-

Home

- >

- Author: Steve Miley (The Market Chartist)

Steve Miley (The Market Chartist)

Steve Miley is the Market Chartist and has 32 years of financial market experience and as a seasoned expert now has many responsibilities. He is the founder, Director and Primary Analyst at The Market Chartist, the Editor-in-Chief for FXExplained.co.uk, the Academic Dean for The London School of Wealth Management

At FXExplained.co.uk Steve is the Editor-in-Chief, alongside producing numerous articles for the site. The ability to be able to reach out to a wide, global audience with his own analysis and also assist and nurture other authors in their creative process makes this a role that Steve values deeply.

Here are Steve’s tips on what pages to follow closely on FxExplained: Current market analysis and Best trading app in UK.

The Market Chartist

The Market Chartist was founded in 2012 and provides daily technical analysis reports, with written commentary and key support/ resistance levels to an institutional, professional and retail client base. The 30+ daily reports include European, UK and US Bonds & Equity Index Futures, G10 currencies, UK Natural Gas, TTF Gas, German Power, EUA Emissions and LME Base Metals.

As The Market Chartist, Steve has won many awards from the Technical Analyst Magazine. He was the 2016 & 2013 Winner (plus 2014 Runner Up) for Best Independent Fixed Income Research & Strategy and winner of Best FX Research & Strategy in 2012. He was also a finalist in the Technical Analyst of the Year category each year for 2012-2017.

Other Current Positions

Steve is also the Academic Dean for The London School of Wealth Management, a role he really enjoys. He appreciates the opportunity to be able to educate a diverse array of students in all aspects of the financial market’s world. Steve says “to be able to be a part of transforming an individual’s life through education is truly a privilege and very exciting”.

Steve also writes extensively for numerous financial markets sites including: FxStreet.com, TechnicalAnalyst.co.uk, InsideFutures.com, BarChart.com, StockTwits.com, StockBrokers.com, AskTraders.com and Investing.com.

Previous to this, Steve was also a Senior Lecturer at The London Academy of Trading where he fully began his journey into the world of education. It was here that he honed his skills as a lecture and mentor in the world of financial markets education.

Vast Technical Analysis Experience

Steve has also helped technical analysis push into a new era in his previous role as Director at Vega Insight. Vega Insight is a relatively new company with a specific focus on Artificial Intelligence and Machine Learning in global commodity and broader financial markets, with special focus on Energy. In his role Steve was responsible for the technical analysis inputs to the Artificial Intelligence and Machine Learning.

Steve spent 2009-2012 as a Director in the Technical Analysis Research Strategy team at Credit Suisse. Steve managed the FX division, responsible for the reports, forecasts and bank wide research for G10 & Emerging Markets currencies. In this role he also covered all major asset classes including Equity Indices, Rates & Credit, plus Commodities.

Steve spent most of his career at Merrill Lynch for 15 years from 1994-2009. The last ten years was as a Vice President in the research department as a technical analyst, responsible for daily reports, client presentations, plus in-house and client education programs. Prior to this, Steve was in the Fixed Income derivatives sales team where he managed the Italian Futures desk (BTP and EuroLira) on LIFFE (the London International Financial Futures Exchange). He was responsible for a four-man sales team, who consistently produced high volume of sales from both in-house and external clients.

He is a Member of the Society of Technical Analysts (MSTA) and holds a Master’s degree in politics, Philosophy & Economics from Oxford University (Lincoln College).

Intermediate

Current Climate: US Economy and Fed Speakers Outlook Federal Reserve officials have recently conveyed a cautious stance regarding the possibility of swift interest rate cuts, reflecting their assessment of the current state of the US economy. Governor Michelle Bowman, among others, emphasised the importance of maintaining the policy rate steady, citing potential risks to inflation … Continued

Intermediate

What to Expect from the UK Budget Report The UK Budget Report, scheduled for presentation by Treasury Chancellor Jeremy Hunt on Wednesday, 6th March at 12:30 GMT, is poised to address critical fiscal and economic matters impacting the nation. Traditionally, the Budget serves as a roadmap for the government’s financial plans for the upcoming fiscal … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: A notable week for central banks, as we see the Bank of Canada (BoC) interest rate decision Wednesday, followed by the European Central Bank (ECB) Interest Rate decision, Statement: and Conference Thursday. Plus, an important focus will be as Fed Chair Jerome … Continued

