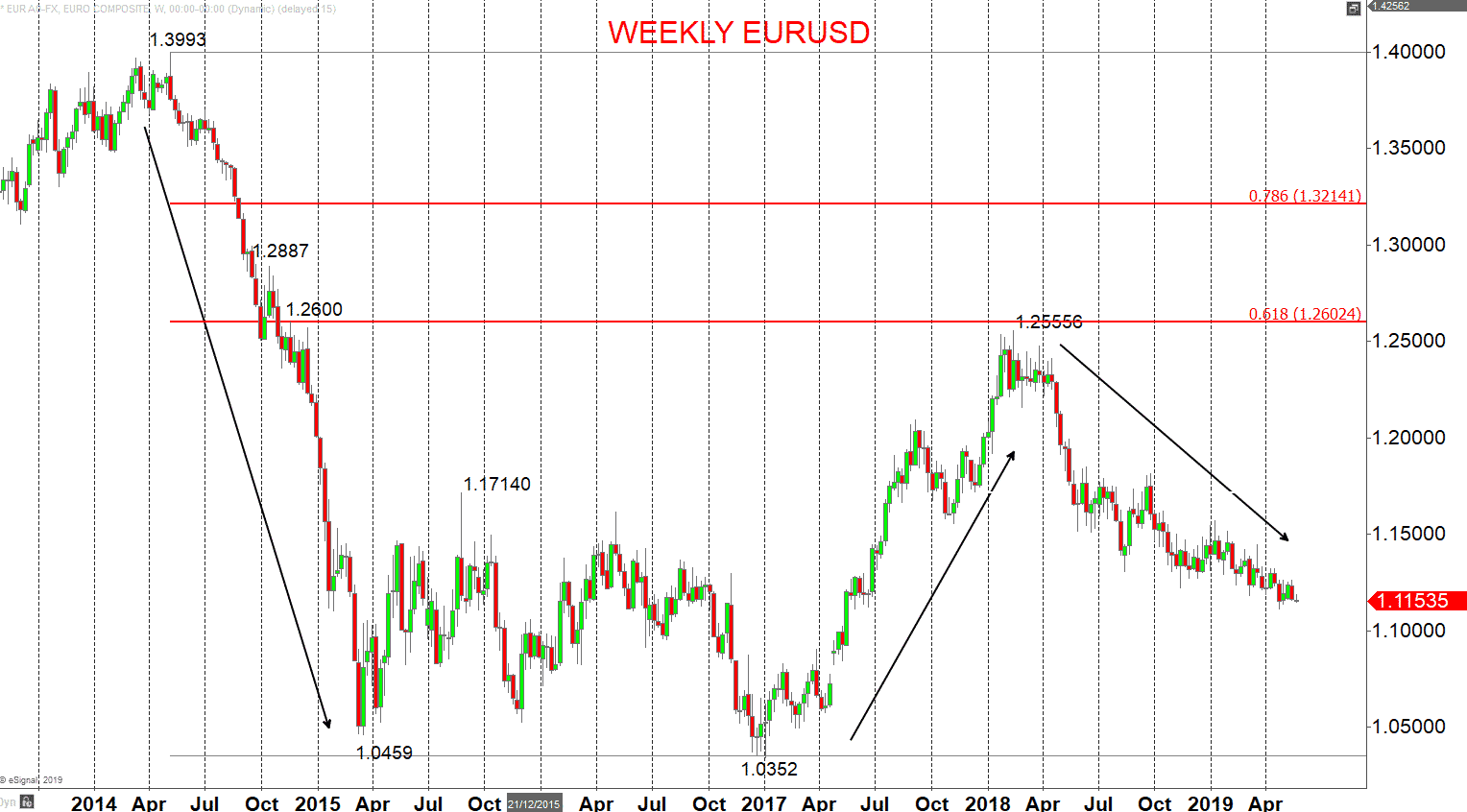

In the below example with EURUSD, we can see that the longer trends in 2014-2015, 2017-2018 and 2018 into 2019 have been for multiple months.

Trading

For trading we can break down the time frame to highlight different types of trading approaches.

