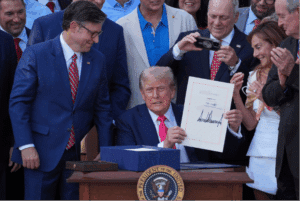

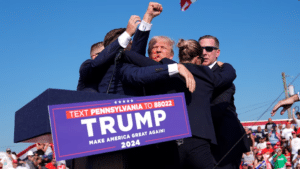

New US equity markets records, as Trump’s “big, beautiful bill” is passed

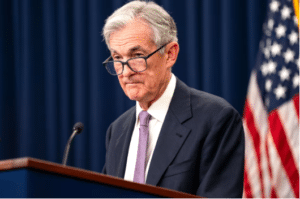

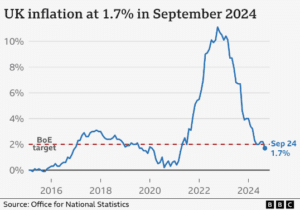

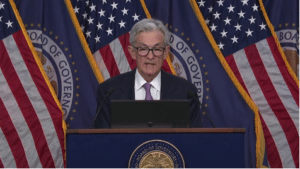

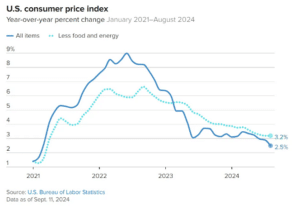

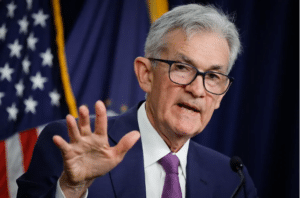

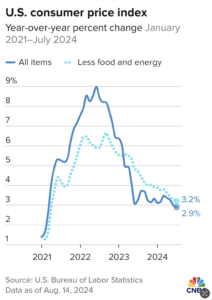

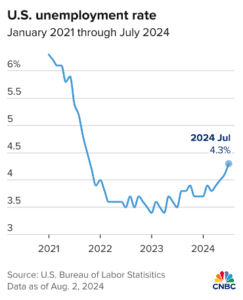

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The main central bank activities this week are the Reserve Bank of Australia Monetary Policy Statement, Interest Rate Decision and Press Conference on Tuesday and the Federal Open Market Committee Minutes on Wednesday. Macro Data Watch: Macro data is light this week, … Continued