Intermediate

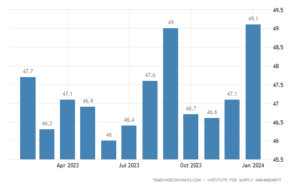

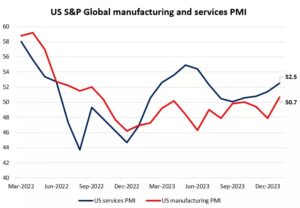

What to Expect from US PMI data The upcoming release of US PMI data is highly anticipated by analysts and investors, providing crucial insights into the performance of the manufacturing sector. S&P Global is set to release its Manufacturing PMI for February at 2:45 GMT, with expectations hovering around 51.5, matching the flash estimate reported … Continued

Intermediate

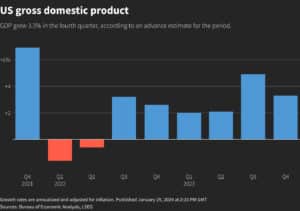

What to expect from the US GDP data The upcoming first revision of Q4 US GDP data, scheduled for Wednesday, February 28th at 13:30 GMT, is highly anticipated as it provides a comprehensive assessment of the nation’s economic performance during the fourth quarter. This data, released by the US Bureau of Economic Analysis, offers insights … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: A very quiet week for central banks, but we do see the Reserve Bank of New Zealand interest rate decision Wednesday. Macro Data Watch: The focus this week will be on German Gfk Consumer Confidence, Retail Sales, Unemployment and CPI, US Durable … Continued

Beginner

When operating in any part of the financial markets, mastering technical analysis tools is essential for traders and investors. One such tool that holds significant importance is the Exponential Moving Average (EMA).This article looks at how the EMA is calculated and explores how it can be leveraged to make informed trading decisions. Understanding Moving Averages … Continued

Intermediate

What to Expect from the US S&P Global PMI Releases As the U.S. S&P Global PMI releases approach, scheduled for 14:45 GMT on Thursday, February 22nd, 2024, analysts are anticipating crucial insights into the country’s economic performance. Consensus forecasts suggest a slight moderation in the S&P Global Services PMI for February, with expectations set at … Continued

Beginner

Why are Walmart’s Earnings so Important? Walmart, the world’s largest retailer by revenue, is a multinational retail corporation headquartered in Bentonville, Arkansas, USA. Founded in 1962 by Sam Walton, Walmart operates a chain of hypermarkets, discount department stores, and grocery stores across the globe. With a presence in 27 countries and e-commerce operations in 10 … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Holidays: As Asian markets return from the Lunar New Year holidays last week, the US President’s Day holiday is on Monday 19th February. Central Bank Watch: A relatively quiet week for central banks, but we do see the PBoC Interest Rate Decision Tuesday. Macro Data … Continued

Intermediate

What to Expect from NatWest’s Earnings Investors eagerly anticipate NatWest’s 2023 Q4 earnings call, scheduled for release on Friday, February 16th, 2024. With a market cap of £17.851B, the bank faces high expectations following its recent challenges and amidst significant market competition. In light of the forecasted Q4 EPS of £0.07 and revenue forecast of … Continued

Beginner

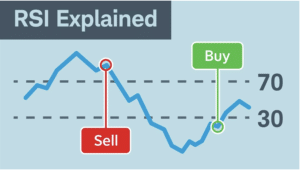

Welcome to the dynamic world of trading, where success often hinges on the ability to read between the lines of market trends. In this exploration, we take a look at the fascinating realm of technical analysis, a cornerstone for traders seeking to navigate the intricate landscape of financial markets. Today, our focus is on momentum—a … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Other Events: Chinese New Year is this week, so mainland Chinese markets and other Asian markets will be closed, so Asian sessions could be particularly quiet. Central Bank Watch: A quiet week for central banks, Fed speakers always in focus. Macro Data Watch: A busy … Continued