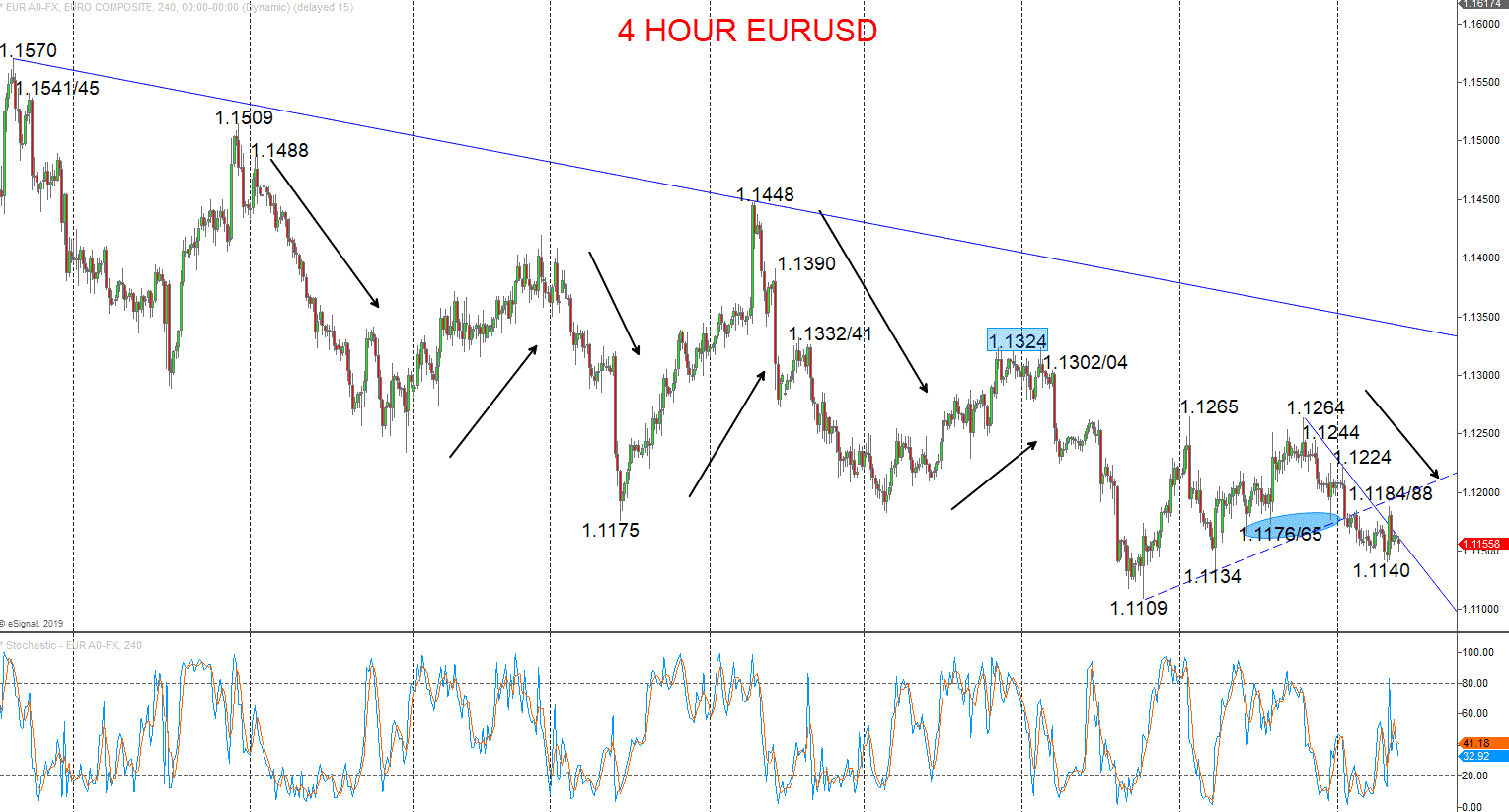

- Position/ Swing Trading is usually seen as holding positions or trading over at least multiple days to multiple weeks, as highlighted in the below example, again for EURUSD. Multiple opportunities arise to benefit from the swings in the market over days and weeks.

