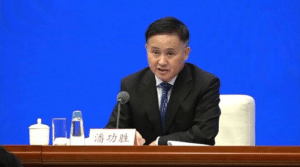

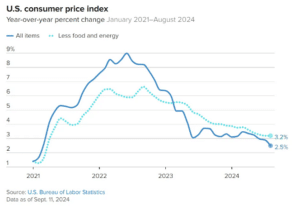

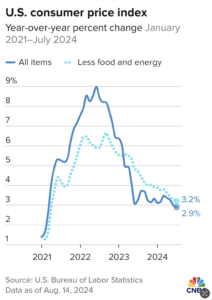

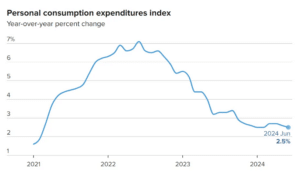

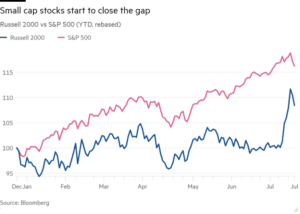

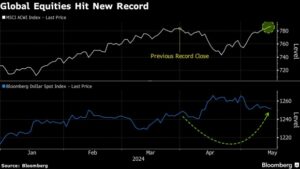

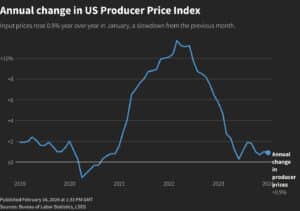

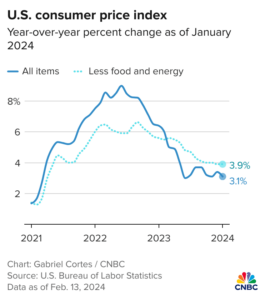

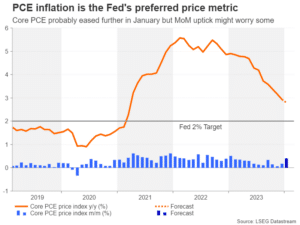

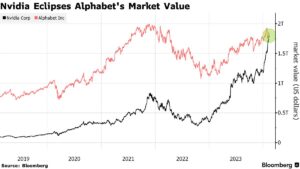

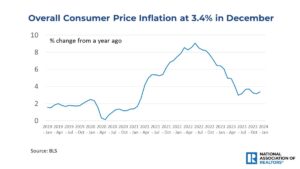

Global stocks gain on China stimulus and cooling US inflation

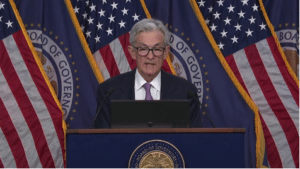

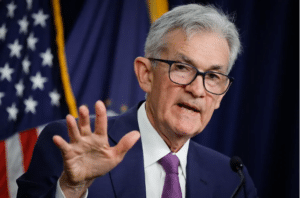

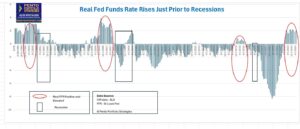

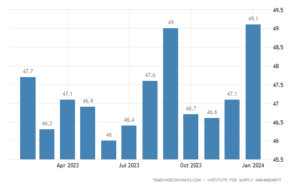

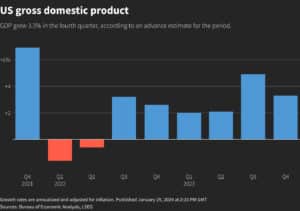

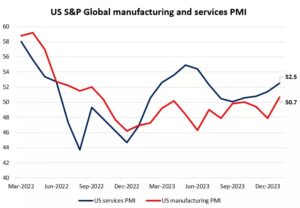

Macroeconomic/ geopolitical developments Global financial market developments Key this week Central Bank Watch: Central bank activity is modest this week, but with Fd speakers still in the spotlight, notably Powell on Monday. Macro Data Watch: The main macro data releases this week are the global PMI which are released Tuesday and Thursday, and of course … Continued