Intermediate

Why are AstraZeneca’s Earnings so Important? AstraZeneca is a leading global biopharmaceutical company renowned for its innovative medicines in areas such as oncology, cardiovascular, respiratory, and immunology. As one of the largest pharmaceutical companies worldwide, AstraZeneca’s earnings releases are highly anticipated and closely monitored by investors, analysts, and healthcare professionals. These releases provide critical insights … Continued

Intermediate

Why are Vodafone’s Earnings so Important? Vodafone Group Plc, commonly known as Vodafone, is a global telecommunications company headquartered in London, United Kingdom. With operations spanning across Europe, Africa, Asia, and Oceania, Vodafone is one of the world’s largest telecommunications providers, offering mobile and fixed-line services, broadband, and digital television. The company’s earnings releases hold … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: A quiet week for central banks, with the Reserve Bank of Australia (RBA) Tuesday, plus as always, a focus on Fed speakers. Macro Data Watch: Also, a quiet week for data. The focus for the week will be Monday’s Services and Composite … Continued

Intermediate

Updated 02/02/2024: Apple’s 2023 Q4 earnings call, unveiled on February 1st, 2024, showcased the tech giant’s financial prowess, with figures that slightly outperformed expectations. The reported earnings per share (EPS) stood at $2.18, surpassing the forecasted $2.1. The revenue for the quarter reached a remarkable $119.58 billion, exceeding the anticipated $118.06 billion. These robust financial … Continued

Beginner

In this article we will focus on the movements of the stock market. It’s not just numbers and tickers, it’s a wild ride, full of excitement. But every now and then, that ride throws a curveball, and we find ourselves in the midst of what folks in the financial realm call a “stock sell-off.” It’s … Continued

Intermediate

Update 31/01/2024: Microsoft’s 2023 Q4 earnings call, released on January 30th, 2024, showcased a robust financial performance for the tech giant. According to data from investing.com, Microsoft reported an earnings per share (EPS) of $2.93, surpassing the forecasted EPS of $2.78. The company’s revenue for the quarter reached $62 billion, slightly exceeding the predicted revenue … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: A significant week for central banks with monetary policy decisions on Wednesday from the Fed and on Thursday from the Bank of England (BoE). Macro Data Watch: Standouts this week are EU GDP (YoY, QoQ) on Tuesday, Japan Retail Trade and Sales … Continued

Beginner

Imagine navigating the complex world of financial markets without a roadmap. For many, this uncertainty is where technical analysis steps in, a powerful tool often misunderstood. Today, we will debunk prevalent myths surrounding technical analysis, revealing the truth behind the charts and graphs. In this exploration, we’ll unravel the mystique, empowering you to grasp the … Continued

Intermediate

Caterpillar Earnings Caterpillar Inc., a global leader in manufacturing construction and mining equipment, engines, and industrial gas turbines, holds significant importance in the financial landscape. Renowned for its iconic yellow machinery, Caterpillar is a key player in the machinery and equipment sector, providing essential tools for construction, resource extraction, and infrastructure development worldwide. Why are … Continued

Intermediate

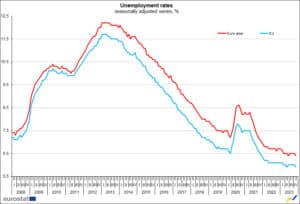

What is the European Central Bank? The European Central Bank (ECB) is the central banking authority responsible for formulating and implementing monetary policy within the Eurozone. Established in 1998 and headquartered in Frankfurt, Germany, the ECB plays a pivotal role in maintaining price stability and supporting sustainable economic growth across the member countries that share … Continued

Beginner

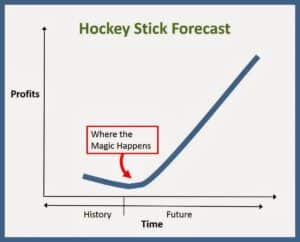

Welcome to the dynamic world of investing, where understanding the nuances of data visualisation can be the key to unlocking profitable opportunities. In this fast-paced financial landscape, being able to decipher trends quickly is crucial. One such tool that empowers investors with insightful visualisations is the hockey stick chart, a type of line chart. So, … Continued