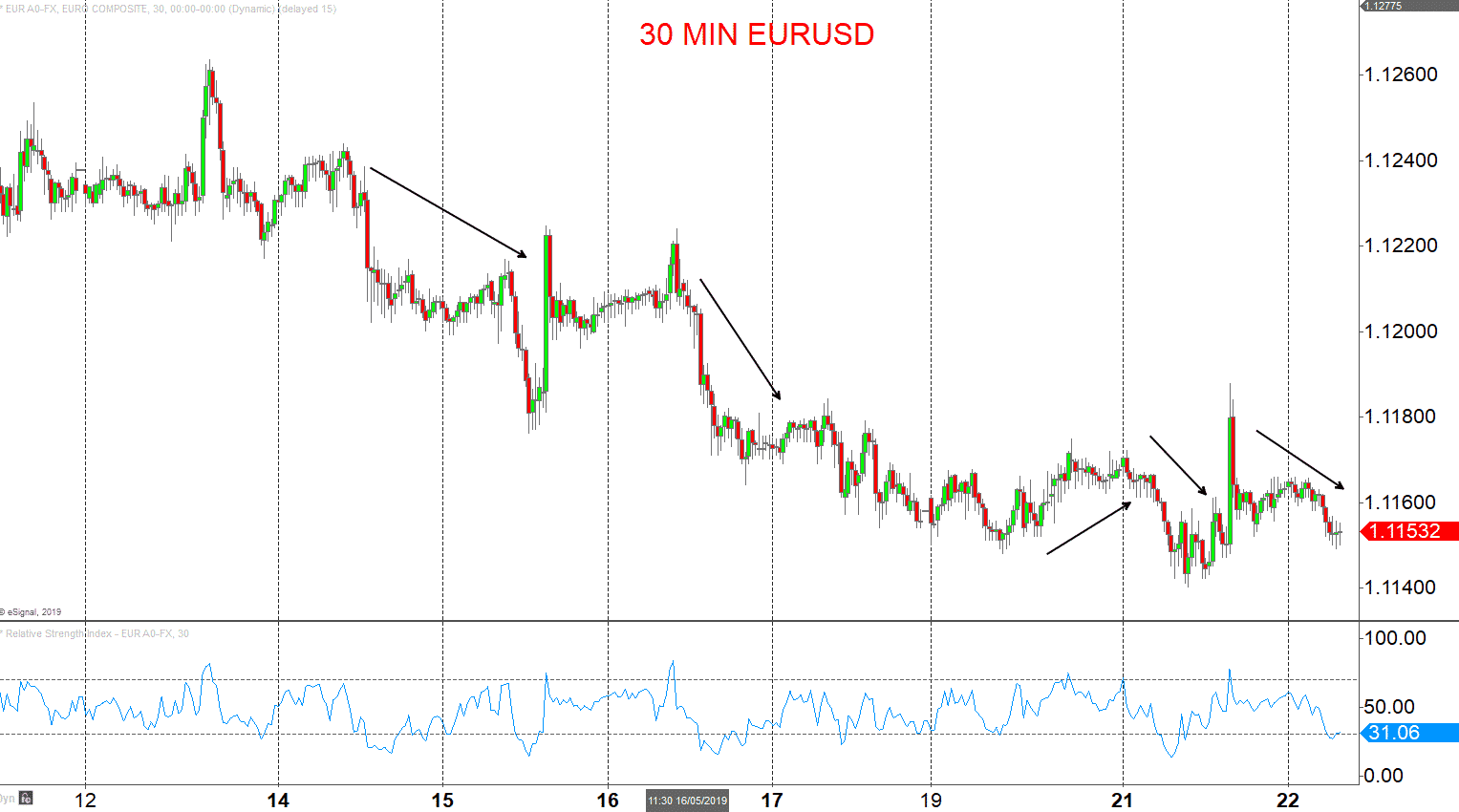

- Day trading is simply trading within a day. Day traders look for short-term opportunities, usually closing positions before the end of the trading sessions, usually not keeping open positions overnight. Again, we use the EURUSD example here to show potential for profitably trading within a day.

