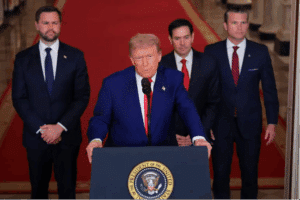

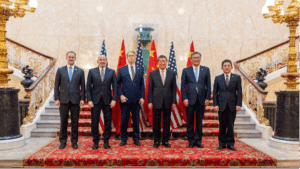

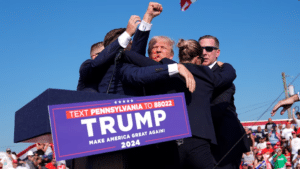

Global stocks hit all-time highs, as Middle Eastern tensions ease

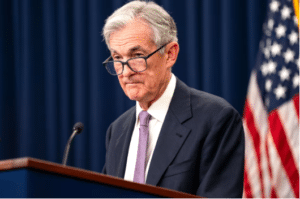

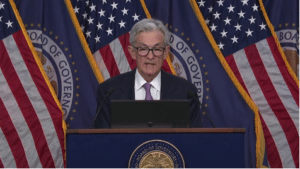

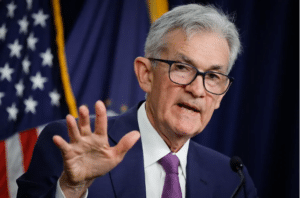

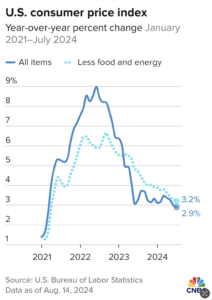

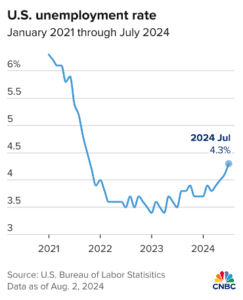

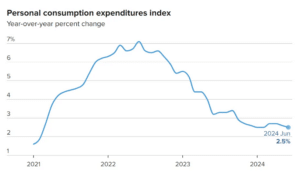

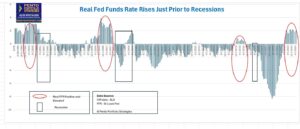

Macroeconomic/ geopolitical developments Global financial market developments Key this week Holiday Watch: It is the US Independence Day holiday on Friday July 4, US stock markets (cash and futures) are closed. Central Bank Watch: It is a light week for central bank activity, however, throughout the week there are numerous speeches from Fed, ECB and … Continued