Intermediate

An earnings release, a critical financial document, is issued quarterly by publicly traded companies to disclose financial performance. Mandated by regulatory authorities like the SEC, it includes income statements, balance sheets, and cash flow statements. This report communicates a company’s financial health, operational achievements, and future outlook to investors and analysts. Investors analyse it closely … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Although the Fed have entered their blackout period, a bust week elsewhere for Central Banks, as we get interest rate decisions from the People’s Bank of China (PBoC) Monday, the Bank of Japan (BoJ) on Tuesday, the Bank of Canada (BoC) on … Continued

Intermediate

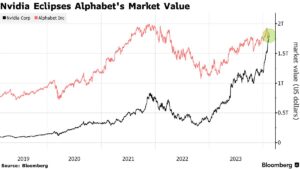

TSMC Stocks Surge, with Positive 2024 Outlook due to Continued Apple Collaboration and AI Boom Who are TSMC? Taiwan Semiconductor Manufacturing Company (TSMC) stands as a global giant in the semiconductor industry, boasting a market capitalization of 486.28 billion and commanding a pivotal role in the manufacturing landscape. Established in 1987, TSMC has evolved into … Continued

Intermediate

As we approach Friday January 19th the first full week of the US Q4 earnings season comes to a close. Investors are preparing for a flurry of corporate earnings releases that will provide key insights into the financial health of major companies. Among the notable players scheduled to announce their earnings on Friday are; Schlumberger, … Continued

Intermediate

Earnings Releases Earnings releases from investment banks like Goldman Sachs and Morgan Stanley are vital for financial markets, serving as key indicators of the financial industry’s health, risk management, and overall economic conditions. These reports influence market sentiment, guide investment decisions, and provide insights into the banks’ adaptability to changing economic environments. There were multiple … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Nothing of note from Central banks this coming week, but as ever we will be watching Fed speakers in the final week before they enter their blackout period. Macro Data Watch: The World Economic Forum in Davos runs all week from 15th-19th … Continued

Intermediate

The stage is set, and the curtains are about to rise on the much-anticipated spectacle in the world of finance – the Q4 2023 US Earnings Season. These unique financial reports reveal valuable data that can send shockwaves through the markets and shape the investment landscape. Investors can trade the news to capitalise on profitable … Continued

Intermediate

German Industrial Production Worse Than Expected Why is German Industrial Production Data Important? In the financial world, the German industrial production data is more than numbers; it’s the heartbeat of Europe’s economic engine. Here’s why it’s a focal point for trading economic news: Eurozone Foundation: Germany, the Eurozone’s economic powerhouse, lays the foundation. The data … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: No central bank activity of note, but as usual watching for Fed speakers. Macro Data Watch: US CPI on Thursday is the standout in a relatively light data week. Date Major Macro Data 01/08/2024 Eurozone Retail Sales (YoY & MoM) and Consumer … Continued

Intermediate

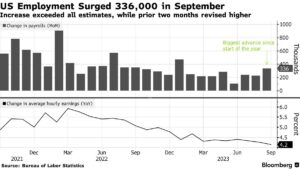

The US Employment Report and Why it Matters When looking at financial markets, few indicators carry the weight and influence of the US Employment Report. Released monthly by the Bureau of Labor Statistics, this comprehensive report provides a snapshot of the nation’s employment landscape, offering crucial insights into the health and direction of the economy. … Continued

Intermediate

What Are The Fed Minutes? The Federal Reserve, often just called “the Fed,” is the gatekeeper of the U.S. economy. They act as the controlling force, pulling levers to control interest rates and monetary policy. Now, the Fed doesn’t operate in complete secrecy; it spills the beans through what we call “Fed Minutes.” Fed Minutes … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: A quieter week for Central Banks, we get the Reserve Bank of Australia (RBA) Meeting Minutes and Bank of Japan (BoJ) Monetary Policy decision, statement and conference on Tuesday, then the People’s Bank of China (PBoC) Interest Rate Decision Wednesday. Macro Data … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Four major central banks in play this week, with the main focus on the Fed decision Wednesday, then we get decisions from the Swiss National Bank (SNB), the Bank of England (BoE) and the European Central Bank (ECB) all on Thursday. Macro … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Major Macro Data 12/04/2023 Nothing of note 12/05/2023 Australia RBA Interest Rate Decision; global S&P Global Services and Composite PMI, US ISM Services PMI 12/06/2023 Australian GDP; EU Retail Sales; BoC Interest Rate Decision and Statement; US ADP Employment Change 12/07/2023 China Trade Balance; … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Major Macro Data 11/27/2023 Nothing of note 11/28/2023 RBNZ interest rate decision, statement and press conference 11/29/2023 EU Consumer Confidence; German CPI; US GDP and PCE (QoQ) 11/30/2023 Chinese PMI; German Retail Sales; German Unemployment; EU CPI; US PCE (MoM and YoY); Canadian GDP; … Continued