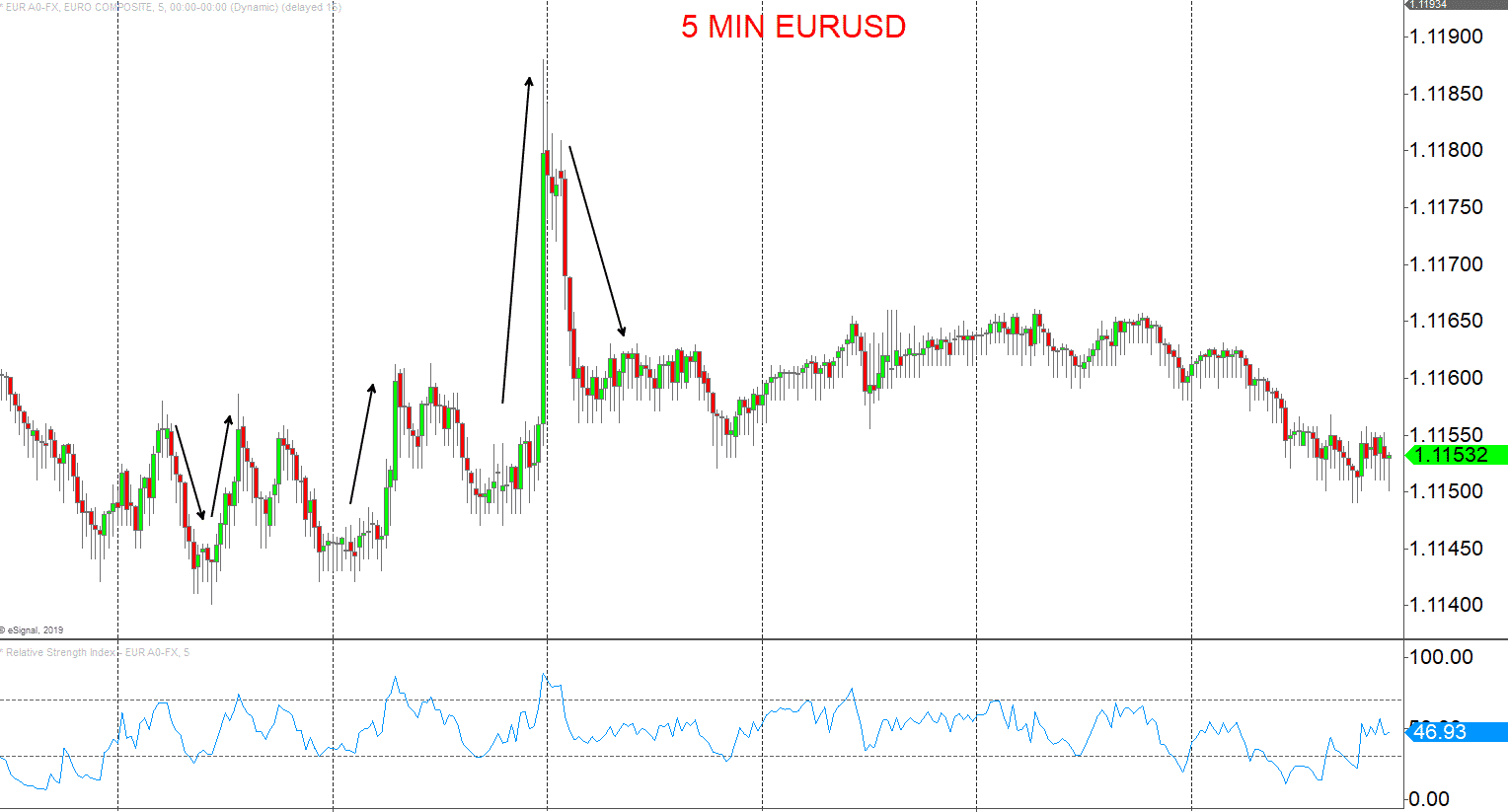

- Scalping is very, very short-term trading, holding exposure for maybe just seconds or minutes. This is usually in reaction to an event, like macroeconomic data or a geopolitical incident. Again, an example below.

- Finally, in relation to trading and time frames we have Ultra High Frequency trading (UHF), which is generally done by a computer, also known as Programmatic, Systematic or Algorithmic Trading.

Flexibility

Investing

Investing is generally seen as long only, the investor buys an asset, a stock, maybe a Bond and holds that asset.

Trading

With trading, the directional exposure is usually viewed as far more fluid, that is, traders can both buy and sell assets, be long or short.

Leverage

Investing

Usually, investing is done at x1 leverage, that is, not leveraged at all. An investment can only go to zero and the amount invested is the maximum loss, in most cases. Sometimes, investing does involve leverage, but it is usually very low leverage.

Trading

With trading, positions are very often leveraged. This means that the trade can offer larger potential rewards, BUT also larger potential losses.

Returns

Investing

Returns from investing would tend to be both capital growth, as the value of the asset hopefully increases, and potentially income derived from the asset.

Trading

Trading usually just relies on profiting from short-term increases in capital, holding periods tends to be too short to derive an income.