Intermediate

US and UK inflation beat expectations => Risk On extends Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Major Macro Data 11/20/2023 PBoC Interest Rate decision 11/21/2023 RBA Meeting Minutes; Canada CPI; US FOMC Meeting Minutes 11/22/2023 US Durable Goods; Michigan Consumer Sentiment 11/23/2023 US Thanksgiving holiday; global Flash PMI from S&P … Continued

Beginner

Trading channels are primarily drawn as parallel support and resistance trend lines on the price chart for any financial market that you may be trading. They are indicators that help you to identify strong support and resistance levels and to also define the market’s trend. In addition, they can be used to signal a change … Continued

Beginner

Trading indicators are mathematical calculations (or algorithms) usually based on three inputs; price, volume and time, as we introduced in more depth in part 1. This article will build on the prior lesson, so you should make sure you have checked out part 1 first. How Many Types Of Trading Indicator are there? There are … Continued

Intermediate

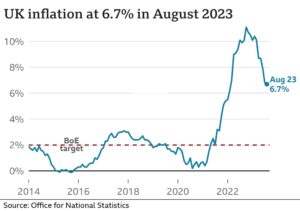

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: A very quiet week for CB with nothing of note apart from the US Fed speakers to stay in focus. Macro Data Watch: An important week for data with CPI data releases from the US (Tuesday), UK (Wednesday) and the EU (Friday), … Continued

Beginner

Trading indicators are an important area in technical analysis and are used in conjunction with the actual price action. Technical trading indicators are mathematical calculations or algorithms broadly based on three inputs; price, volume and time. They are visual representations that you can use to help in deciding the future direction of price, alongside other … Continued

Beginner

Trend lines and breakouts are an important part of any technical analysis trading strategy. Trend lines will help you figure out whether markets are in a trending stage or a consolidation phase. You’ll find them very useful when defining uptrends, downtrends, ranges and breakouts. Being able to draw trend lines and identifying real breakouts are … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week General: US Daylight Saving Time ended at the weekend, so the time difference between the US and the rest of the planet is back to normal in most cases Central Bank Watch: A relatively quiet week for CBs, we get Bank of Japan (BoJ) Meeting … Continued

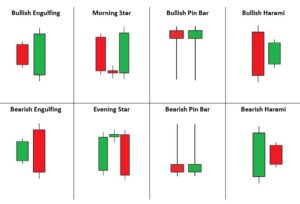

Beginner

Candlestick patterns in trading are a way of looking at price action in a different way to the line, bar or OHLC charts we looked at in our article on types of charts. Candlestick patterns have a long and ancient history dating back to 18th Century Japan. They were developed by Munehisa Homma, who was … Continued

Beginner

Financial analysis reports are produced by analysts to reflect the financial health of a company. This is done in order to recommend its shares to traders and investors (or not as the case may be). A covers the core of the company, what is its business and why it may be a good investment, or possibly … Continued

Beginner

Trading the news and trading events are opportunities for financial market traders to benefit from the often-heightened volatility that occurs when there is either: In this article we are going to look at various types of trading events and news that could provide opportunities as they produce notable moves in various financial market asset classes. … Continued

Beginner

In the world of trading every decision you make can be vital and impact your future financial situation, whether good or bad. It can be extremely exciting, but just as frustrating. It is essential for traders to use the right tools to maximise their chance of success, this will be explored as we continue. All … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week General: UK and EU Daylight Saving Time ended at the weekend, so for this week there is only a 4-hour time difference between London and New York. Daylight Saving Time ends in the US next weekend, 4/5 November. Central Bank Watch: The Bank of Japan … Continued

Beginner

An economic calendar is a timetable that is usually arranged in chronological order, similar to a normal calendar, in time and date order, showing important events that could impact financial markets. Economic calendars display upcoming data that is due to be released and also previous economic data, that has already been published. This data is … Continued

Beginner

Candlestick patterns are an exciting tool that traders can use when trading to diversify their trading experience and potential secure profits. This article will explore the world of candlesticks from the very basics of what they are to how best to trade them. They are a way to read the market from a different lens … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: The Fed is in its blackout period ahead of the November 1st interest rate decision. We get the Bank of Canada (BoC) and European Central Bank (ECB) interest rate decisions, statements and press conferences on Wednesday and Thursday respectively. Macroeconomic data Watch: … Continued

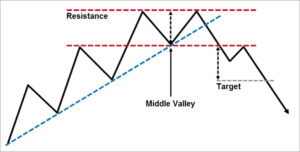

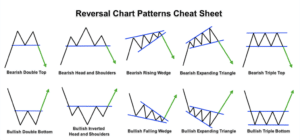

Beginner

Charts patterns are formed on differing markets and asset classes when trends take a pause and go into a consolidation stage. Chart patterns are a way for you to be able to decide if the price is going to continue in the same direction as the underlying trend after the consolidation phase has ended, OR … Continued

Beginner

Moving on from our previous article on trading charts, the study of chart patterns is an area of technical analysis that deals with the patterns formed by the price movements on the charts. It is possible to identify these patterns on many different timeframes, from one-minute charts, through one-hour charts, to daily, weekly, and even … Continued

Beginner

Two of the main concepts in trading and technical analysis are support and resistance. In basic terms, support and resistance are a specific price levels or areas of price that acts as barriers to a market price moving through them. It is a simple concept but identifying these levels can trip you up sometimes. Here … Continued

Beginner

Trading charts can be used to plot the price of any market; forex, stocks, bonds, commodities and more, any market where the price changes. Charts are at the core of technical analysis. For you, the trader, an understanding of different chart types is vital when using technical analysis and helps you make informed trading decisions … Continued

Beginner

Technical analysis is a way of assessing financial markets to be able to determine and hopefully predict future market price moves. It is also sometimes referred to as charting, with technical analysts being known as chartists. Technical analysis is just one type of the many different approaches to market analysis that a trader, investor or … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: A quiet week for central banks, though we do get Fed speakers through the week, which is the last week before the Fed speaker blackout period ahead of the early November FOMC Meeting. We get Reserve Bank of Australia (RBA) Meeting Minutes … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week A quiet start to the week, with the US Columbus Day holiday on Monday, US cash bond markets are closed, plus it is Thanksgiving Day in Canada. Central Bank Watch: A quiet week for central banks, with the main focus on the release of the … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 10/02/2023 Global Manufacturing PMI from S&P Global; US ISM Manufacturing PMI; Fed’s Powell speaks; EU Unemployment 10/03/2023 RBA interest rate decision and statement 10/04/2023 RBNZ interest rate decision and statement; Global Services and Composite PMI from S&P Global; EU Retail Sales; … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 09/25/2023 German IFO Survey 09/26/2023 US Consumer Confidence 09/27/2023 Bank of Japan Meeting Minutes; Australian CPI; US Durable Goods Orders 09/28/2023 German CPI; US GDP and Personal Consumption Expenditure (PCE) QoQ; Fed’s Powell speaks 09/29/2023 UK GDP; German Retail Sales and … Continued

Beginner

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 09/18/2023 No events of note 09/19/2023 RBA meeting minutes, EU CPI, Canadian CPI 09/20/2023 UK CPI report, FOMC interest rate decision, monetary policy statement and economic projections 09/21/2023 Swiss National Bank interest rate decision and monetary policy assessment, Bank of England … Continued

Intermediate

Macroeconomic/ geopolitical developments Global financial market developments Key this week Date Key Macroeconomic Events 09/11/2023 Nothing of note 09/12/2023 UK Employment report; German ZEW Survey 09/13/2023 UK GDP, Industrial and Manufacturing Production; US CPI 09/14/2023 Australian Employment report; ECB interest rate decision and press conference; US PPI and Retail Sales 09/15/2023 Chinese Industrial Production and … Continued